To start, I want to make two points. Investing successfully requires that you remain engaged and motivated. Just because you choose to ignore the markets, the markets won’t reciprocate and ignore you. Zig Ziglar said, “People often say that motivation doesn’t last. Well, neither does bathing — that’s why we recommend it daily.” One of my goals is to keep you engaged and motivated.

To start, I want to make two points. Investing successfully requires that you remain engaged and motivated. Just because you choose to ignore the markets, the markets won’t reciprocate and ignore you. Zig Ziglar said, “People often say that motivation doesn’t last. Well, neither does bathing — that’s why we recommend it daily.” One of my goals is to keep you engaged and motivated.

My second point follows the first. Investing is all about change. My observation is that often there isn’t an immense difference between an average investor and a great investor.

I’ve met many passionate but average investors who are only excited about their vision of themselves as being stock market gurus. A few winning trades can do that. Instead, they need to be both passionate and disciplined about learning to be a competent and consistent investor. In other words, embrace both change and personal growth.

Reality is this. The education of an investor is never done. Dare I say it: we must suffer for our craft. Perhaps think of yourself as a machine learning algorithm. Every investment experience — be it optimal, sub-optimal or negative — should result in an adjustment to the investor’s personal algorithm.

So these two points about ongoing motivation and continuing your education together lead directly to my first life passage and address my two objectives — staying motivated and growing as a person. Coincidentally, this blog’s title — “The Traders Journal” — has reflected this ever since I began to write these in 2012 .

Passage #1 – Keeping a Journal

I started keeping a journal when I was 13 years old. My track and field coach was John Hudson who eventually became Canada’s National Coach. He encouraged me to keep a training journal. He assured me that the result would be something he labelled as “crystallized wisdom”. Gosh — who wouldn’t want that?! It sounded as if Lord of the Rings would speak to me. It did in fact change my life, both in athletics and investing.

The foundations for my best races were well documented in my journal. I could thereby focus on replicating and improving my preparation for competitions. Similarly, disappointing results were usually explained in the training journal leading up to race. These days digital and hand written journals are common place in sports — be it F1 racing or the NFL, NHL, NBA and MLB. My trading journal today is much more detailed and structured, and I’ve written various blogs describing my journal. I encourage you to keep a trading journal. You will not be disappointed in the value it yields.

Passage #2 – What vs. Why

When I made the personal commitment to become a full-time investor, I had the sheer good fortune (more like divine intervention) of running a small ad looking for part-time help and having Paul Ferwerda call me. In 1970, Paul was the founder and first president of the Technical Securities Analysts Association (TSAA) in San Francisco. Sorry, New York. The TSAA came first — before the Market Technicians Association (MTA). Paul had retired from Bank of America and turned out to be the ideal mentor for me. He taught me that the market only rewards investors who act upon “WHAT” is happening in the present moment.

Paul said educated investors can waste precious time and energy focusing on “WHY”. The assumption being that you’ll be rewarded for knowing why. “WHY” may be more intellectually satisfying, but unfortunately it is often late to school, allowing only “WHAT” to score the higher grades.

Paul also taught me that the market is a complex auction arena fueled by millions of investors voting with their money based upon their unique information, beliefs and emotions. Eventually with an equity, you might learn exactly “WHY” a price move happened. The most importance for profitability, however, is “WHAT” is happening now. Are the buyers or sellers winning this war? The chart tells you this. The charts do not lie. Trade the “WHAT” — today. You’ll learn the “WHY” tomorrow.

A key corollary Paul taught me was that by trusting the charts, I was liberated to deploy powerful technical tools and focus on putting the winds of probability at my back. But more on that later. For now, trust your charts. Here’s a blog I wrote on the topic.

Passage #3 – The 5 Stages of Investor Growth

The stock market requires humility. Regardless of your IQ or the letters after your name, the stock market doesn’t care how smart or educated you are. Yes, you may have a streak of winning trades that all ended with the raising of champagne glasses and a salute to your wisdom. Reality is that the University of Wall Street requires you to pay tuition. The well documented “5 Levels of Investor Growth” is described in detail in our book, Tensile Trading. It’s widely accepted and was not our creation. It’s similar to a college freshman having to complete their sophomore, junior and senior year before graduating. That’s how it is. You don’t start first year and then pole vault over your sophomore and junior years to land as a senior in your second year.

