From impact on hedge fund performance and product launches to investor activity and investor interest – how has the Covid-19 pandemic affected the hedge fund industry and how will the industry move forward?

Q2 2020 hedge fund letters, conferences and more

The Covid-19 pandemic is far from over, but it has already had a dramatic effect on the way hedge funds do business. How has the coronavirus impacted asset raising and what lasting changes will there be? HFM conducted a survey among more than 80 hedge fund professionals on the impact caused by the coronavirus. Please refer to the following report showcasing key highlights on the pandemic’s effects on hedge funds and an analysis of how the industry will move forward.

Covid-19 Pandemic Overview

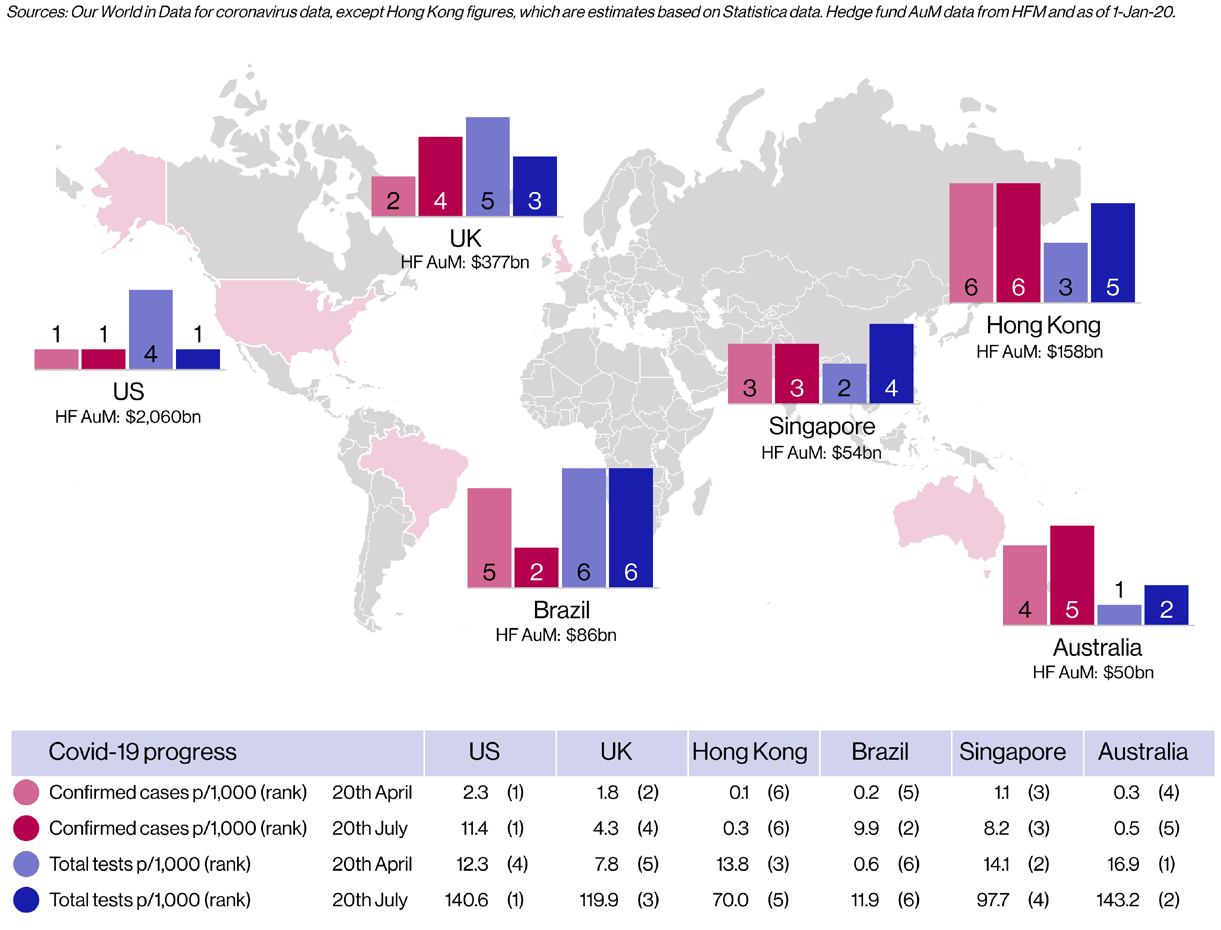

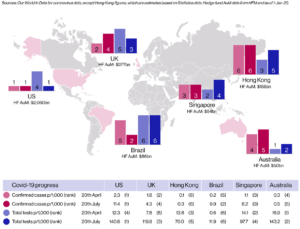

Covid-19 in the countries with the largest hedge fund markets: It’s been a little over four months since the world went into lockdown. Some industries paused. Some ground to a halt. Others have had to pivot. For hedge fund managers, the relentless pace of business is one of the few things that hasn’t changed. Markets and their indices have lurched on regardless, requiring all investment professionals to adapt in parallel with – not before – their daily tasks and routines. How successful have they been? In June, HFM surveyed 83 hedge fund professionals – the results paint a picture of an industry in flux, but also one that will see just as many opportunities as it will obstacles in the months ahead. Raising assets is a good example. No doubt there have – and will – be significant challenges regarding sales and marketing. Indeed, our research shows that half of all managers lost an investor meeting as a result of the pandemic, and almost one in six an allocation. But furthermore, one in three managers reported fresh investor interest as a direct result of the crisis. Anecdotal evidence and search data suggest investors are including hedge funds in their plans for H2.

Ex. 1: The six largest hedge fund markets by manager AuM ranked by Covid-19 cases and tests in the total population, Apr-20 vs Jul 20

