Investors do not wait. Get ready for Active Management now!

Now is the time for investors to incorporate quantitative tools to empower their portfolio management. Any change in the direction of any of the principal components of earnings growth such as sales growth, gross margins, operating or financing costs, may be important indicators about future direction of the growth rate of the company. Inovalon Holdings Inc (NASDAQ:INOV) continues to shine in Health Care Information Services.

Q2 2020 hedge fund letters, conferences and more

Inovalon Holdings (INOV) $25.050 BUY this poor company getting better

Inovalon Holdings has been an unprofitable company with frequently low cash return on total capital of 5.0% on average over the past 5 years. Over the long term, the shares of Inovalon Holdings have declined by 9% relative to the broad market index.

Correlated with Fundamental Growth Factors

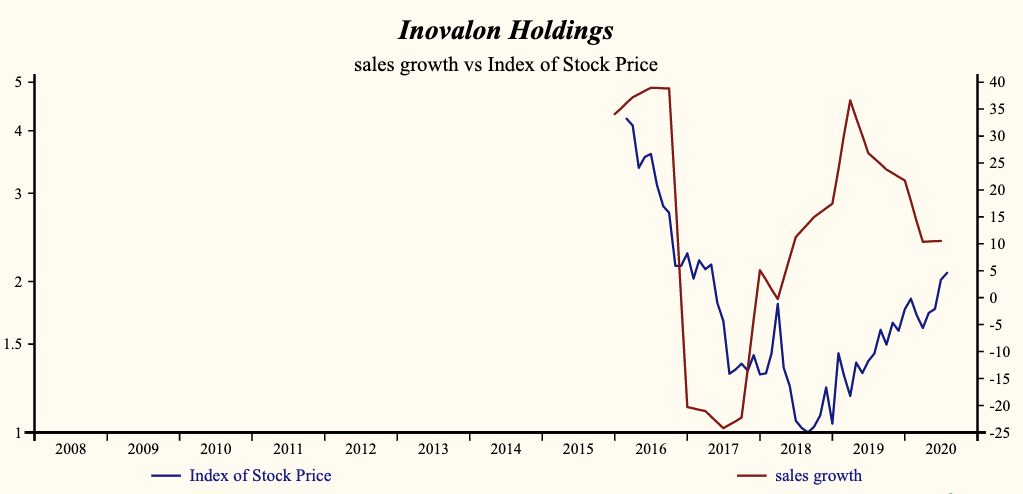

Sales growth last quarter remained high and reversed the downward trend started back in early 2019. Rising Sales growth has been 72% correlated with the direction of the share price (three-quarter lead).

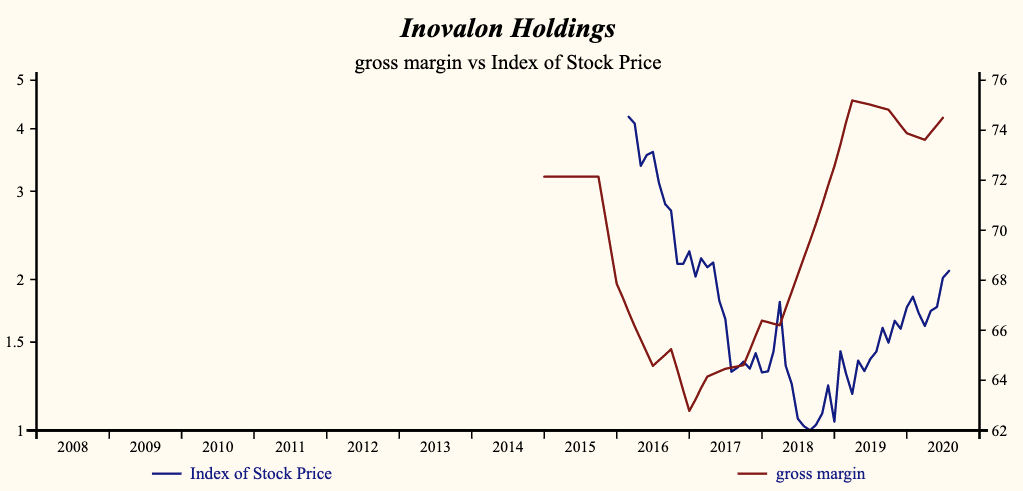

The company is recording a high and rising gross profit margin which has also been correlated with the share price. Cost containment has been evident since early 2019 as demonstrated by stable SG&A expenses. That implies that the company can further cut costs in order to maintain future EBITD growth. Higher gross margins and steady SG&A expenses are supporting the EBITD relative to sales.

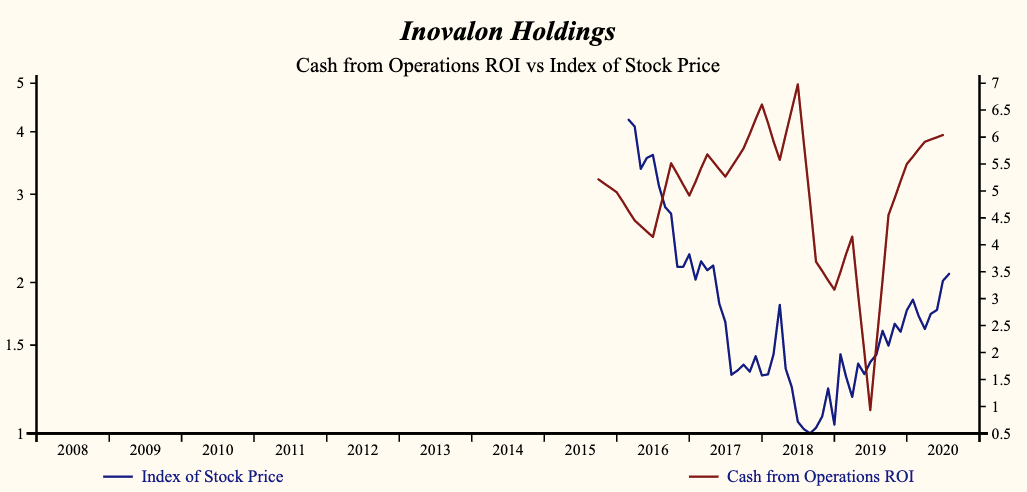

Cash from Operations (ROI) continues to be very strong. Interest costs are high in the record of the company and falling relative to sales. Lower interest costs not only free up cash and encourage free cash flow growth but are often associated with lower valuation.

The shares of Inovalon Holdings have outpaced the broad market since the October, 2018 low. More recently, the shares are trading at the upper-end of its volatility range relative to its share price trend.

Despite the currently extended share price the continued strength in fundamentals provides a great opportunity to purchase stock of a resilient company.

The more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

The post Inovalon Holdings: Resilient Growth Within Healthcare appeared first on ValueWalk.