This is an exciting day for EarningsBeats.com and its members. It’s the day when we select the 10 equal-weighted stocks for each of our 4 portfolios – Model, Aggressive, Income, and Strong AD. Portfolio results-to-date have been superb and you can check out our holdings the past 3 months below. Here’s a recap of each portfolio’s history:

Model Portfolio

Here’s the portfolio’s history by quarter and vs. the benchmark S&P 500:

- Quarter 1 (11/19/18-2/19/19): +25.67% vs. +3.31%

- Quarter 2 (2/19/29-5/19/19): +3.55% vs. +2.87%

- Quarter 3 (5/19/19-8/19/19): +13.83% vs. +2.24%

- Quarter 4 (8/19/19-11/19/19): -0.67% vs. +6.72%

- Quarter 5 (11/19/19-2/19/20): +9.07% vs. +8.52%

- Quarter 6 (2/19/20-5/19/20): +4.63% vs. -13.68%

- Quarter 7 (5/19/20-8/19/20): +35.33% vs. +15.46%

- Quarter 8 (8/19/20-11/19/20): +17.03% vs. +6.13%

- Quarter 9 (11/19/20-2/19/21): +32.26% vs. +9.07%

Since inception, the Model Portfolio has gained 251.78% vs. the S&P 500’s gain of 45.19%. It’s outperformed the S&P 500 in 8 out of 9 quarters.

Here is how each Model Portfolio stock performed over the past three months:

7 of our 10 Model Portfolio stocks outperformed the S&P 500, including massive gains by ROKU, TSLA, and SNAP.

Aggressive Portfolio

Here’s the portfolio’s history by quarter and vs. the benchmark S&P 500:

- Quarter 1 (5/19/19-8/19/19): +16.53% vs. +2.24%

- Quarter 2 (8/19/19-11/19/19): -2.96% vs. +6.72%

- Quarter 3 (11/19/19-2/19/20): +10.05% vs. +8.52%

- Quarter 4 (2/19/20-5/19/20): +0.43% vs. -13.68%

- Quarter 5 (5/19/20-8/19/20): +18.18% vs. +15.46%

- Quarter 6 (8/19/20-11/19/20): +4.71% vs. +6.13%

- Quarter 7 (11/19/20-2/19/21): +37.97% vs. +9.07%

Since its inception, the Aggressive Portfolio has gained 113.40% vs. the S&P 500’s gain of 36.62%. It’s outperformed the S&P 500 in 5 out of 7 quarters.

Here is how each Aggressive Portfolio stock performed over the past three months:

9 of our 10 Aggressive Portfolio stocks crushed the S&P 500, including the near 80% gains in both SPWR and CELH.

Income Portfolio

Here’s the portfolio’s history by quarter and vs. the benchmark S&P 500:

- Quarter 1 (5/19/19-8/19/19): +7.62% vs. +2.24%

- Quarter 2 (8/19/19-11/19/19): +3.84% vs. +6.72%

- Quarter 3 (11/19/19-2/19/20): +10.96% vs. +8.52%

- Quarter 4 (2/19/20-5/19/20): -20.54% vs. -13.68%

- Quarter 5 (5/19/20-8/19/20): +11.33% vs. +15.46%

- Quarter 6 (8/19/20-11/19/20): +3.58% vs. +6.13%

- Quarter 7 (11/19/20-2/19/21): +15.47% vs. +9.07%

Since its inception, the Income Portfolio has gained 31.20% vs. the S&P 500’s gain of 36.62%. It’s outperformed the S&P 500 in 3 out of 7 quarters.