Covid-19 Impact On Hedge Fund Performance

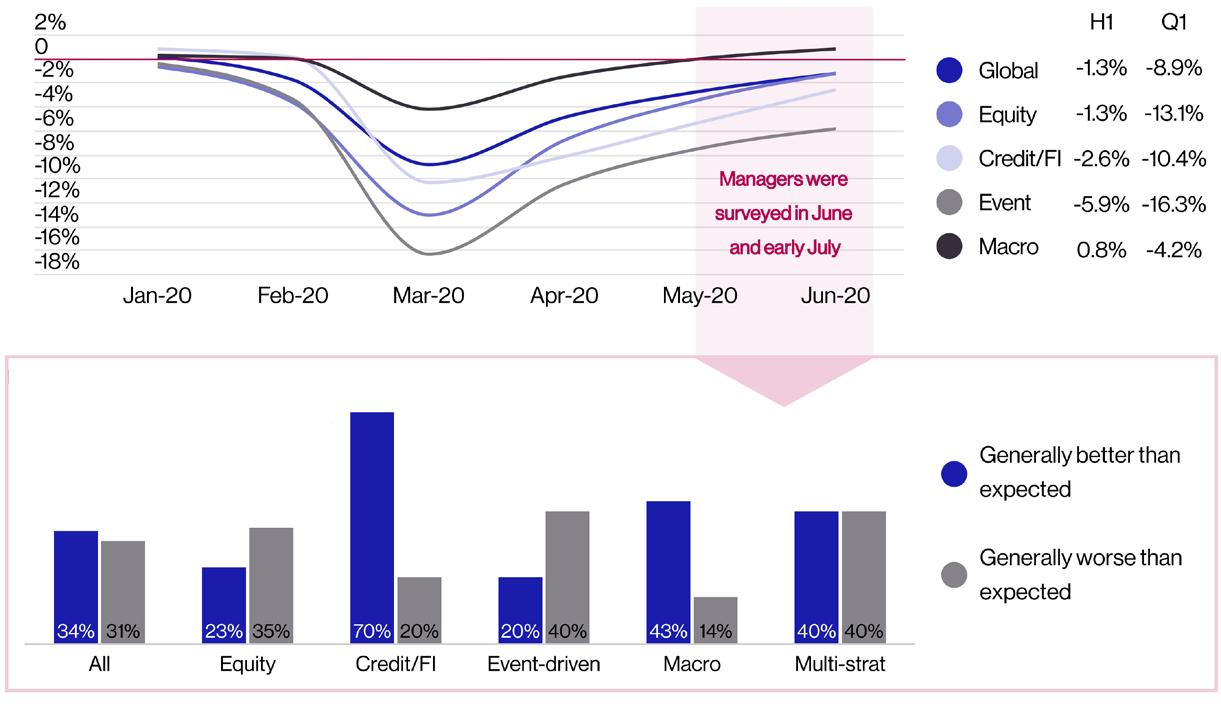

A third of managers say their funds have performed better than expected: We asked managers: so far, how has the pandemic affected the performance of your funds? Most hedge funds remained underwater YTD at the end of June, although the speed of recovery from the deep losses in March and the direction of travel are encouraging. However, event-driven firms, down an average of 6%, might disagree (Ex. 2). The real question: how have your funds fared relative to your performance expectations for such a scenario? Here, slightly more managers said they were ahead (34%) than behind (31%) with credit/fixed income firms leading the way (Ex. 3). Hedge funds have staked their reputation on relative performance in a downturn, and while investors will be the ultimate judges, it bodes well for marketing narratives that so many funds already feel they have a story to tell.

