New report names Wells Fargo and JPMorgan Chase as main players pouring big money into troubled fracking industry

Q2 2020 hedge fund letters, conferences and more

Highly Concentrated Financing For The Fracking Industry

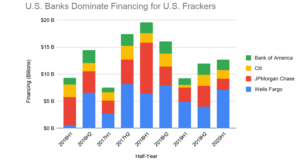

San Francisco – A new report by Rainforest Action Network (RAN) and Oil Change International reveals that financing for the fracking industry is highly concentrated, with Wells Fargo the biggest banker of U.S. frackers since the Paris Climate Agreement was adopted, and JPMorgan Chase a standout second place. The fracking industry has been hit hard by the pandemic, with dozens of bankruptcies so far this year, but its troubles long predate the coronavirus.

The report shows banks have continued financing the fracking industry through the years despite numerous warnings that the sector was financially unsustainable — on top of the well-documented environmental, health and climate impacts of fracking.

“The fracking sector has become a poster child for the serious problems facing the U.S. oil and gas industry,” said Alison Kirsch, lead researcher of RAN’s Climate and Energy program. “The disastrous climate consequences of fracking, as well as the horrific community health impacts, are well known, but the continued billions of dollars pouring into this dying sector means that banks are injecting a real level of systemic risk as well to the U.S. economy.”

“The history of the oil industry is one of repeated booms and busts. Every time both oilmen and bankers swear the next time will be different. It never is. But this time must be different. The planet cannot afford any more oil booms,” said [OCI]. “The lesson for the future is that banks will need to be forced by regulators, shareholders and the public to consider the climate impact of their business activities so that they do not facilitate yet another oil boom when the current pandemic is past.”

“[The money that these banks are pouring into the troubled fracking industry has real impacts on my community…],” said Karen Feridun, founder of Berks Gas Truth, a grassroots citizens’ group fighting to bring an end to unconventional natural gas drilling in Pennsylvania.

40% Of The Financing For Fracking-Focused Companies Came From JPMorgan Chase And Wells Fargo

The ~50 U.S. fracking-focused companies analyzed in this report received $224 billion in financing since the Paris Agreement was adopted (1/1/16-8/31/20), with almost 40% of that financing coming from JPMorgan Chase and Wells Fargo alone.

Combined with Citi and Bank of America, four major Wall Street banks provided over half of U.S. fracking financing since Paris.

The fracking companies analyzed in this report have $120 billion in debt set to mature from 2021 to 2025, much of which now seems unlikely to ever be repaid. In fact, 72% of the bonds issued by these companies were rated non-investment grade when brought to market, compared to only 17% of U.S. bonds issued economy-wide. Analysis of funding over time shows a significant change from 2017 onwards in the mix of the funding streams from banks for frackers: the proportion of financing from loans soars, while that from new debt and equity tumbles in the two full years following. This implies that investors were finally waking up to the basic flaws in the industry’s debt-soaked business model and its inability to turn a profit, and yet banks continued to shower the sector with loans.

Banks’ own profits are not the only thing impacted by their poor due diligence in evaluating the viability of fracking companies. Investors throughout the economy — including the pension and retirement funds that many workers and middle-class families depend upon — feel the hurt when the frackers’ stocks and bonds, introduced to the markets through banks’ underwriting activities, turn out to be lemons.

The report concludes that we cannot afford for banks to ride out another boom and bust cycle with the fracking industry: given the climate emergency, and the dire community health impacts of fracking, banks must refuse to fund a new round of fracking expansion. At the same time, regulators and shareholders must act to force banks in the right direction, for the sake of our communities and climate.

The post Fracking Fiasco: The Banks That Fueled the U.S. Shale Bust appeared first on ValueWalk.