The latest issue of ‘The Globe‘, Eurizon monthly publication describing the Company’s investment view. In this issue, a focus is dedicated to “Easing of inflation consolidating”.

Scenario

US inflation dropped again in December, in line with expectations. The Fed intends to press on with the monetary restriction but should slow the pace of its rate hikes.

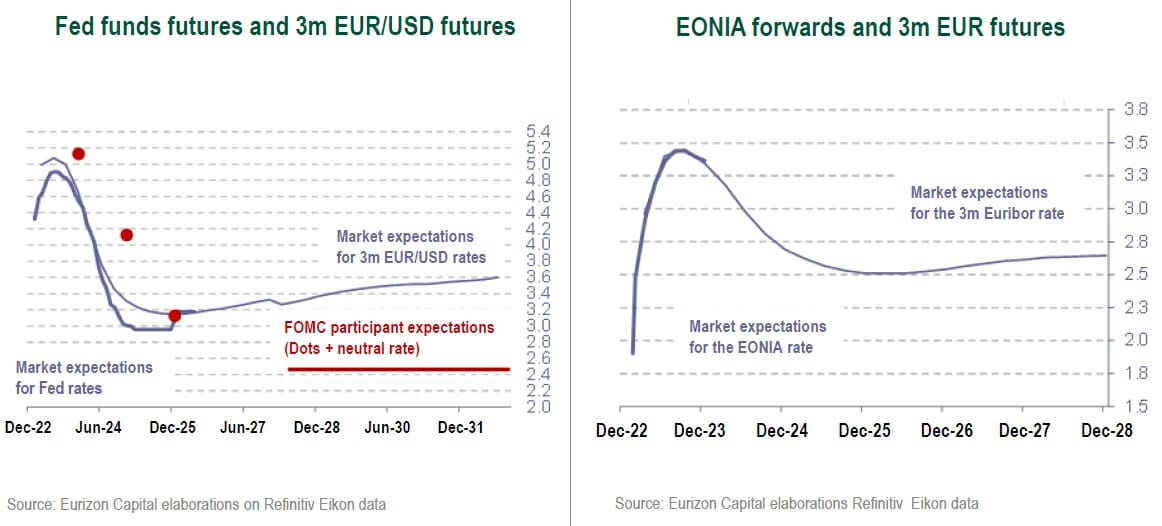

Fed Fund futures are pricing in 25 basis points at the February and March FOMC meetings, and rate cuts starting in the autumn.

Q4 2022 hedge fund letters, conferences and more

Inflation also dropped to lower levels than expected in the Eurozone , after peaking in October, but is still higher than in the US. Core inflation, by contrast, is still rising.

In February, the ECB should hike rates more than the Fed (by 50 vs. 25 basis points), although implicit expectations on the monetary market point to an end of the tightening cycle in the spring , in view of the drop of

Macro data are supporting a soft landing scenario for the economy in the US and the Eurozone , as opposed to a sharp slowdown (hard landing). The US labour market is confirmed solid, and confidence data in the in Eurozone have outlined signs of a recovery thanks to the drop in gas prices. Reacceleration of the Chinese economy confirmed , after the peak in cases that followed the scrapping of the “Zero Covid” policy.

Macro Economy

- Inflation confirmed on the decline in the US and in the Eurozone. The global economy is slowing but seems resilient to the re str ictive monetary policies for the time being.

- Monetary market futures are pricing in new Fed and ECB rate hikes in 1Q 2023, but the restrictive cycle is then expected to e nd.

Asset Allocation

- •The context characterised by easing inflation and the macro slowdown is favourable for the core bonds markets.

- Risk asset valuations are appealing, but could prove volatile in the next few months, in waiting to assess the size of the macro slowdown.

Fixed Income

- Overweighting confirmed of US and German government bonds, that could benefit both from the decline of inflation and from the macro slowdown.

- Among spread bonds, a preference is still awarded to the Investment Grade and Emerging Market segments, whereas the picture for High Yield bonds still seems uncertain. Neutral view on Italian government bonds.

Equity

- Stock market valuations are at historically appealing levels and would find support in a soft landing scenario.

- However, a hard landing for the economy cannot be ruled: an outcome that would keep volatility high on the stock markets.

Currencies

- The dollar could continue weakening as a result of the drop of inflation, that reduces the need to resort to safe haven curre nci es, and against the euro, of a more hawkish ECB compared to the Fed.

Investment View

Our baseline scenario points to a further decline of inflation, with focus increasingly on the slowdown of growth. The curren t s olidity of macro data will allow the Central Banks to keep tightening monetary policy in the opening quarter of the year, with the Fed probably slowing the pace of its hikes.

