The recent rotation our of high-growth stocks and into economically sensitive cyclicals has created some unique opportunities to purchase select growth names at a discount. Before considering this strategy, however, it’s important to make sure that several characteristics are in place.

To begin, you’ll want to reduce uncertainty by making sure the company has already reported 2nd quarter earnings and that these earnings were better than expected. This, coupled with positive guidance from management going into year-end and beyond, will also help put you in front of ideal candidates.

These growth prospects are going to be the primary driver of the stock going higher.

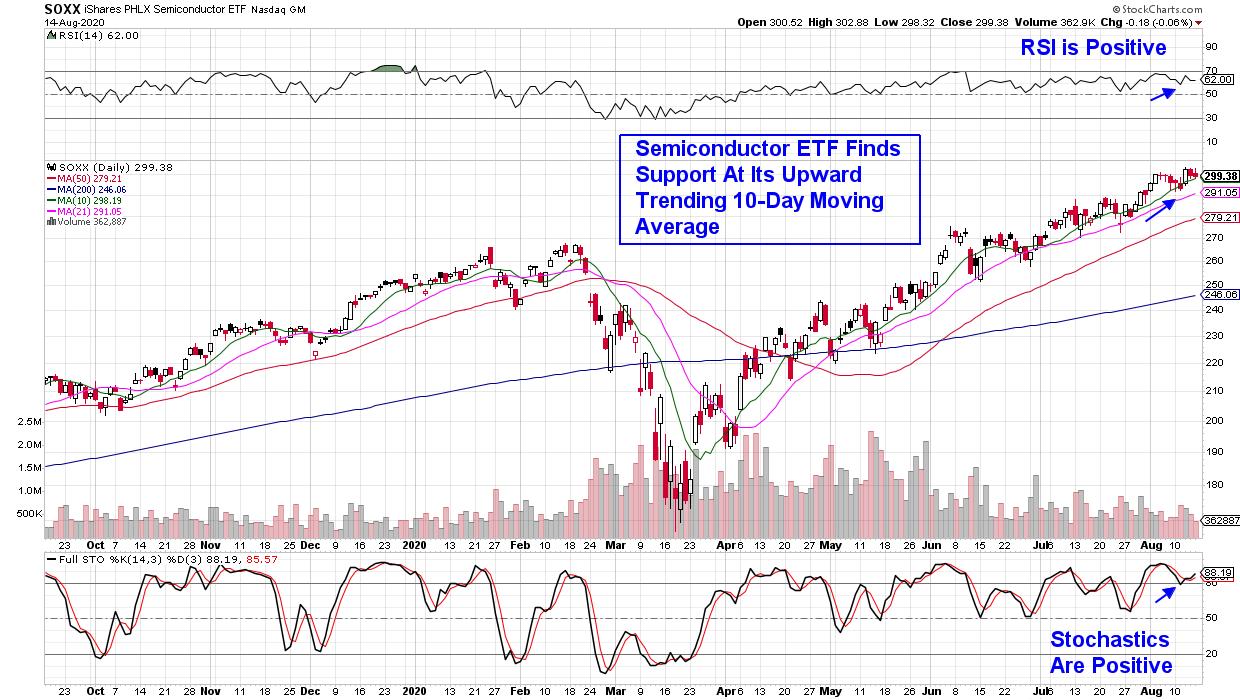

Next up, you’ll want the stock to be a part of a strong industry group or sector. In other words, the company provides products or services that are being met with high demand not only currently, but going forward as well. Below is a chart of the Semiconductor Industry, which is in a very confirmed uptrend as demand for chip stocks has been particularly strong.

DAILY CHART OF SEMICONDUCTOR ETF (SOXX):

Lastly, and of particular importance, you’ll want to make sure that the stock is finding support at its key simple averages, which are in an uptrend. This last item can carry the most weight as it will point toward the near-term prospects for your stock.

