According to a recent S&P Global Market Intelligence analysis, the aggregate value for healthcare M&A increased sharply in Q3, both compared to the first half of the year and the year-ago period, as three deals crossed the $15 billion mark.

Q3 2020 hedge fund letters, conferences and more

The Resurgence In Deal-Making Activity Boosts Healthcare M&A Value

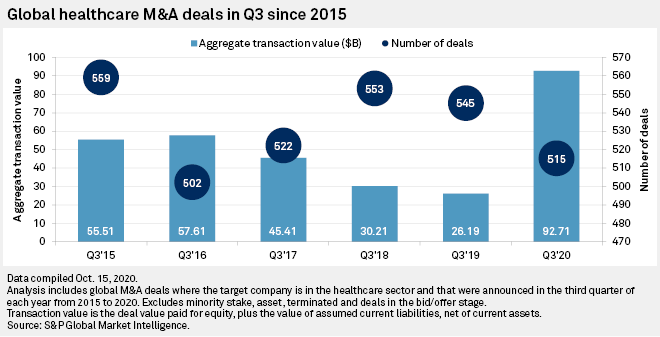

Aggregated transactions totaled $92.71 billion in Q3, compared to $12.26 billion in Q2 and $26.19 billion in the year-ago quarter. The increase can be attributed to large and complex deals, whereas Q3 saw a 256% increase in transactions valued at $5 billion or more, per Mergermarket.

Additional key highlights from today’s healthcare M&A analysis include:

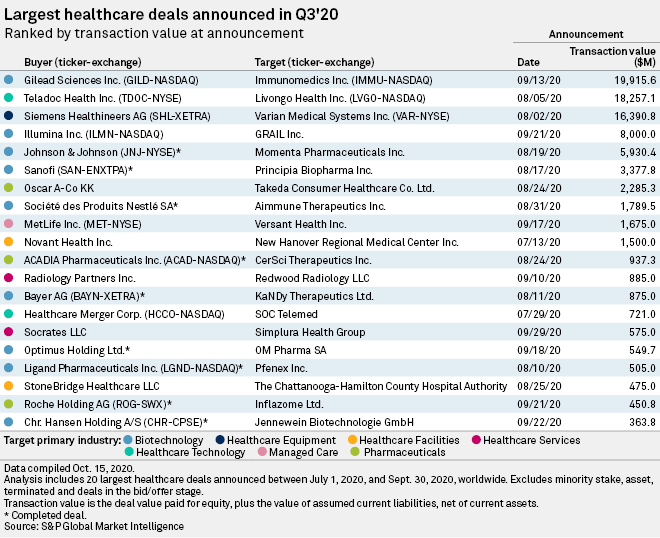

- Of the 20 largest healthcare deals in the quarter, nine targeted biotechnology companies and three involved pharmaceutical firms.

- The largest M&A transaction of Q3 belonged to Gilead Sciences Inc.’s acquisition of Immunomedics Inc. valued at $19.92 billion. This is followed by Teledoc Health Inc.’s acquisition of the California-based Livongo Health Inc. at $18.26 billion.

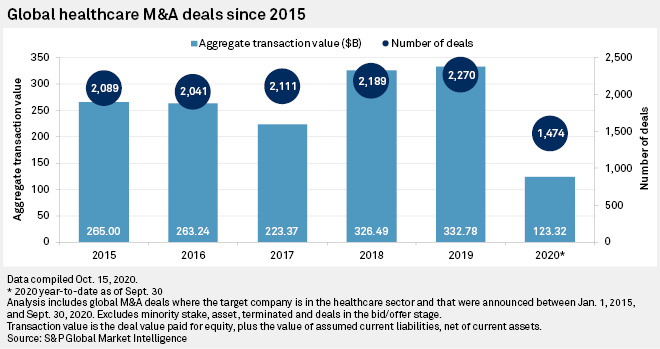

- Despite the uptick in M&A activity in Q3, the increase could not cover the slowdown in activity from earlier in the year attributed to COVID-19 uncertainty. The overall value of the disclosed deals year to date is down 27.9% to $1.86 trillion from $2.58 trillion during the same period in 2019.

Mergermarket’s Global and Regional M&A Report for the third quarter said Blackstone’s acquisition of Takeda Consumer Healthcare is the largest private equity buyout deal during the third quarter and is part of a wave of noncore asset divestitures by Japanese blue-chip companies.

The resurgence in deal-making activity in the third quarter was driven by the largest and most complex deals — a 256% increase on a quarterly basis in transactions valued at $5 billion or more, according to Mergermarket. Most of the healthcare sector’s $1 billion-plus deals were announced in the second half of the year, and only one was announced before May.

Read the full analysis here by S&P Global Market Intelligence

The post Healthcare M&A Value Surges In Q3 As Large Transactions Resurrect Deal Making appeared first on ValueWalk.