Mathematician Jim Simons and his hedge fund Renaissance Technologies have an incredible track record. RenTec’s flagship Medallion Fund has returned 66.1% annually before fees and 39% after fees between 1988 and 2018. Investors are always curious about what their favorite investing legends have bought and sold. And the 13F filings let us dig into the current holdings of legendary investors such as Simons. Here we take a look at Jim Simons’ top 10 largest stock holdings.

Investment firms with more than $100 million in equity assets are required by the Securities and Exchange Commission (SEC) to submit a Form 13F quarterly report. Jim Simons’ Renaissance Technologies submitted its Form 13F for the January-March quarter on May 14th. RenTec employs complex mathematical models to analyze and execute trades.

The Medallion Fund is notoriously secretive, and it’s no longer available to outside investors. Only Renaissance employees are allowed to invest in the Medallion Fund. In 2005, RenTec launched the Renaissance Institutional Equities Fund (RIEF) and Renaissance Institutional Diversified Alpha (RIDA) for outside investors.

According to the 13F documents, Jim Simons was betting big on healthcare stocks, at least during the January-March quarter of 2020. Healthcare accounts for 24% of RenTec’s portfolio. About 15% of the portfolio was in the information technology sector, followed by consumer discretionary sector with 13%.

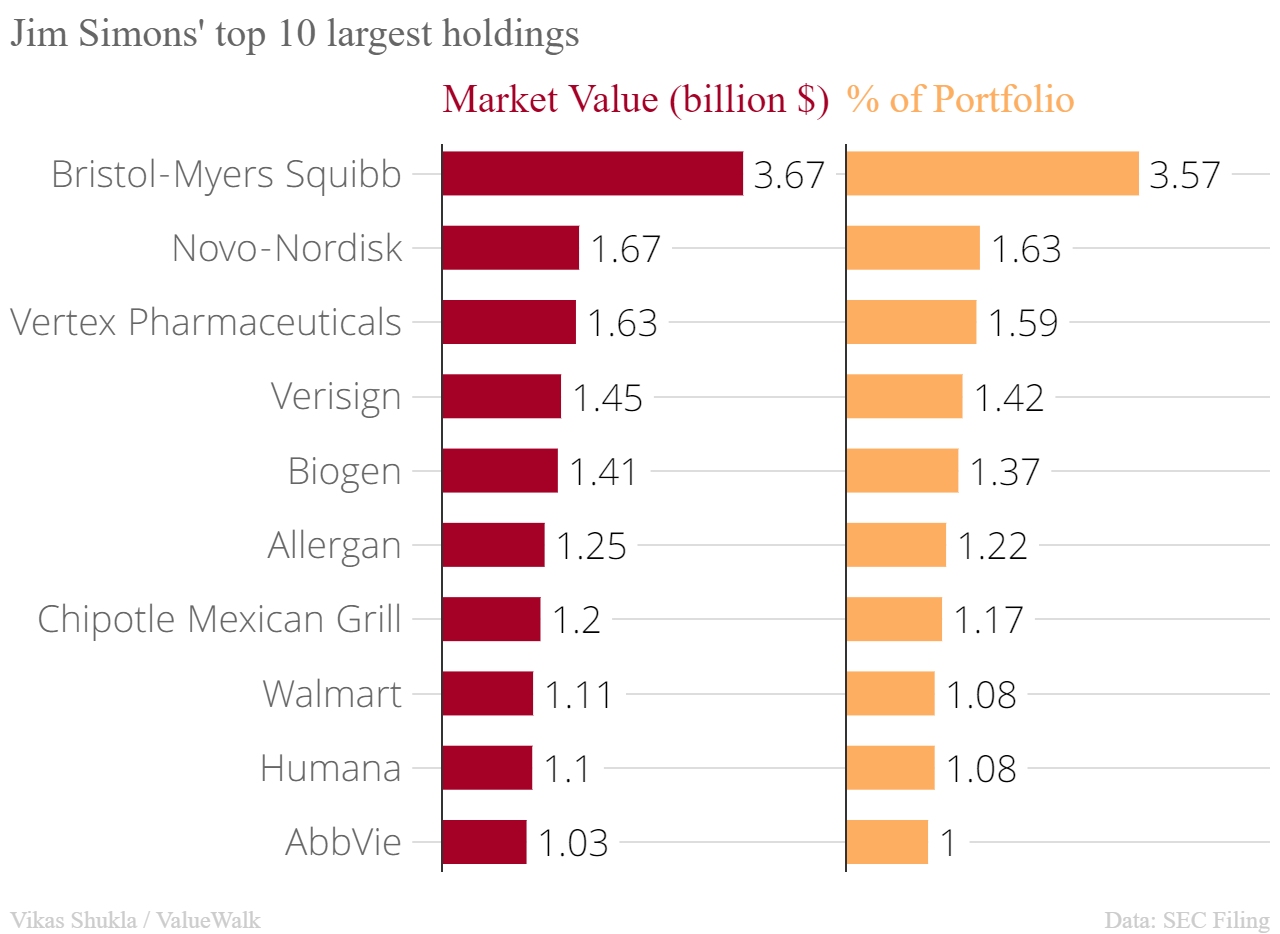

These are Jim Simons’ top 10 largest stock holdings as of March 31, 2020. At the end of March 2020, Renaissance Technologies had $102.96 billion in managed 13F securities.

10- AbbVie Inc

AbbVie was spun out of Abbott Laboratories in 2013. At the end of March, Renaissance Technologies owned 13,555,849 shares of AbbVie worth $1.03 billion. The hedge fund purchased 1,759,105 AbbVie shares during the January-March quarter.

9- Humana Inc

Simons purchased an additional 577,900 shares of Humana during the first quarter, taking his total holding to 3,529,142 shares worth $1.10 billion. The Louisville, Kentucky-based health insurance giant accounts for only 1.08% of RenTec’s portfolio.

8- Walmart Inc

Walmart operates more than 11,000 stores worldwide. Its massive footprint has helped it compete against Amazon. More than 90% Americans live within 10 miles of a Walmart store. Simons’ hedge fund owns $1.11 billion worth of Walmart shares. During the March quarter, RenTec increased its Walmart holding by 875,377 shares to a total of 9,802,214 shares.

7- Chipotle Mexican Grill Inc

