The Broad Market Index was down 2.26% last week and only 25% of stocks out-performed the index.

Q1 2020 hedge fund letters, conferences and more

The big surprise in the first quarter financial statements (now 85% complete) was an increase in the proportion of market capital accounted for by rising sales growth companies and an increase in the average sales growth rate from 7.1% to 7.4%.

Improvements In Healthcare Industry And Amazon

All sectors except energy recorded a small increase in capital value accounted for by improving sales growth while the improvement was not evident at the average company. That reflects that large companies (particularly Amazon.com, Inc. (NASDAQ:AMZN) where sales growth increased to 22.8% from 20% at year-end) are performing better than small companies. Overall, sales growth has improved at 38% of companies which is down from 42% last quarter.

The numbers also, so far, do not reflect retailers who will report their fiscal quarters ended April at the end of this month. Those sales growth numbers will reflect two months of virus impact whereas companies reporting their fiscal quarter results ended March are displaying only one month of virus impact.

Still, we wanted to get a predictive measure of the market decline. The reports received as of yet indicate a strong pattern of small companies performing worse than large ones and not surprisingly most of the improvement is in healthcare and Amazon.

Asset Allocation in a Falling Market

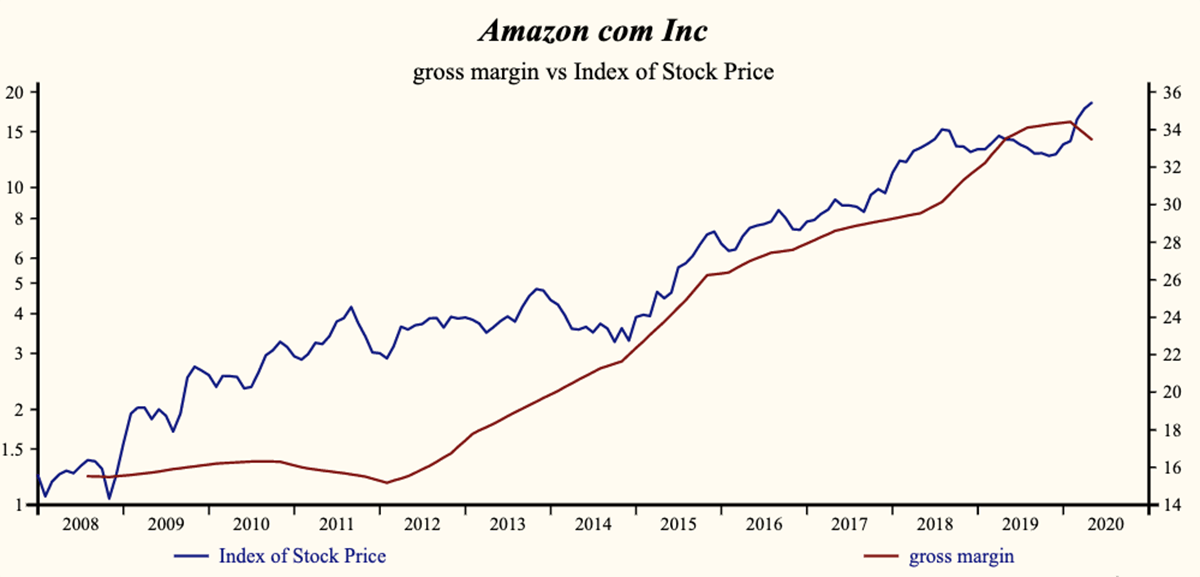

The more important factor for asset allocation is the gross profit margin which fell on average and more frequently for the third consecutive quarter. Amazon’s gross margin has been 96% correlated with the direction of the share price (five-quarter lead) and fell last quarter from its all-time high. Historically the direction of the profit margin is a very reliable indicator of the direction of stock prices.

The primary downtrend in stocks that began in November 2018 is unlikely to reverse until the market’s gross profit margin improves. That suggests that we will be managing stock portfolios in a falling market for a while yet.

The other surprise in the first quarter update was an improvement in the basic industrial sector. Although it is too soon to see how the shape of the recovery from the virus crisis will look, the aggressive policy response has shifted to deficit spending (from monetary easing). That should benefit industrial companies and we may be seeing some of that already in the numbers.

For now, continue to focus investments in rising sales growth and rising profit-margin companies and avoid poor financial condition. Shift to active management now and maintain a portfolio of companies with high and rising profitability.

Whatever shape the recovery takes Machine Learning and AI will be an important component of it. Empower yourself with data and analytics that has identified every market peak and trough in the past 50 years. Register at Otos.io – Please remember Otos in your money and investment conversations.

The post Healthcare And Amazon Paint Early Earnings Picture appeared first on ValueWalk.