Given the fragile state of the economy amid the coronavirus pandemic, there’s been some renewed emphasis placed on financial literacy. It’s always been important to have a general understanding of finances in order to stay afloat, but it’s, perhaps, never been more crucial. This tenet also undoubtedly applies to student loans; a topic that’s been a big point of discussion throughout the country over the last several months.

Q2 2020 hedge fund letters, conferences and more

In order to understand more clearly Americans’ level of financial knowledge and how it relates to student loans and demographics, CollegeFinance.com analyzed three data sets – FINRA’s The State of U.S. Financial Capability study, the U.S. Census Bureau, and the U.S. Department of Education. The results paint an eye-opening picture of how certain factors contribute to student loan health and just how important financial literacy is right now.

It Pays to Know Your Finances

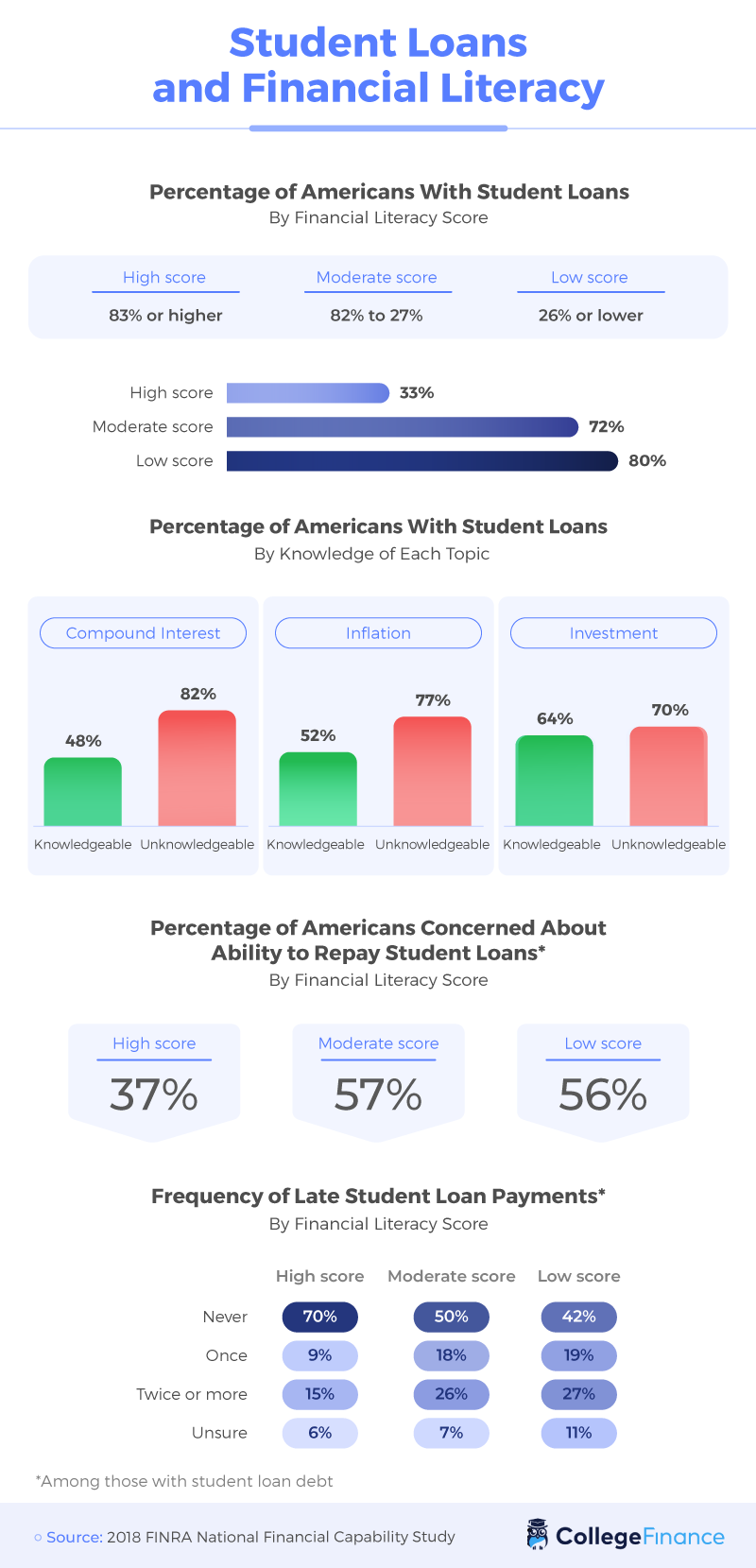

The data analyzed by College Finance showed that just 33% of those with high scores on a financial literacy test graduated with student loans, while 72% of those with a moderate score had debt. Most notably, 80% of those who received low scores on financial literacy tests graduated with student loans.