Ex.2: Cumulative performance of key HFM indices in H1 2020 (top) and Ex. 3: Impact of Covid-19 pandemic on fund performance according to managers

Covid-19 Impact On Firms

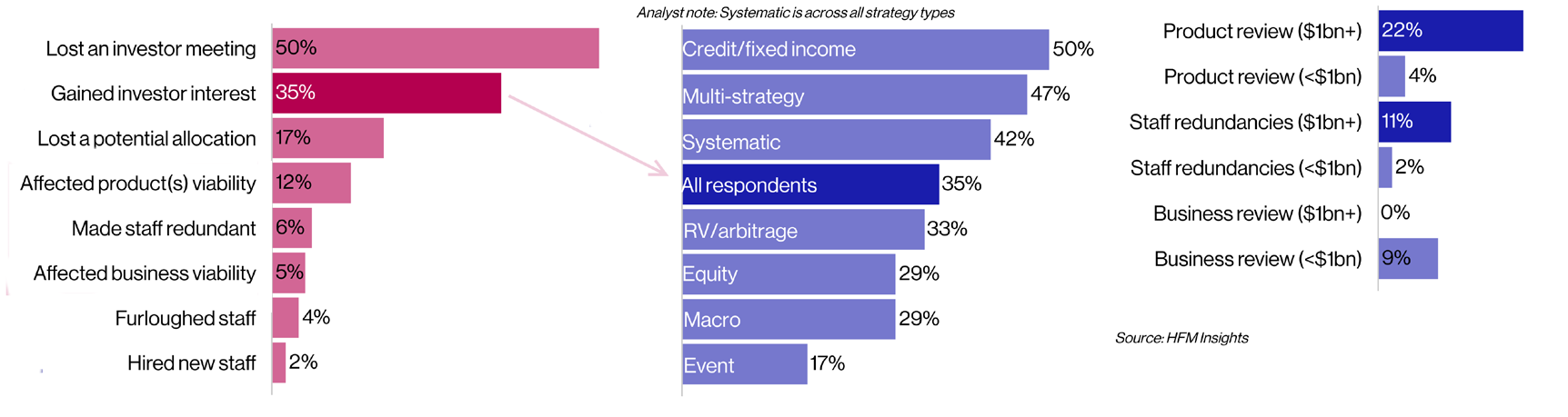

Half of credit and multi-strategy specialists reported an uptick in enquiries: While half of the hedge fund firms surveyed said they had lost an investor meeting, and 17% had lost an allocation, 35% said they have gained investor interest (Ex. 4). Credit/fixed income funds were most likely to report fresh investor interest as a result of the crash (50%). For all strategies, firm AuM made little difference (Ex. 5). Ultimately, the consequences of the pandemic for hedge fund businesses have depended on size, with layoffs and product reviews mainly at larger firms (Ex. 6). Many investors are preparing for the next stage of the crisis with hedge funds in mind. Not only that, but all top-level strategies are reporting upticks in enquiries.

