On the back of a lot of earnings announcements, the financial sector is getting a lot of attention this week. A few stocks, led by SIVB, FRC, and GS, got hurt pretty bad yesterday with >5% declines.

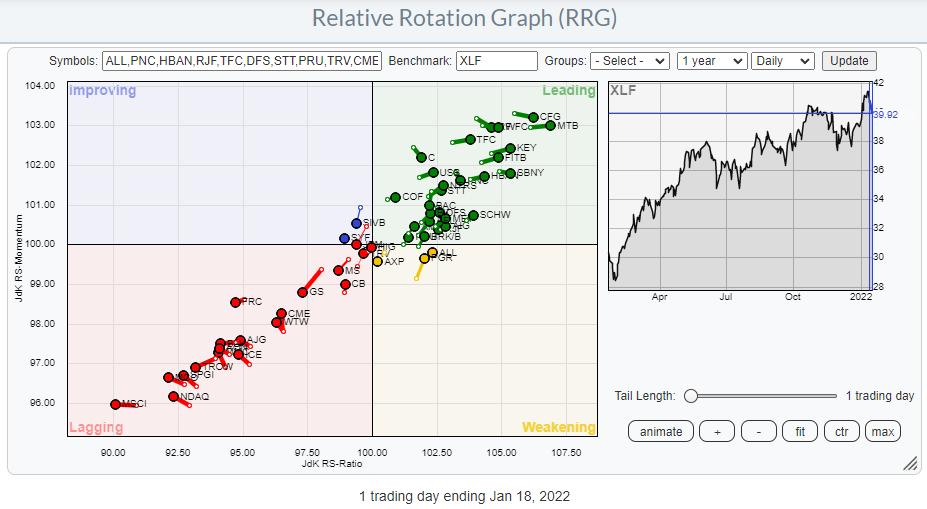

The RRG above shows the (top 50) stocks inside the financial sector. As you can see there is a large group moving further into the leading quadrant at a strong RRG-Heading. While there is an almost equally large group traveling deeper into lagging at a negative RRG-Heading.

Looking at the performance table that is plotted below the RRG we can see that the bottom part is mainly populated by banks and investment services. And the “banks” at the bottom of the list are heavily involved in investment-related activities. For example, GS and MS are technically not “banks” but investment services companies.