High-scoring individuals fared well when it came to making late payments as well, with 70% of those who scored well on literacy tests never making a late payment. Just 9% of those with high scores made a late payment once. On the flip side, only 42% of low-scoring individuals had never made a late payment on their student loans.

The State of Financial Education

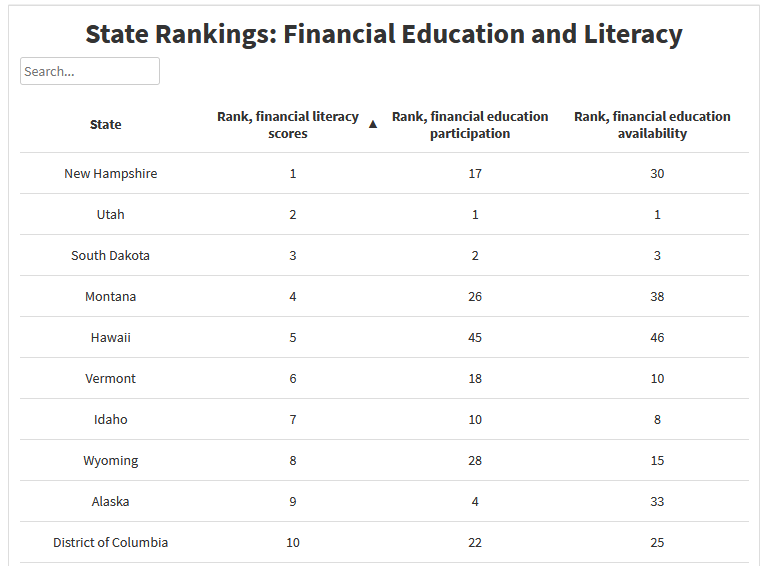

Do demographics factor in at all when it comes to financial literacy? As it turns out, the correlation between participation and availability of financial education in different states and financial literacy scores paints an interesting picture. New Hampshire ranked number one for financial literacy scores among states, but 17th for participation and 20th for availability. On the other hand, though, Utah came in first for both participation and availability – as well as number two in the ranking of financial literacy scores.

The worst state for participation and availability was Kentucky, who ranked 51st in both. However, they remained a bit further up the list of literacy scores; coming in at number 42. Mississippi fared the worst in terms of financial literacy, though they ranked 11th and 18th for participation and availability, respectively.

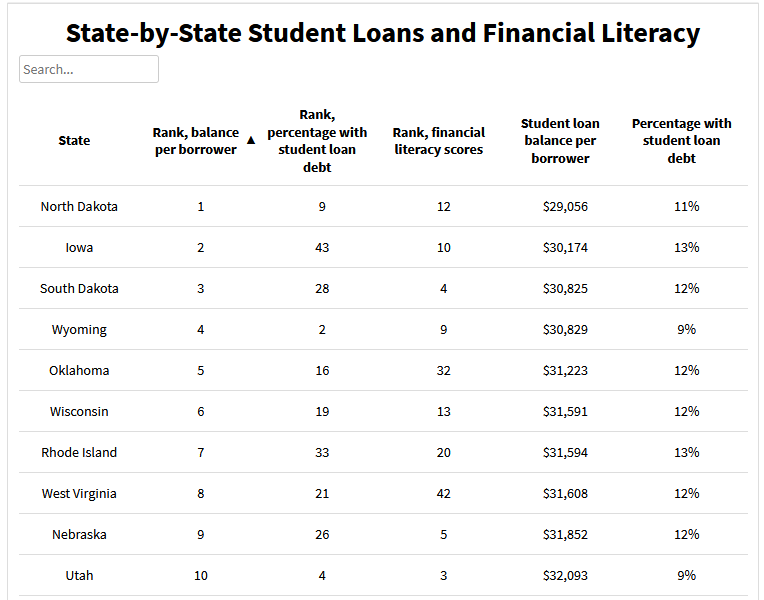

How does all of this play into student loan debt? Currently, the two states with the most student debt are Ohio and Georgia – with 15% of residents having loans to pay. Interestingly, Ohio ranked 36th in financial literacy scores, while Georgia landed 43rd.

