When I roll through different payment stocks it is almost money in a barrel. These stocks are rising nicely and it doesn’t seem to be constrained to pre and post pandemic names.

Visa is kicking off some nice signals after finding resistance at the $220 level. I like the long-term trend change on the PPO signalling a momentum trend change. The stock price is climbing week-after-week after breaking out. I would like to see the downtrend in the $SPX relative strength in purple break out.

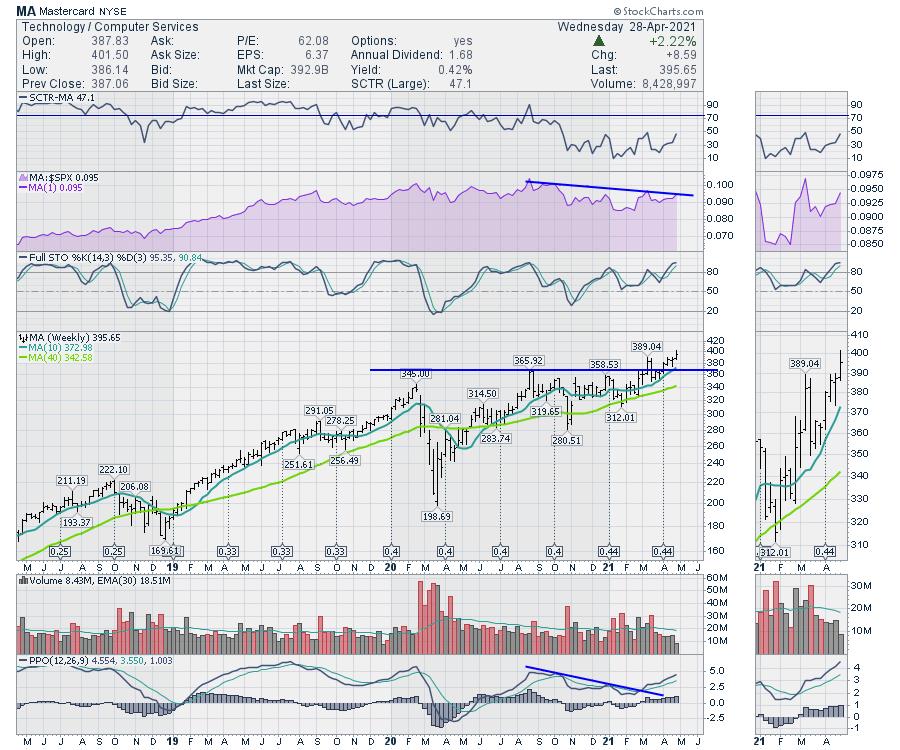

Mastercard. The chart is similar to Visa. It is really a great stock. In the November timeframe, the relative strength shown by the SCTR dropped significantly. It now appears to be climbing out of the hole. Both MA and V are breaking out to new highs as people return to onsite purchases.

In Canada, we had tap to pay for many years, but it was limited to $100. With the pandemic, this soared up to $250. At $250, you can accommodate a significant part of purchases with tap. The simplicity, the no-touch, the speed of tap payments is really a boost for V and MA. It is always interesting to go to major US retailers like HD and LOW who don’t accept tap yet. It’s a real roll your eyes moment when everyone is used to tap.

As tap speeds up in America, this continues to enable the MA and V payment. I have an Apple Watch and I tap all the time. It is almost a wallet free world now.

Square has been breaking into the small business environment where they are not location based stores. The handheld SQ payment in your backyard to the window washer or the flea market retailer is easily handled. They have also started to allow bitcoin payments for those tech savvy buyers. One of the more interesting parts of the chart is the drop in momentum shown on the PPO. The price action is still in line with the $SPX as shown on the purple area chart.

Paypal looks similar to SQ. The stock is still in the top right corner. The SCTR ranking has dropped from being a top performer to being an average performer under 75, suggesting it is keeping up with the Joneses, but not the stellar outperformance we witnessed in 2021. The stock still has a nice relative strength uptrend. However, it also has declining momentum showing up on the PPO.

When I look at the 4 charts, the V and MA charts are just getting the mojo again, but these charts are beautiful. The youthful names of PYPL and SQ are also continuing to do just fine, but the charts show a subtle deceleration from more extreme growth rates. All in all, they look great.