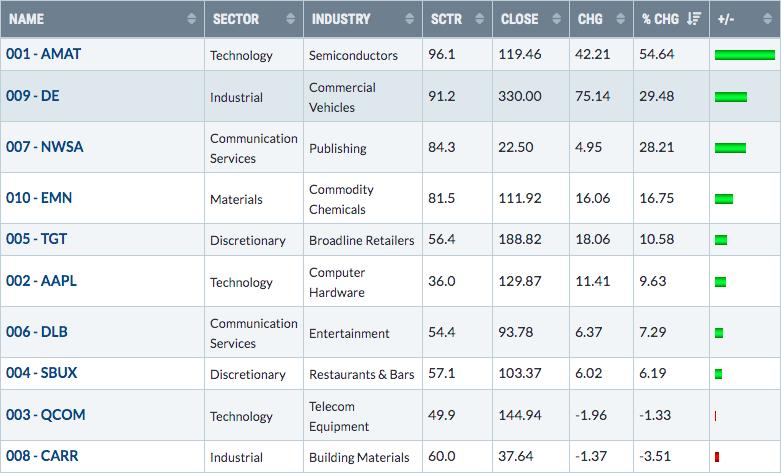

Here is how each Income Portfolio stock performed over the past three months:

6 of our 10 Income Portfolio stocks beat the S&P 500, including a huge quarter from AMAT, which gained more than 50%.

Strong AD Portfolio

Here’s the portfolio’s history by quarter and vs. the benchmark S&P 500:

- Quarter 1 (5/19/20-8/19/20): +19.35% vs. +15.46%

- Quarter 2 (8/19/20-11/19/20): +27.77% vs. +6.13%

- Quarter 3 (11/19/20-2/19/21): +40.08% vs. +9.07%

Since its inception, the Strong AD Portfolio has gained 113.61% vs. the S&P 500’s gain of 33.66%. It’s outperformed the S&P 500 in all 3 quarters since it began.

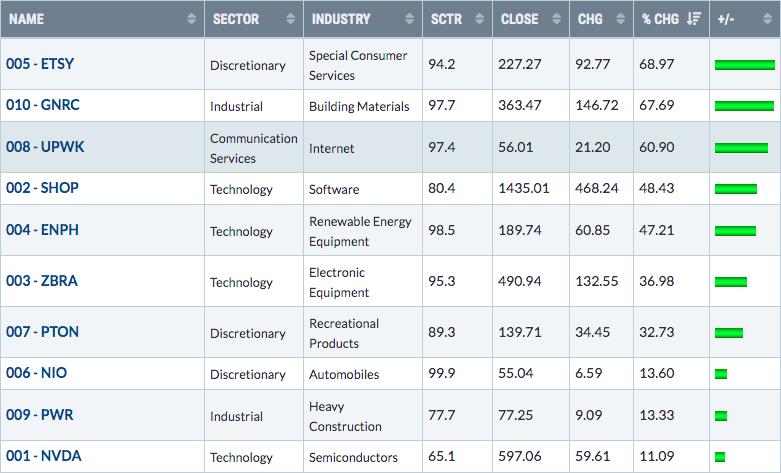

Here is how each Strong AD Portfolio stock performed over the past three months:

The Strong AD Portfolio components went a perfect 10 for 10 in beating the S&P 500 with 3 gaining more than 60% each – ETSY, GNRC, and UPWK.

The Quarter Ahead

I remain very optimistic. All portfolio stocks but the Strong AD Portfolio stocks come from our flagship Strong Earnings ChartList. Of the 456 companies currently on this ChartList, the average earnings beat was 31%. That’s absolutely incredible and is helping to fuel the PE expansion we’re witnessing. While many PEs may seem historically high, they’re warranted given that there’s very little alternative to investing. Yields near historic lows and lots of liquidity has sent stocks soaring and I believe it continues throughout 2021 – with pullbacks along the way, of course.

The Draft

At 7:00pm ET today, I’ll be hosting our “Top 10 Stocks” webinar, where we’ll announce the new list of 40 stocks that will comprise our 4 portfolios for the next 3 months. Some of this past quarter’s winners will likely repeat as portfolio stocks, but there’ll be newbies as well. One shift that we made last quarter was to include more small cap stocks. The S&P 600 Small Cap Index ($SML) has soared vs. the benchmark S&P 500 since the positive vaccine news was reported on November 9th. We saw this relative strength early and capitalized on it. Many small cap names will find their way into our portfolios in the upcoming quarter as well.

I’d love to have you join us for this evening’s event. If you’re not already an EarningsBeats.com member, you can CLICK HERE to join using our no cost, 30-day trial. I’m ready to unveil our stocks.

Let the DRAFT begin!

Happy trading!

Tom