Ex. 4: Selected consequences of the Covid-19 pandemic (L), Ex. 5: Firms to report new investor interest due to crisis and Ex. 6: Firms to report business changes due to crisis by firm AuM (R)

Covid-19 Impact On Hedge Fund Investor Interest

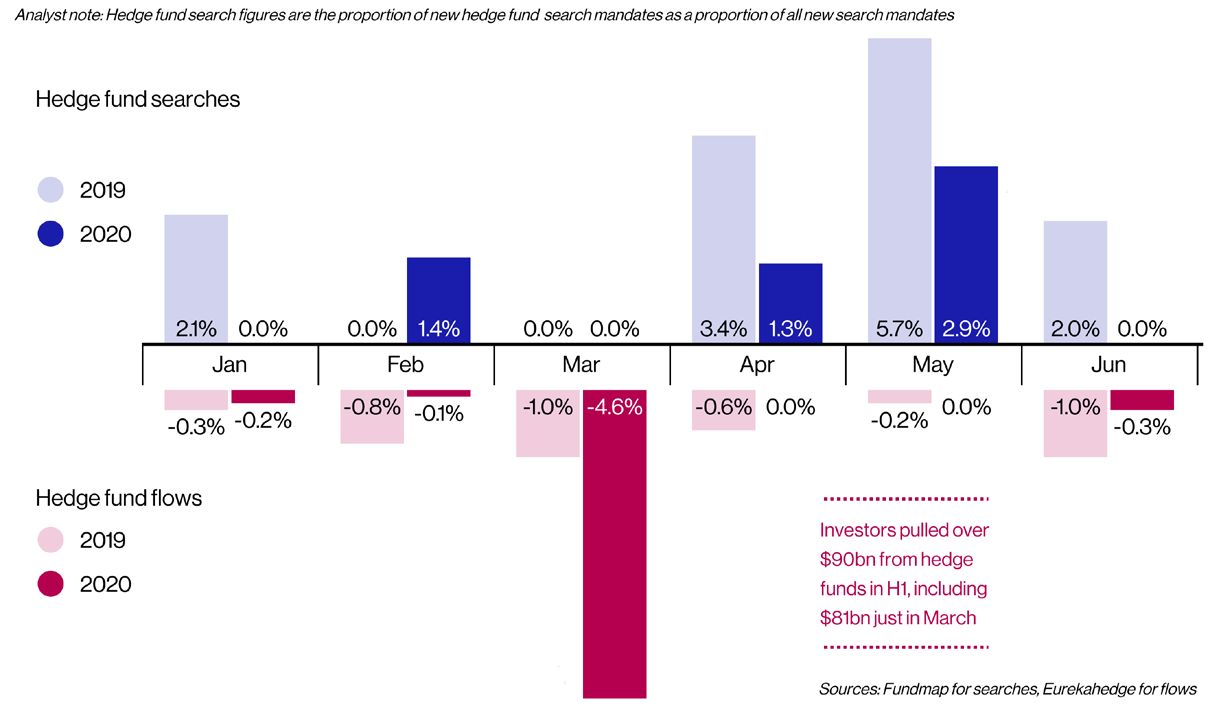

Hedge fund searches by institutional investors edged up in April and May: Unsurprisingly, given industry performance and the wider economic challenges, investors pulled a large amount of capital from hedge funds in H1. That it should mostly happen in March is further evidence that liquid FoHFs played a leading role. If flows data is disheartening, search data is a little more encouraging: an uptick in interest from pensions (Fundmap’s focus) in Q2, with a healthy number of searches in May, although June shows there is still plenty of work ahead. The uptick in interest seen in earlier anecdotal evidence has some basis in hard data. HFM expects institutions – mainly US pensions – to continue showing interest in H2 as they seek to manage volatility while retaining liquidity.