Based on these expectations, we confirm our positive views on duration and on the stock markets, and the underweightin g o f the dollar. Neutral view on Eurozone spread and on the credit market also confirmed.

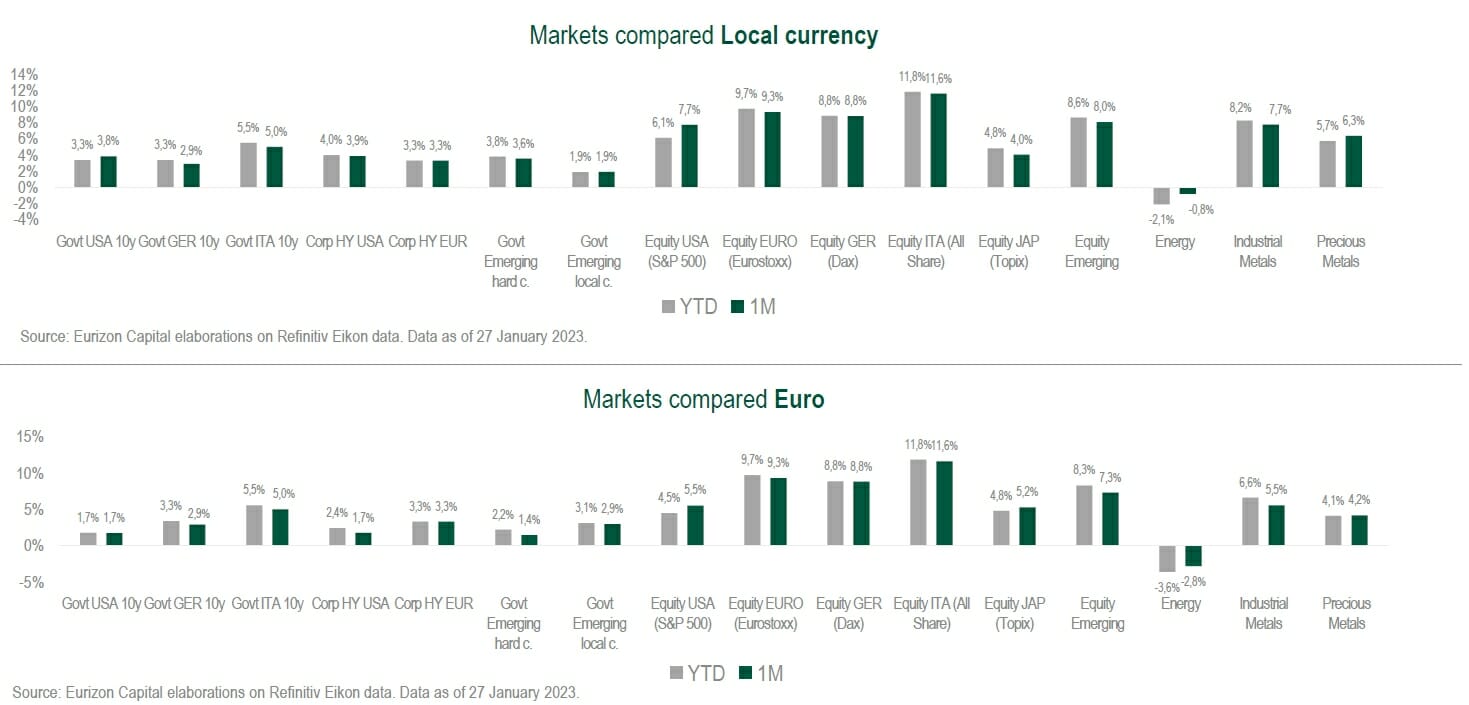

Asset Classes Compared

The financial markets got off to a good start in 2023, going against the trend observed in 2022. Bond rates dropped across ma tur ities, with inverted curves both in the US and in the Eurozone. Spreads narrowed on peripheral euro area bonds (180 basis points in Italy ), corporate bonds, and Emerging Market bonds.

The stock markets recovered, with the Eurozone and Emerging Market indices outperforming the other markets. Dollar on the decline to close to 1.09 against the euro.