As of March 2020, Renaissance Technologies held 1,839,242 shares of Chipotle worth $1.2 billion. The stock hit a bottom of $465 per share on March 18, but has surged to a little over $1,000 per share on May 19. Chipotle operates fast casual restaurants across the US, UK, Canada, France, and Germany.

6- Allergan Plc

Allergan Plc has now become a subsidiary of AbbVie. The $63 billion transaction was completed earlier this month. RenTec aggressively purchased 2,069,332 Allergan shares in the January-March period, and held 7,089,144 shares worth $1.25 billion at the end of the quarter.

5- Biogen Inc

Biogen is the fifth largest stock holding of Jim Simons. He sold 95,994 Biogen shares during the March quarter, but still held 4,473,912 shares worth $1.41 billion. Notably, Warren Buffett’s Berkshire Hathaway purchased around $200 million worth of Biogen stock towards the end of 2019. It was Buffett’s first biotech investment.

4- VeriSign Inc

Simons trimmed his stake in VeriSign. As of March 2020, RenTec owned VeriSign shares worth $1.45 billion. The Reston, Virginia-based communications and network infrastructure company saw its stock skyrocket from just $18 per share in January 1999 to $248 in March 2000 at the peak of the Dot-Com bubble. More than 20 years later, the stock is still trading at around $215 a share.

3- Vertex Pharmaceuticals Inc

Boston-based Vertex Pharmaceuticals makes specific drugs for rare disorders such as cystic fibrosis. Last year, Fortune magazine named it among companies with the strongest long-term growth potential. Renaissance Technologies sold 216,900 shares of Vertex in March quarter. The stock accounts for 1.59% of RenTec’s portfolio.

2- Novo-Nordisk A/S

Denmark-based Novo-Nordisk is Jim Simons’ second largest stock holding. RenTec purchased 1,643,200 Novo-Nordisk ADRs during the March quarter. The pharmaceutical giant accounts for 1.63% of RenTec’s portfolio.

1- Bristol-Myers Squibb Co

New York-based Bristol-Myers Squibb is RenTec’s largest stock holding, accounting for 3.57% of the hedge fund’s portfolio. Jim Simons purchased 5,781,450 Bristol-Myers Squibb shares during the March quarter. The company makes prescription drugs and biologics in many therapeutic areas including diabetes, cardiovascular diseases, oncology, hepatitis, and psychiatric disorders. Last year, it acquired Celgene in a $74 billion deal, one of the biggest acquisitions in the pharmaceutical industry ever.

The post Jim Simons’ top 10 largest stock holdings: Big on healthcare appeared first on ValueWalk.