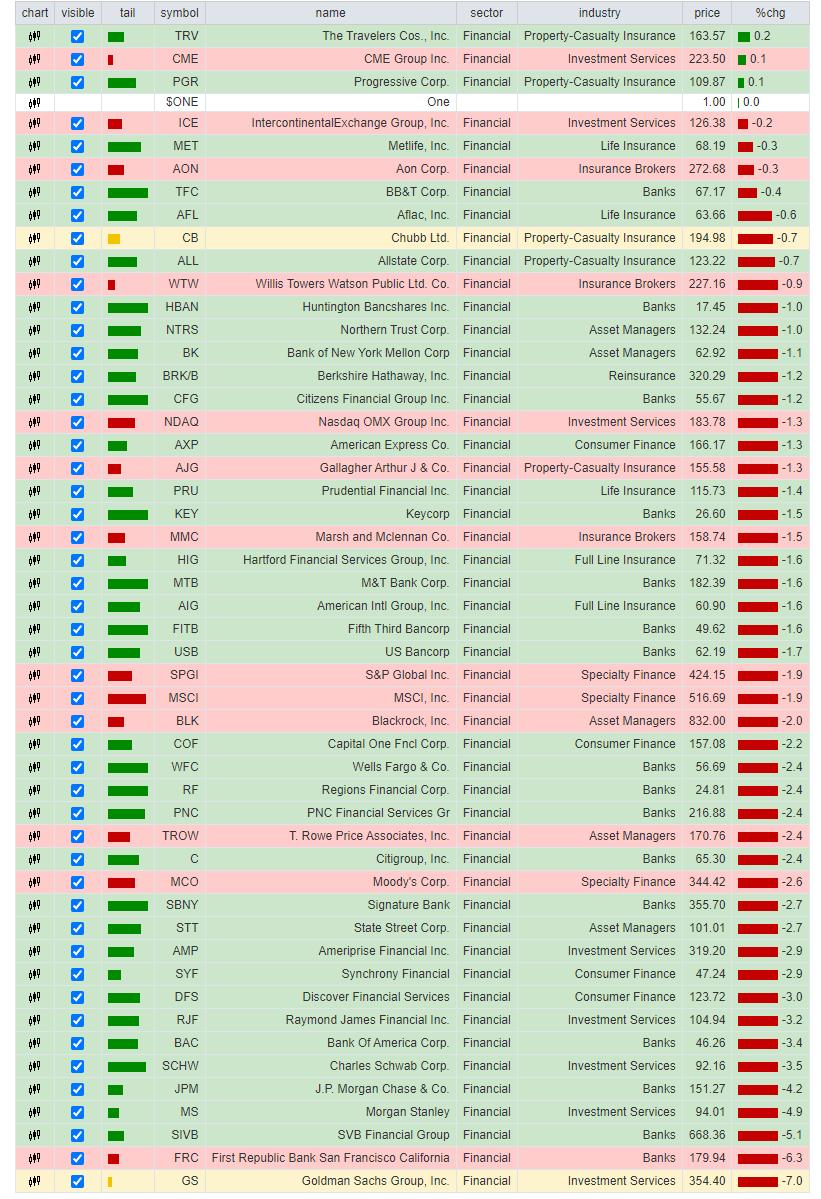

It is interesting to see that at the top of the list we also find investment services companies like CME, and ICE. My take on this dispersion is that CME and ICE are both exchanges, providing a service (access to markets) that benefits from a lot of activity (=volatility). The companies at the bottom of the list are important users of those exchanges and they, in a way, also benefit from a lot of activity. But what they don’t like, especially the trading desks, is inconsistent activity or volatility.

The VIX index above shows how volatility continued to decline into Q4-2021 then rapidly shot up to levels above 30 at the start of December, followed by an equally rapid decline back to levels below 20 at the end of the year. These are difficult conditions for trading desks to consistently make money. And that is reflected in the earnings of companies like GS.

However, there are many more groups and stocks inside the financial sector than just banks and investment-related companies. And not all banks are (investment) banks.

To get a clearer picture of rotations inside the financial sector I have plotted the Relative Rotation Graph for the industries inside the sector below.

There are a few clear trends/rotations visible.

Financial Administration is deep inside the lagging quadrant, moving up on the RS-Momentum scale recently but still a way to the left unlikely to make the complete rotation to leading from here. Consumer Finance inside the improving quadrant and rising on the RS-Momentum scale. Given the position of the other industries, Consumer Finance also seems too low on the JdK RS-Ratio scale to make it all the way to leading from here.

Inside the weakening quadrants we find four tails that are heading towards lagging (RRG-Heading between 180-270 degrees). These groups are Specialty Finance ($DJUSSP), Insurance Brokers ($DJUSIB), Investment Services ($DJUSSB), and Banks ($DJUSBK).

The stronger industries at a strong RRG-Heading and inside or approaching the leading quadrant are Reinsurance ($DJUSIU), Life Insurance ($DJUSIL), Mortgagage Finance ($DJUSMF), Property & Casualty Insurance ($DJUSIP), and inside weakening but rotating back up towards leading we find Full Line Insurance ($DJUSIF).

Are you seeing the same theme I noticed 😉

All these groups that are travelling at a positive heading and in a relative uptrend against XLF are related to the Insurance industry. So going forward it looks like the various insurance related groups will be driving the financial sector.

The RRG above isolates these four insurance related groups so their rotations are better visible.

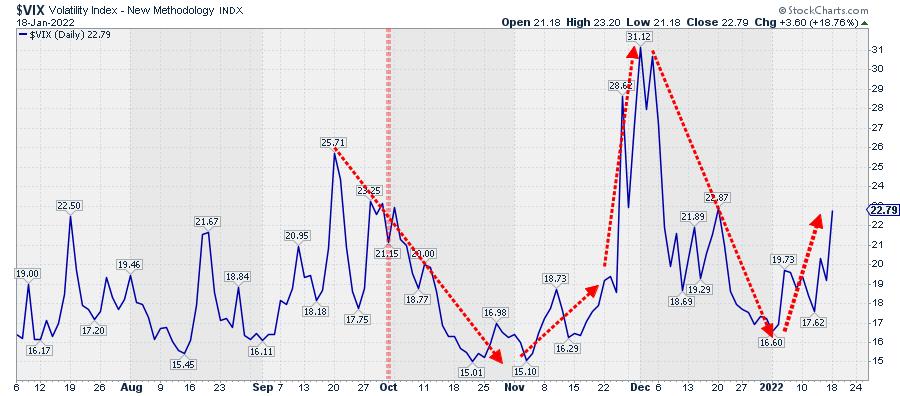

Reinsurance Index

This index is currently moving fastest and highest on the RS-Ratio scale. The improvement in relative strength as well as price is obvious but the fast move higher after breaking away from the consolidation also means this group has quite a bit of risk for a pull-back.

