Fairpointe Mid-Cap Composite commentary for the fourth quarter ended December 31, 2021.

Q4 2020 hedge fund letters, conferences and more

We See Benefits from Continued Market Rotation

The trends in market rotation that we discussed recently have continued and have been positive for our stocks. After several years of markets being dominated by growth, momentum, and passive investing, we have seen a reset back to fundamental value-based investing. The pandemic in 2020 resulted in disruption to growth in economies around the world. With the availability of vaccines, attractively valued companies that will benefit from increased economic activity are now gaining favor. The expectation of additional fiscal stimulus from the next administration has further boosted the rotation since the Georgia Senate elections were completed. We expect economic and earnings growth to improve sequentially during 2021, and this should benefit our portfolio holdings.

Throughout this cycle, we have maintained our disciplined valuation approach of investing in mid-cap companies. Although 2020 was a volatile year with a lot of uncertainty in the market, we took advantage of the opportunities and added several new positions to the portfolio.

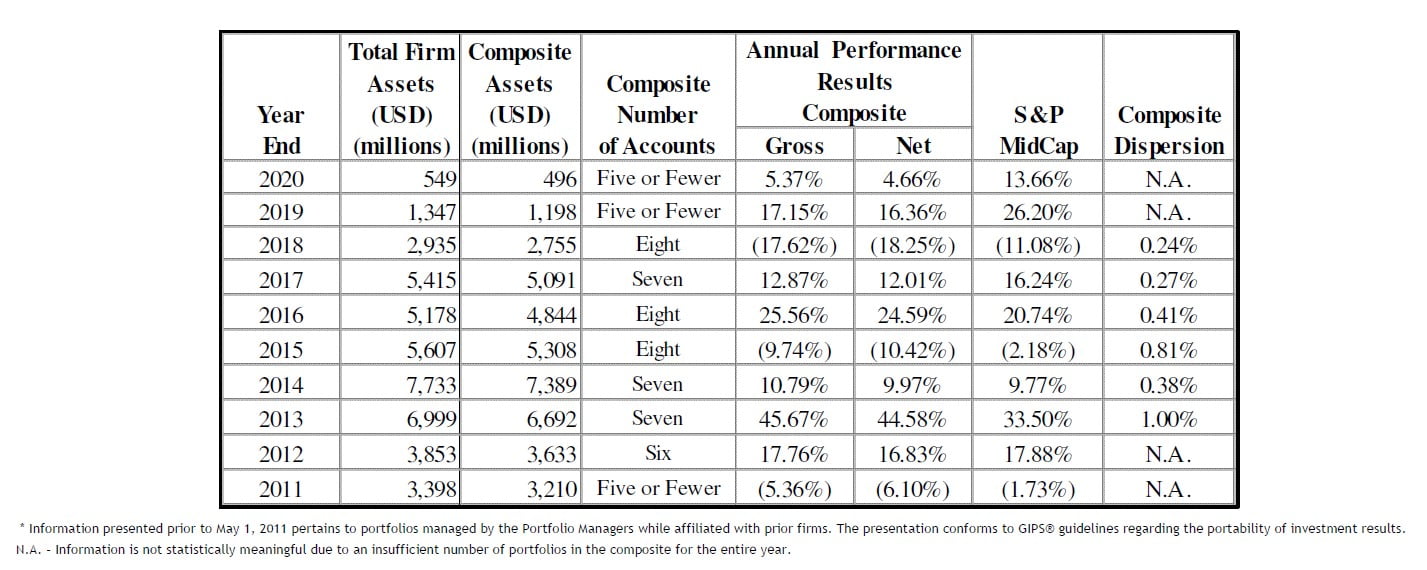

Equity markets rallied strongly in the fourth quarter driven by positive vaccine developments that will help society gradually return to normal during 2021. While all benchmarks were positive, there was a rotation in leadership to midcap stocks, as well as a shift from growth to value. The S&P 400 MidCap Index returned 24.4%, and the NASDAQ returned 15.6%, followed by the S&P 500 Index at 12.2%. The S&P 500 Value Index returned 14.5% compared to the S&P 500 Growth Index at 10.7%. Value performance exceeded growth in the mid and small cap categories as well. The Fairpointe Mid-Cap Composite (net of fees) returned 20.3% in the quarter. The performance was broad-based with 23 stocks up over 20% in the quarter.

Top and Bottom Contributors For Fairpointe Mid-Cap Composite

The top contributors in the fourth quarter included long-term holdings Mattel and Magna, as well as Charles Schwab, which was added during the market downturn in March. The top five contributors to performance were Mattel, Inc., Magna International, Inc., Charles Schwab Corporation, Lear Corporation, and Cree, Inc.

Mattel, a leading toy company with world-class brands that include Barbie, Hot Wheels, Fisher Price, and American Girl demonstrated continued and significant progress on its turn-around effort, exceeding expectations during its most recently reported quarter. We anticipate further improvement in profit margins and debt paydown in the coming years that should drive further upside in the shares as excess cash flow should accrue to the equity value.