Ex. 7: Hedge fund investor searches and flows in H1 2020 versus H1 2019

Covid-19 Impact On Hedge Fund Product Launches

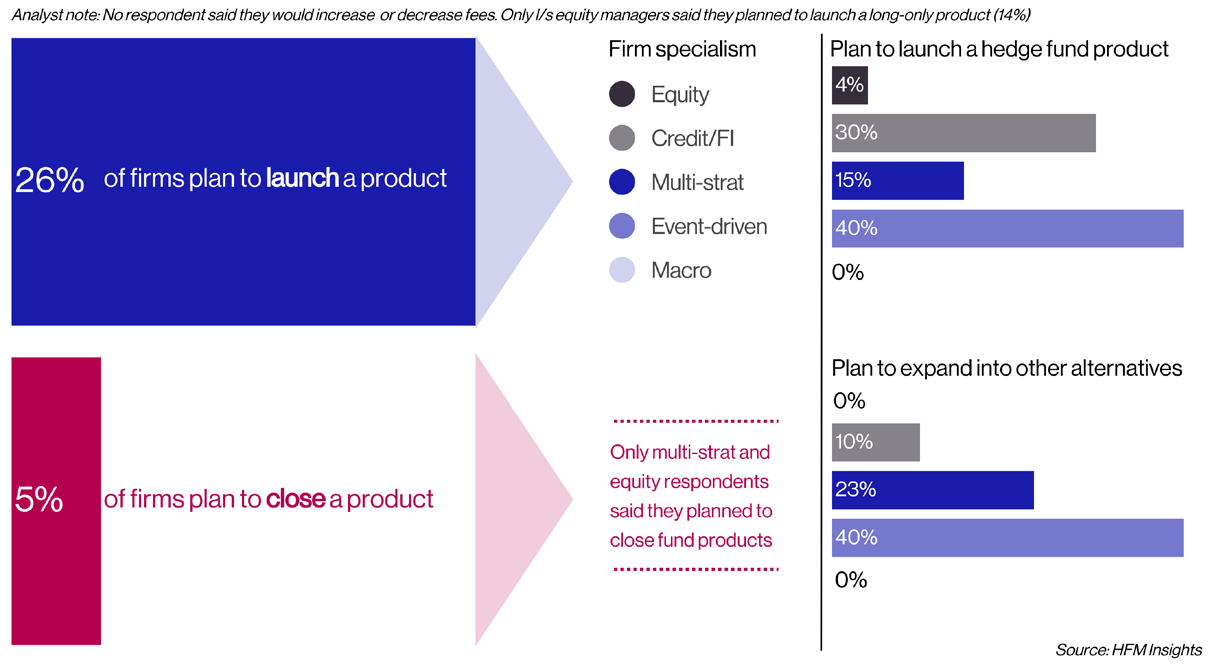

One-quarter of managers plan to launch a new fund as a result of the crisis: Hedge fund firms are five times more likely to be planning to launch a new product as a result of the Covid-19 pandemic as they are to close one, providing more evidence that firms are leaning into the opportunities presented. But the type of product varies. Credit/fixed income and multi-strategy firms see this as a time to launch a hedge fund, event-driven firms are expanding into other alts, while l/s equity specialists have their eyes on long-only. This crisis could prove a turning point for the future of l/s equity. There have been some high-profile closures in recent months and our research suggests more l/s equity and event-driven specialists may pivot away from hedge.

Ex. 8: Product-focused actions hedge fund firms will likely take as a result of the Covid-19 pandemic

About HFM

HFM provides hedge fund professionals with an unparalleled blend of business essential data, exclusive industry intel and market-leading events. Combining 22 years of industry heritage with a cutting-edge platform, to create true business intelligence; the intelligence needed to raise assets, allocate funds or source new business opportunities.

The post How Covid-19 Has Impacted Hedge Fund Performance appeared first on ValueWalk.