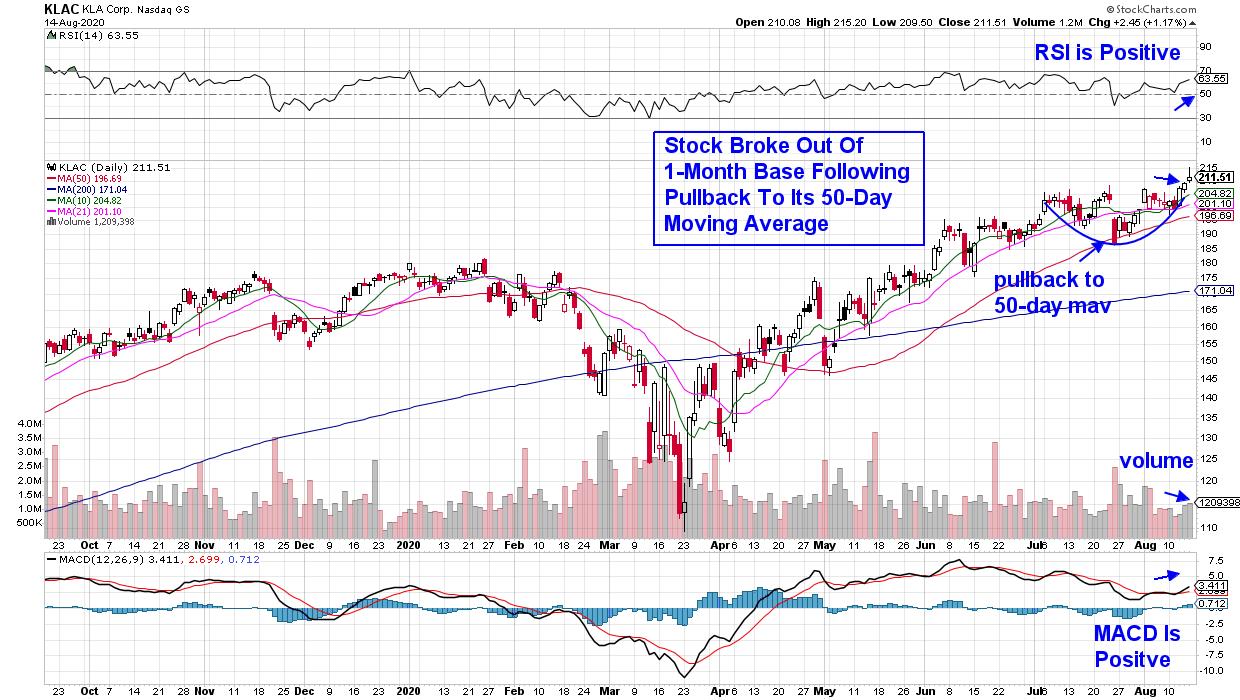

Below is a daily chart of KLA Corporation (KLAC), which is a Semiconductor Equipment supplier that reported earnings and sales late Monday that beat Wall Street’s targets for its fiscal fourth quarter. Management also guided higher for their current quarter.

DAILY CHART OF KLA CORP. (KLAC):

KLAC pulled back to its upward-trending 50-day moving average late last month before bullishly breaking back above its shorter term 10-day moving average (green). The company’s bullish earnings and sales report helped push the stock out of a 1-month base on volume, with the RSI and MACD in positive territory.

Below is an example of a stock that’s also from the strong Semiconductor industry and, as you’ll see, this stock did not find support at its key 50-day moving average. This indicates that the recent downtrend in the stock may well be more than a pullback as the stock appears headed lower.

DAILY CHART OF FORMFACTOR INC. (FORM):

In addition to breaking below key support, the RSI and MACD for the stock are also in negative territory. The fact that the company reported weaker-than-expected sales is another signal that you’re not looking at a leading stock in within a leading industry.

Semiconductor stocks entered into the bear market with strong growth prospects that have only gotten stronger during this historic pandemic. These chips are needed in many vital industries, including digital cloud computing centers that allow remote workers to remain connected, as well as the expansion of 5G networks that allow this data to move faster.

I’ve identified several top Semiconductor chip providers in my bi-weekly MEM Edge Report and, if you’d like access to these top stocks poised to trade higher, take a 4-week trial for a nominal fee. This top-performing report will also point you toward leading cyclical stocks that are currently moving into favor. Click Here to make sure you receive this Sunday’s report!

Warmly,

Mary Ellen McGonagle. MEM Investment Research