Magna is a global producer of parts and technology for the new car market with a history of outpacing industry growth. During the quarter, Magna announced a joint venture with LG Electronics to manufacture electric motors and on-board chargers to support the growing shift toward vehicle electrification. The market for electric motors and electric drive systems is expected to record significant growth between now and 2030. The joint venture will target this fast-growing global market with a world-class portfolio. With the Biden administration’s focus on climate change, demand for stocks with exposure to electric vehicles has been strong. We think that Magna’s inexpensive valuation offers investors an attractive way to invest in this trend.

Charles Schwab has a strong brand and technology platform which enabled it to add over 2 million new accounts (without the TD Ameritrade acquisition) in 2020. Schwab closed its acquisition of rival TD Ameritrade in October. We expect continued asset growth and expense synergies with TD Ameritrade to drive long-term shareholder returns. The bottom five detractors to performance were Lions Gate Entertainment Corporation, Teradata Corporation, Meredith Corporation, Akamai Technologies, Inc., and Hormel Foods Corporation. Of these, only Teradata declined more than

10%.

Lions Gate creates motion picture and television content. We consider the company’s 17,000 title movie and television library an under-appreciated asset. The company is investing heavily to expand its streaming content and add subscribers to its Starz platform. While shares are under-valued, we reduced the position, as the growth investments will weigh on profits for the next few years.

Teradata is a data analytics company which has changed its focus from hardware sales to recurring software sales with mixed results. We exited the position.

Meredith creates content for print and digital magazines and owns local broadcast television stations. Its brands include People, Better Homes & Gardens, and Southern Living. We consider the local television business to be an underappreciated asset, while the print magazine business has had growth challenges. We reduced the position.

Portfolio Changes

2020 was a volatile year with a lot of uncertainty. We took advantage of the uncertainty to add nine new positions and eliminate eight. During the fourth quarter, we added Biogen, Inc., Western Digital Corporation (highlighted below), and Smith & Nephew Plc as new positions, and eliminated Teradata. The 2020 changes led to an improvement in the portfolio holdings’ profit margins, growth potential, and financial leverage.

Biogen is a multinational biotechnology company specializing in the discovery, development, and delivery of therapies for the treatment of neurological diseases. With the shares trading at 10.7x projected 2021 earnings, the valuation gives little credit to the company’s pipeline of new drug candidates. The company recently announced a collaboration with Apple to identify early biomarkers of cognitive decline using an Apple watch. We see a very favorable reward/risk opportunity for the stock.

Western Digital produces hard disk drives and flash memory storage for mobile devices, desktop and laptop computers, gaming consoles, and servers. We expect storage demand to grow, driven by increasing digital data. The company has a new CEO (formerly at Cisco) who is focused on improving the company’s profitability and cash flow and reducing debt. We think there is substantial opportunity for the company to improve margins and earnings which, when coupled with debt paydown, offers significant upside potential.

Portfolio Outlook and Observations

Looking ahead to 2021, the biggest positive is the rollout of COVID vaccines so society can return to normal. While this will lead to a recovery in economic growth and employment, it will take months to vaccinate enough people, creating risk in the meantime. The economy will need further stimulus to help people manage as we transition.

We are concerned about market speculation and potential risk. A recent Wall Street Journal article highlighted that investors’ margin debt reached a record $772 billion at the end of November. Given market valuation, and the risks surrounding the pace of vaccine rollouts and further stimulus, we will likely experience volatility in the months ahead. We will continue to use market opportunities to add to existing positions and invest in new positions, as we did when we initiated positions in Check Point Software and Charles Schwab in March of 2020. With the portfolio changes, financial risk is lower, and the growth outlook is higher.

The pandemic has caused huge short-term disruptions for economies, businesses, and individuals, and everyone has been forced to adapt. As we slowly emerge from the shutdowns and limitations imposed to reduce the spread of the virus, we expect to see varying impacts on companies. Some of the changes made during the pandemic will be permanent. For example, companies have embraced new technologies faster than they otherwise would have and a number of companies have indicated that fewer employees will be needed as activity resumes. While in-person meetings will continue to be important, companies have identified considerable unnecessary travel and will adjust. The role of the Internet has expanded exponentially with implications rippling throughout society. As we evaluate our investments, both existing and potential, we are factoring in the short-term and longer-term impacts of the pandemic.

In terms of themes, several positions will benefit from increasing Internet traffic and security demands: Corning, Juniper Networks and Nokia. Akamai and Check Point are well positioned to benefit from increased demand for network security seen after the recent widespread hacking of many government agencies and Fortune 500 companies. A return to normal life will benefit several holdings including Copa and Hexcel (travel), Scholastic (back to school), and Molson Coors (reopening restaurants and bars).

We expect investors to continue to favor stocks with good fundamentals in 2021 as the economy recovers from the COVID slowdown. The portfolio is well positioned to benefit from this shift. While the S&P 500 Index is trading at 24.6x projected 2021 earnings (highest since dot-com period), the economy needs to catch-up to the market. The S&P 400 MidCap Index trades at 20.4x, while our portfolio is positioned more attractively at 17.8x.

Thank you for your support. We wish you a safe and prosperous New Year!

Fairpointe Investment Team

The post Fairpointe Mid-Cap Composite 4Q20 Commentary appeared first on ValueWalk.