Global mining assets at risk of significant increase in carbon pricing according to Trucost

Q2 2020 hedge fund letters, conferences and more

One-third of global mining assets across 56 countries could be exposed to an increase in carbon pricing four times greater than current levels

New York, NY, 20th August 2020 –Trucost, part of S&P Global, unveiled research today conducted across 1,418 mining assets in 56 different countries revealing nearly a third of the global mines will be exposed to an increase in carbon price. The increase in carbon price will be upwards of $100 per tonne of CO2e in 2030, four times the current carbon price of the EU’s Emissions Trading Scheme, if countries around the world implement policies that are in line with the ambitions set out in the Paris Agreement.

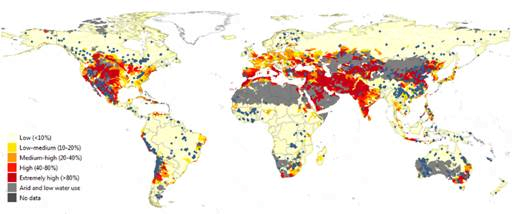

The research also showed that if the climate commitments of nations fail to reduce global emissions levels, extreme weather events, droughts, heatwaves and floods would likely become more frequent. Using Trucost’s Physical Risk Analytics, the research noted 27% of mines are located in areas where water risk due to climate change will increase between now and 2030, highlighting one of the many potential physical risks within the industry.

Steve Bullock, Global Head of Research and Innovation, Trucost, part of S&P Global: “An accelerated low-carbon transition presents both opportunities and risks for the mining sector. The shift to a greener economy means increased demand for renewable technologies such as electric vehicles, solar panels and battery storage systems, all of which require vast amounts of metals to produce. However, stricter climate regulations such as carbon pricing schemes could raise operating costs for businesses and affect their bottom lines.”

The research noted that the mining sector consumes 1.25% of the world’s total energy, equivalent to the annual energy consumption of Spain. Four metals drove 2% of total global industrial greenhouse gas (GHG) emissions: aluminium, copper, gold and iron.

The water risk of about a third of the gold and copper mines is expected to double by 2030. Increases in water risk are driven by the depletion of water tables, changing weather patterns or increases in demand.

These mines are likely to be exposed to higher water costs, either in the form of increased extraction costs or water tariffs.

Climate-related risk is coming under the spotlight of investors

S&P Global Market Intelligence Textual Data Analytics shows a 1,200% increase in mentions of specific environmental and social issues in company earnings calls between 2017 and 2018, drought being the issue with the largest increase[1]. The Financial Stability Board’s Task Force on Climate-related Financial Disclosures (TCFD) is calling for more transparency on climate risks including carbon pricing risks and has garnered support from companies and financial institutions representing a market capitalization of over $12 trillion[2].

To manage the risk of unexpected shocks, energy-intensive sectors that are dependent on the use of natural resources need analytical tools to help them understand their exposure to the unpriced risks of climate change and integrate them into their decision-making processes.

Editor’s Note:

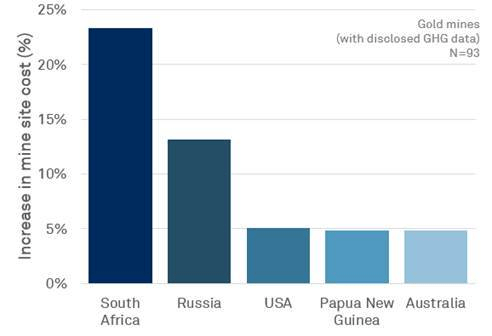

Carbon pricing risk at the mine level is a function of the carbon price at the location of the mine and the greenhouse gas (GHG) emissions intensity of the mining asset itself.

Figure 2 Increase in mine site costs (labour, fuel and electricity cost at mine and mill) from unpriced carbon risk – 2025 (High carbon price scenario)

Source: Trucost Analysis, for illustrative purposes (data as of 12/31/2019).

About S&P Global Market Intelligence

At S&P Global Market Intelligence, we understand the importance of accurate, deep and insightful information. We integrate financial and industry data, research and news into tools that help track performance, generate alpha, identify investment ideas, perform valuations and assess credit risk. Investment professionals, government agencies, corporations and universities around the world use this essential intelligence to make business and financial decisions with conviction.

S&P Global Market Intelligence is a division of S&P Global (NYSE: SPGI), the world’s foremost provider of credit ratings, benchmarks and analytics in the global capital and commodity markets, offering ESG solutions, deep data and insights on critical business factors. S&P Global has been providing essential intelligence that unlocks opportunity, fosters growth and accelerates progress for more than 160 years. For more information, visit

www.spglobal.com/marketintelligence.

Trucost, a part of S&P Global

Trucost is part of the S&P Global family, operated by S&P Market Intelligence. The firm assesses and prices risks relating to climate change, natural resource constraints and broader ESG factors.

Companies and financial institutions use Trucost intelligence to understand exposure to ESG factors, inform resilience and identify the transformative solutions of tomorrow. Trucost data also underpins ESG indices, including the S&P 500 Carbon Efficient Index® and -S&P/IFIC Carbon Efficient Index®. For more information, visit www.trucost.com

[1] Trucost, S&P Global Market Intelligence (2019).

[2] TCFD (2020). Task Force on Climate-Related Financial Disclosure – TCFD Supporters.

The post Global Mining Assets At Risk Of Increase In Carbon Pricing appeared first on ValueWalk.