I prefer not to chase and wait to possibly get better entry opportunities on a drop back while relative uptrend and breakout remain intact.

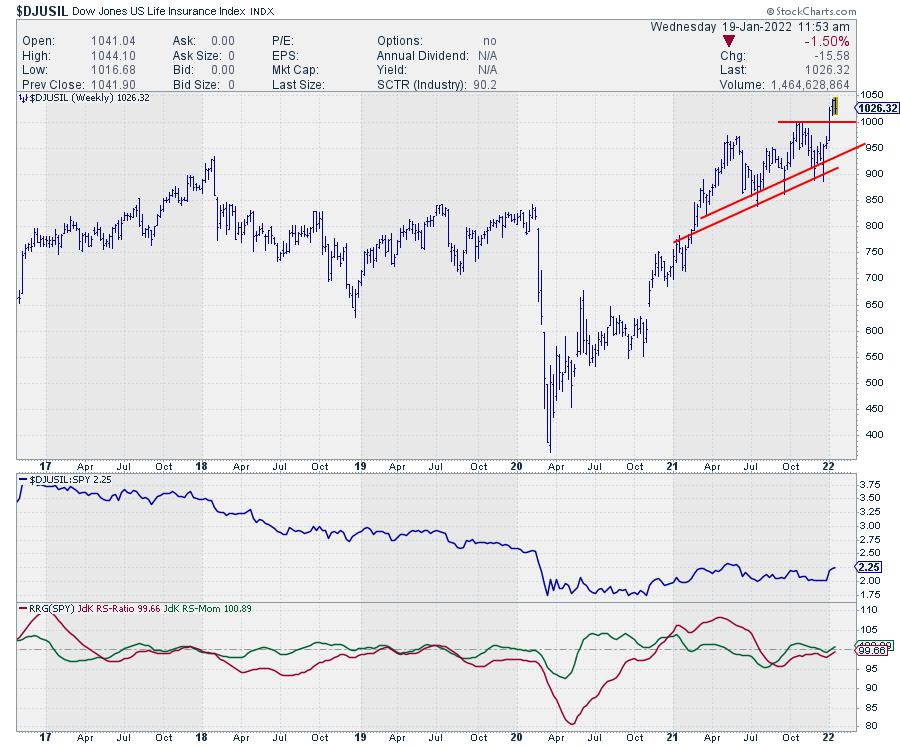

Life Insurance

Life Insurance is on a similar trajectory as Reinsurance but a lower levels on both scales. This means it is earlier in the rotation than Reinsurance. The same goes for the price chart where Life Insurance has less downside risk and therefore, most likely, better upside potential (risk/reward).