Theme Of The Month – Easing Of Inflation Consolidating

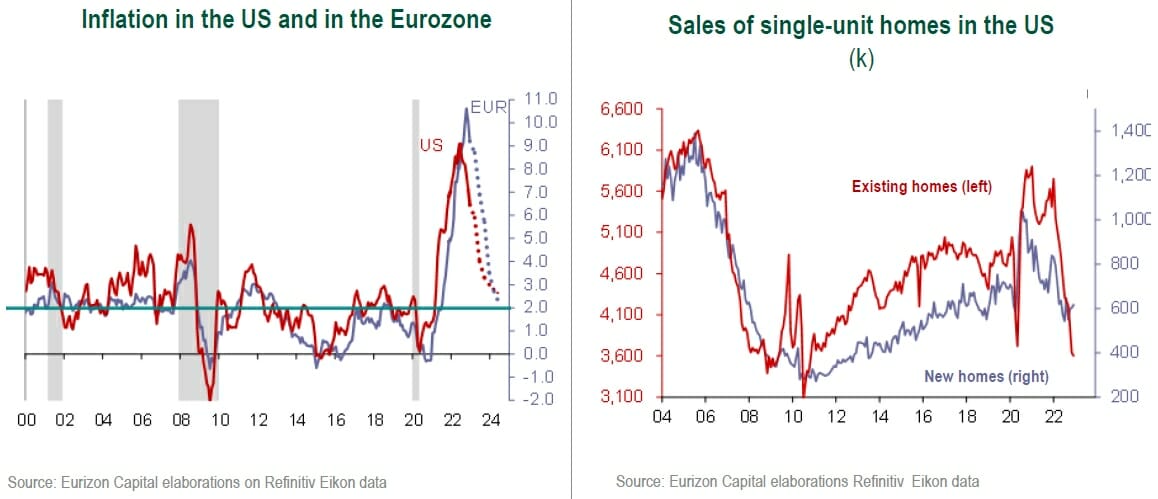

Inflation was confirmed on the decline by December data as well, both in Europe and in the US. The progressive reabsorption of post Covid excesses, and the impact of the restrictive monetary policies implemented in 2022, are reaping their effects.

In the United States, the decline of inflation should continue in the coming months, in step with the materialisation of the effects of the monetary restriction in deflating the housing component of spending, and rents in particular, that are assigned a relevant weight in the US price index.

A noteworthy development on this front is the sharp slowdown of the real estate sector. The index that measures residential housing starts dropped consistently throughout 2022. Existing home sales have returned to levels in line with 2010, and home prices have started to decrease, albeit slowly.

In the months ahead, a further drop in home prices should ease pressures on rents as well, consolidating the decline of core inflation (net of energy and food).

The decline of the core components of inflation will be essential from now on to consolidate the disinflation process, as the impact of the other components is waning.

In fact, the supply side bottlenecks that took shape in correspondence with post Covid reopenings have largely been resolved . International freight rates, for instance, are back at the same levels as in 2019.

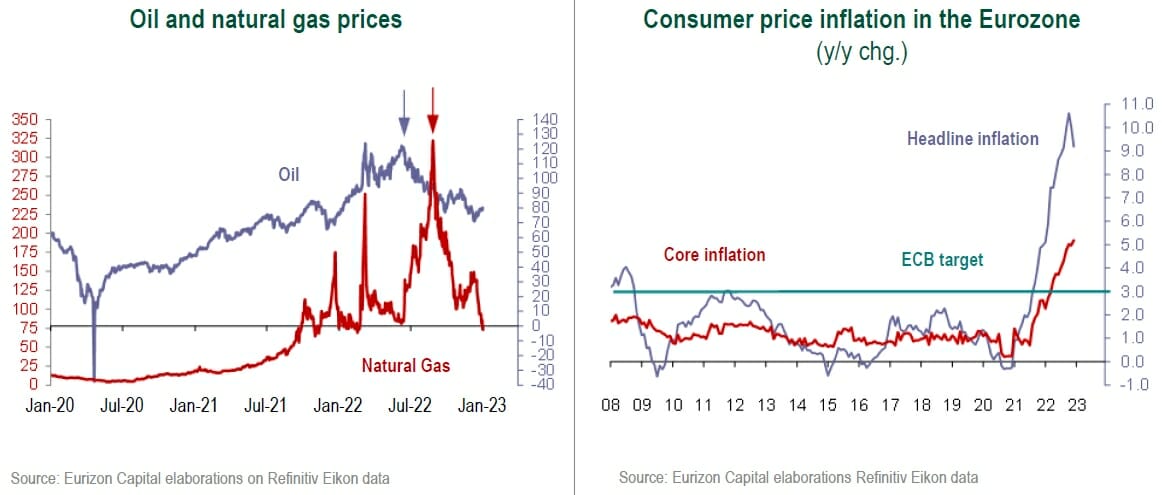

The disinflationary impact of the drop in commodity prices is also waning , as confirmed by the fact that the prices of industrial metals have stopped decreasing, as also oil prices.