Investors similarly start as “novices” with a mixed bag of tools and ideas. There is no jumping levels from “advanced beginner” to “proficient.” You might, however, accelerate through the “competent’ stage. Nonetheless, you must spend some time in each stage. It’s akin to a law of nature! God will be laughing if you believe you’ve become a Level 4 “proficient” investor in under a year.

Be humble. Accept paying tuition. We all did. Understand that if you make a disciplined and organized effort, you will progress from

- Novice

- Advanced Beginner

- Competent Investor

- Proficient

- Expert

The market will reward you as you grow. Read more.

TOOLS

The investor will always be paramount. The tools are secondary. This is why Stage 3: The Investor Self is the most important chapter in our book, Tensile Trading: The 10 Essential Stages of Stock Market Mastery. Novice investors don’t believe it. Expert investors know this to be true.

Let me paraphrase from a favorite movie of mine — Bottle Shock. Claude Debussy used a standard piano. Monet used off-the-shelf paint. Rodin’s bronze was not a unique metal. But look what they all achieved. It wasn’t about the medium — it was about the artist. Investors must embrace the belief that their financial masterpiece can be created with straight-forward off-the-shelf tools. It’s about the investor — it’s not about the tools. It’s always been that way.

Having said that, today we investors have far too many tools from which to choose. It’s analogous to standing in front of a fire hose trying to get a drink of water. It’s overwhelming. Herein, too, lies a conundrum. It’s counter-intuitive but I’ve learned over many decades of investing that “simplification tames complexity in the stock market.”

We investors need tools. We need a few tools and we need the right tools. Unlike our capitalistic mantra of “more”, investors should strive for the art of reduction with a mantra such as “more with less”. Build your investment methodology with a minimalist mindset as if you’d grown up in a Soviet orphanage. Instead of embracing the belief that adding one more indicator or one more fundamental factor will magically reveal to you the Holy Grail, try to understand that additional complexity is like pouring quickset concrete into the only water well in the desert.