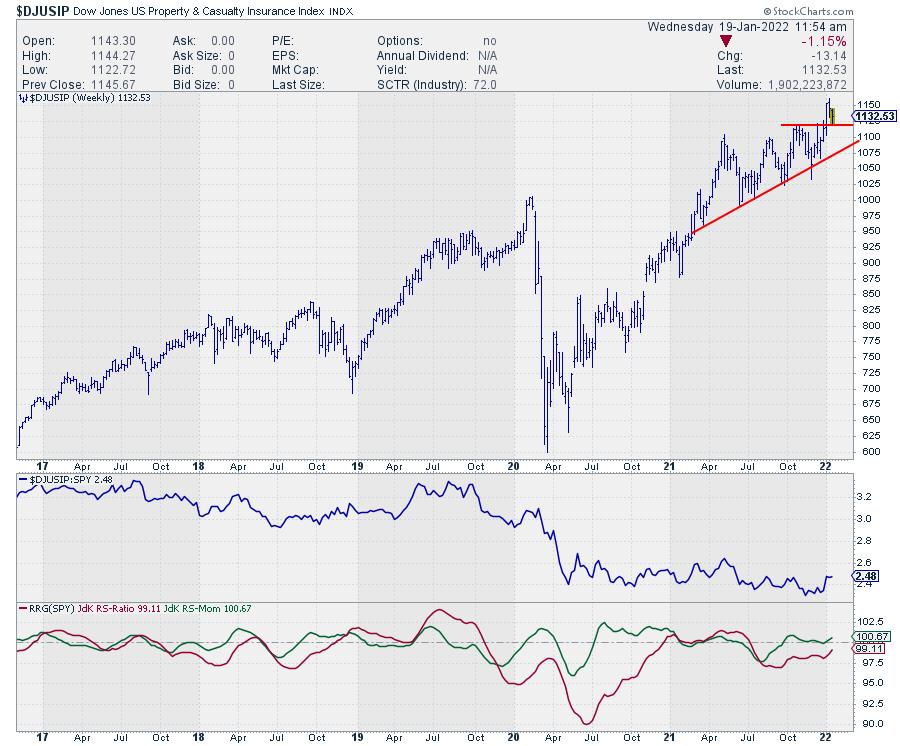

Property & Casualty Insurance

On the RRG Proprty & Casualty Insurance is still inside the improving quadrant, but very close to crossing over. Price already broke out of its consolidation and already testing the old breakout resistance level as support now. As long as that level, around 1120-1125, holds this looks like a good entry level on the back of improving relative strength.

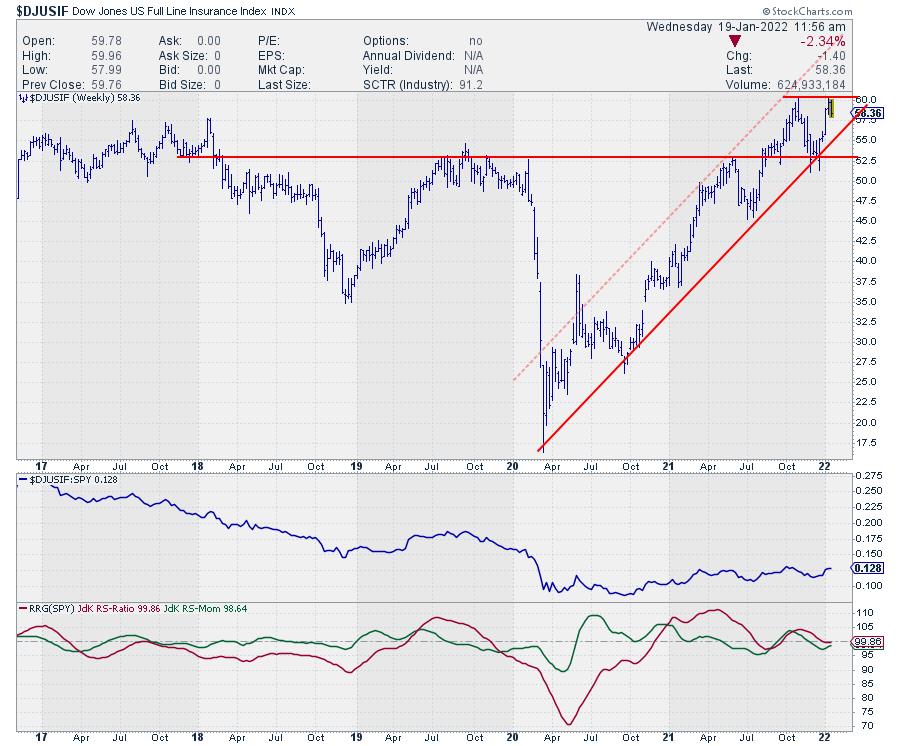

Full Line Insurance

Full Line Insurance already broke above resistance in September, rallied to a new peak at 60, and then dropped back to find support at the breakout level. This has caused relative strength to improve and push both RRG lines above 100 and the tail into the leading quadrant.

Full Line Insurance already broke above resistance in September, rallied to a new peak at 60, and then dropped back to find support at the breakout level. This has caused relative strength to improve and push both RRG lines above 100 and the tail into the leading quadrant.

The dip in price and the resulting loss of relative strength has made the tail rotate from leading into weakening, where it has now started to turn back up again as price reached back to its previous peak.

What is needed now is a break back above 60 in price and a continuing improvement of relative strength to complete the rotation back to the leading quadrant.

—

All in all it looks like Property and Casualty Insurance is offering the best risk/reward at the moment, followed by Full Line insurance when that index breaks above 60.

#StaySafe, –Julius