However, the inflation cycle in the Eurozone is lagged. The impact of the drop in natural gas prices has only started to become visible recently in the Euro area , after peaking at the end of August. The recent return of gas prices to below the levels recorded before the outbreak of the Russia Ukraine war will only be visible in the inflation readings of the next few months.

However, it will be important in the Eurozone, for the ECB in particular, to identify signs of a weakening of core inflation , still driven upwards to date by the delayed effects of producer price increases over the past few months.

As inflation declines, the end of the monetary restriction nears.

The Federal intends to press on with the monetary restriction process in February and a March, in order to consolidate the decline of inflation, but could slow the pace of its rate hikes. At the FOMC meeting on 1st February, a 25 basis points increase is forecast, that will probably be replicated in March. At that point, the Fed funds corridor would be 4.75% 5.0%, and the Fed should bring its tightening to an end and assess the resilience of economic activity.

The ECB , that has also switched to smaller, 50 basis points hikes, has continued to use markedly hawkish tones in its guidance. Despite these hawkish tones, the expectations priced in by the monetary market point to the ECB winding up its tightening in the spring, after having increased rates by a further 75 100 basis points in total between February and March.

Investors do not believe the ECB will stay on a divergent path compared to the Fed for too long for at least two reasons . First of all, there are indications that inflation will continue to decline in the next few months, as anticipated by the plunge in natural gas prices. Secondly, the ECB’s rate increase have strengthened the euro and could continue to support it. A strong euro reduces imported inflation and slows economic activity, holding back exports.

With the decline of inflation, focus will increasingly be on the resilience of economic growth.

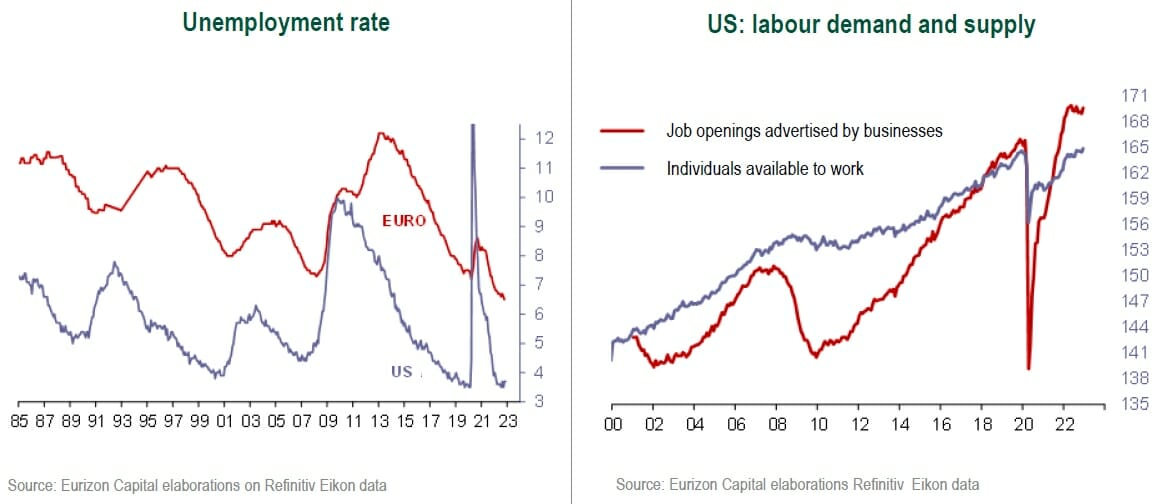

Data released in the past month have supported the probability of a soft landing of the economy , as opposed to a sharp slowdown (hard landing). The signals of strength still being sent by the labour market are particularly significant , with unemployment rates in line with long term lows both in the US and in the Eurozone.

In fact, labour market data will be in the spotlight in order to assess the size of the economic slowdown.

As usual, US data play a key role in signalling trends. Post Covid reopenings definitely overheated the US labour market, to the point that job openings advertised by businesses greatly outnumber the individuals available to work.

The economic slowdown imposed by the Fed with its monetary restriction is primarily aimed at correcting this excess, by reducing the demand for labour originated by businesses. The soft landing scenario depends on a controlled adjustment of the labour market. On the other hand, should the employment trend come to a sudden halt, it would signal a hard landing for economic activity.

This is the main dynamic to watch over the next few months.