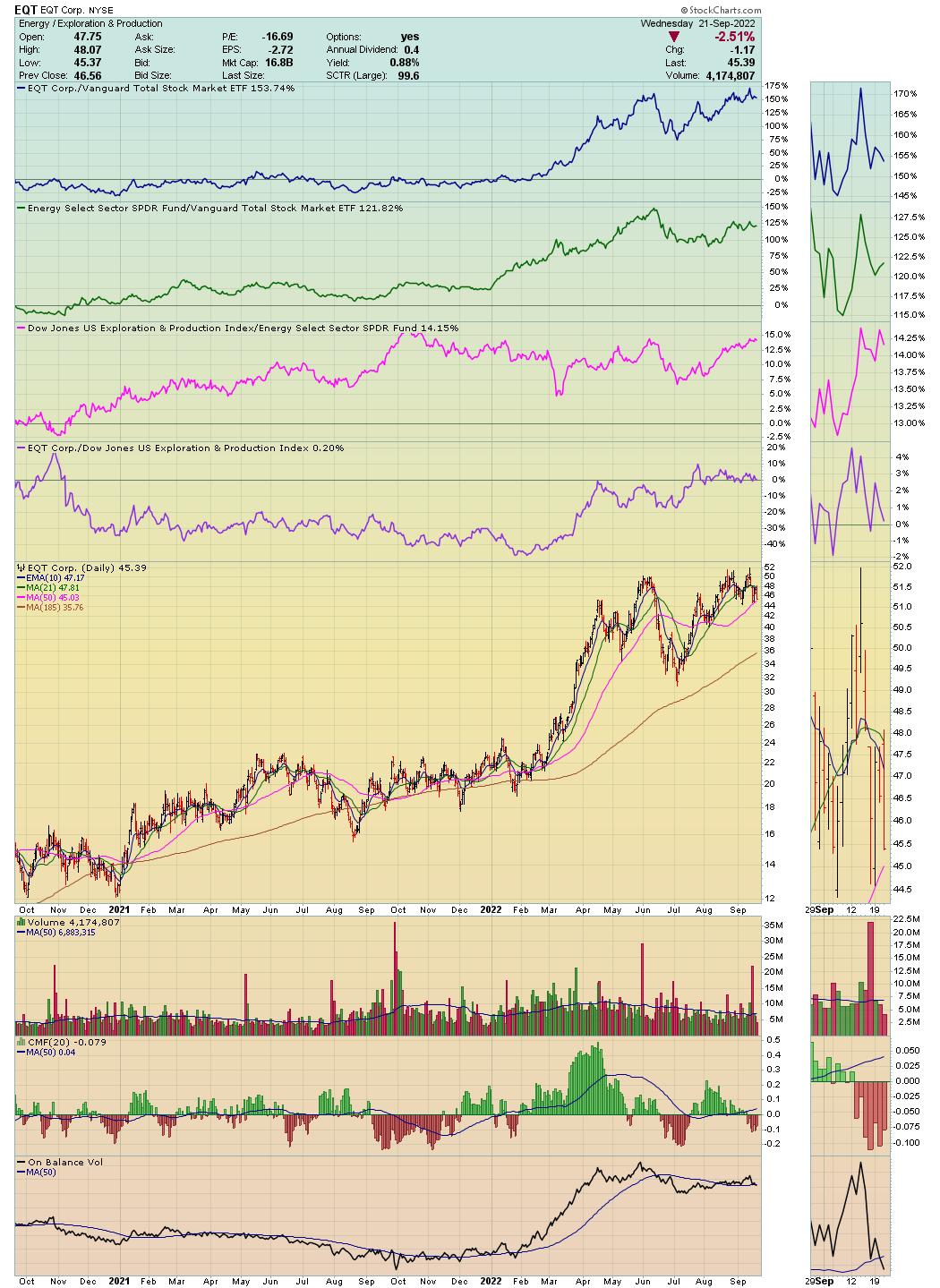

As an example, I’ll share my arsenal of tools that reflects my philosophy of simplification. One that is clearly evident in our Stock Market Mastery ChartPack and our book. When I look at an equity chart, I want to know five things. I use ten indicators to give me the insights I need.

Q1: WHAT’S THE PRICE ACTION RELATIVE TO THE MARKET?

Tools:

- Price Relative (Relative Strength)

Q2: WHAT’S THE TREND?

Tools:

- Draw Trendlines

- Moving Averages

- Average Directional Index (ADX)

Q3: WHAT’S VOLUME TELLING ME?

Tools:

- Chaikin Money Flow

- On-Balance Volume (especially powerful with one-minute data)

Q4: WHAT’S MOMENTUM?

Tools:

- Relative Strength Index (RSI)

- MACD

- Stochastics

Q5: WHAT’S THE PRESENT RISK-TO-REWARD?

Tools:

- Point & Figure Charts

There you have it. Not much gets by me with this simple toolkit. Read more.

FIVE LESSONS

- It’s okay to be wrong. It’s unforgivable to stay wrong. — Marty Zwieg

- Monitor and manage your precious time. Routines make this possible. Think ChartPack.

- Be aware when you begin to distort market information to fit your own beliefs and expectations. Neutralize these tendencies. You are Switzerland!

- Don’t let a string of winning trades result in an inflated opinion of yourself. Stay true to your methodology and disciplines. Warren Buffett often says, “We don’t have to be smarter than the rest. We have to be more disciplined than the rest.”

- For 17 years, Matt Krantz wrote an investment column for USA Today. When he left, he disclosed his “top investing lesson” as follows: “If you want to make money investing, forget the minutiae, stop obsessing, don’t procrastinate, just get started.”

In addition to the passages, tools and lessons herein, I had promised to include a story in this series of blogs. So here’s my story. Over the years, I’ve had the opportunity to attend hundreds of formal and informal investment oriented gatherings. A little trick that Dr. Hank Pruden taught me (who no doubt attended thousands of these kinds of events) was to quickly ascertain the investment seriousness of whomever I struck up a conversation with. He suggested that I tactfully steer the conversation around to books and then respectfully ask if the person had read Reminiscences of a Stock Operator by Edwin Lefevre. Dr. Pruden’s observation was that this gauged the seriousness of the individual with whom you were speaking.

p.s. I’m really looking forward to exchanging ideas and thoughts with you October 7th and 8th at ChartCon 2022. I hope you join all of us at this very special event! CLICK HERE for more information and to register.

Trade well; trade with discipline!

Gatis Roze, MBA, CMT

- Author, “Tensile Trading: The 10 Essential Stages of Stock Market Mastery” (Wiley, 2016)

- Developer of the “Stock Market Mastery” ChartPack for StockCharts members

- Presenter of the best-selling “Tensile Trading” DVD seminar

- Presenter of the “How to Master Your Asset Allocation Profile DVD” seminar