Access to Education

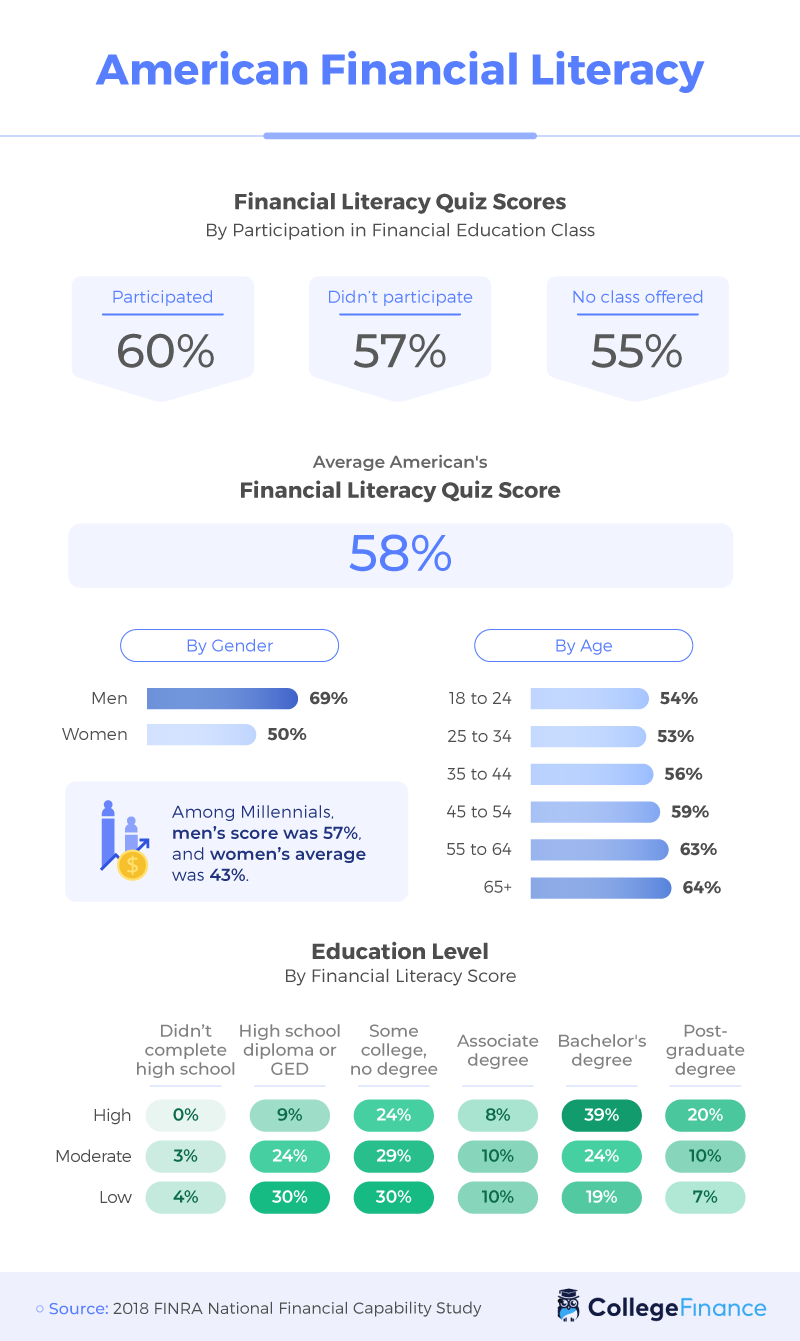

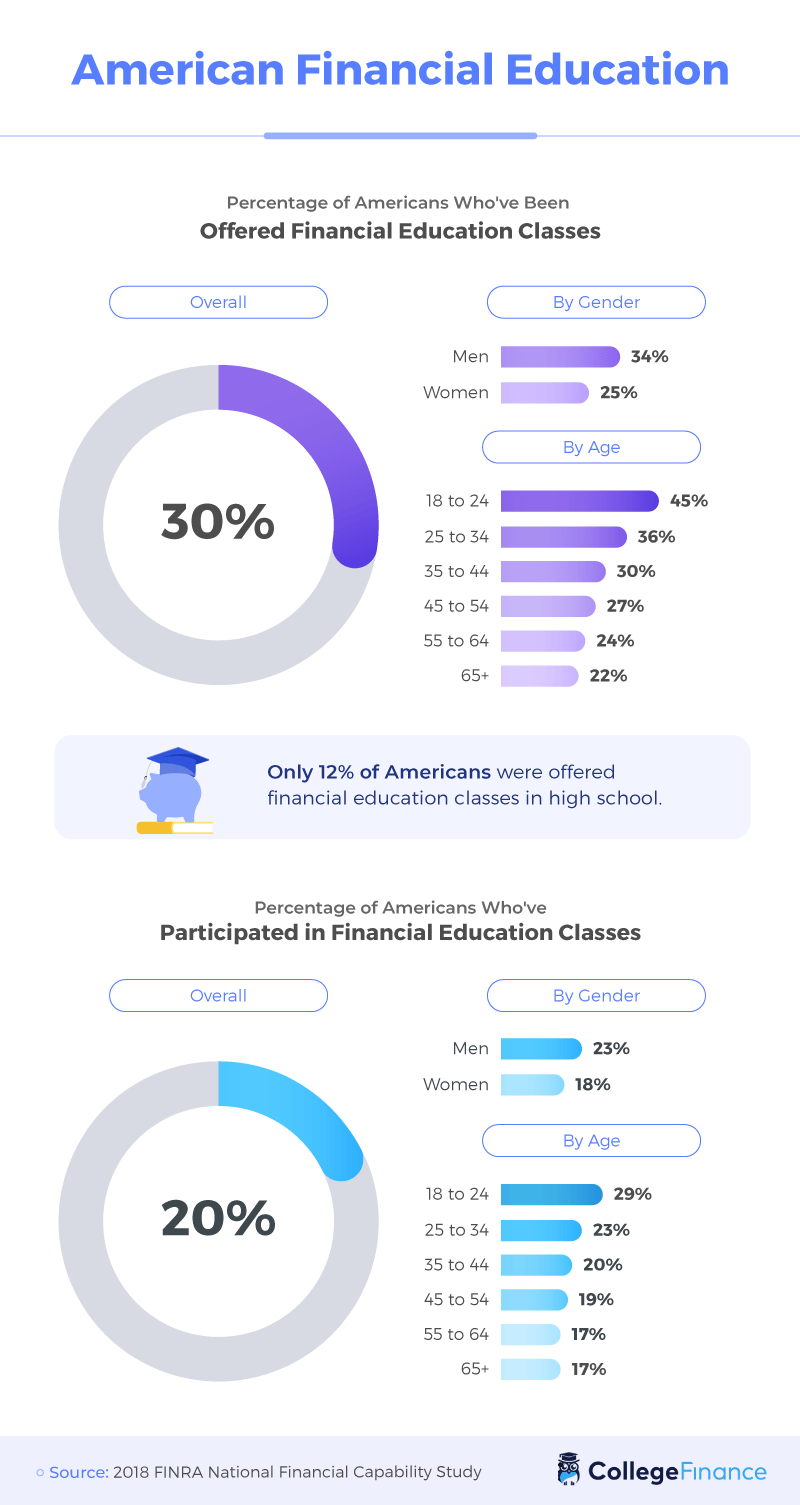

When it comes to financial literacy, the biggest question that remains amid all of the data is maybe the most important: Who has access to the proper financial education, and who participated? The College Finance study showed that 34% of men were offered adequate financial education, while 25% of women were given the same opportunity.

Only 23% of men actually participated in those classes, however, while 18% of women took part. Age offered, perhaps, the most interesting results, with 45% of those from ages 18 to 24 being offered financial education. Compared to the oldest generation (age 65 and up), of which 22% were offered proper financial education, these findings show what kind of opportunities are available today as opposed to years ago.

Overall, 30% of Americans were offered financial literacy education, and 20% actually participated in courses. Twenty-nine percent of those in the 18- to 24-year-old age bracket participated, while 17% of those ages 65 and up did the same. That seems to say a lot about what is offered these days – in fact, just 12% of Americans were offered financial education courses in high school.

There’s been a fair amount of criticism leveled against the education system as a whole for a lack of financial preparedness, resulting in a more recent uptick in “adulting” classes that emphasize economics. Even celebrities have taken to doing their part to provide financial education to young people on a local and state level, with rapper 21 Savage leading the charge in trying to help people become better educated on finances.

The Importance Of Financial Literacy

It’s clear from the data analyzed by the team at College Finance that there’s a strong correlation between financial education and student debt. And at a time when student debt is front and center in the economic crisis facing the country as a result of the pandemic, the fact that financial literacy has a positive impact on college loans can’t be ignored. The recent push to provide better education on real-world financial topics is a welcome one, as the crisis only highlights the need for better preparedness when it comes to finances and handling debt. The findings emphasize not only the importance of staying on top of student debt, but also how much of a leg up those with proper financial education have when it comes to tackling it.

The student debt crisis may not get better any time soon, especially with the economic decline from the pandemic only getting worse. It’s obvious, however, that with the right understanding of how finances work in the real world, managing the often overwhelming debt that comes along with getting a higher education can be significantly easier.

The post Financial Literacy and Student Loans: A Complex Relationship appeared first on ValueWalk.