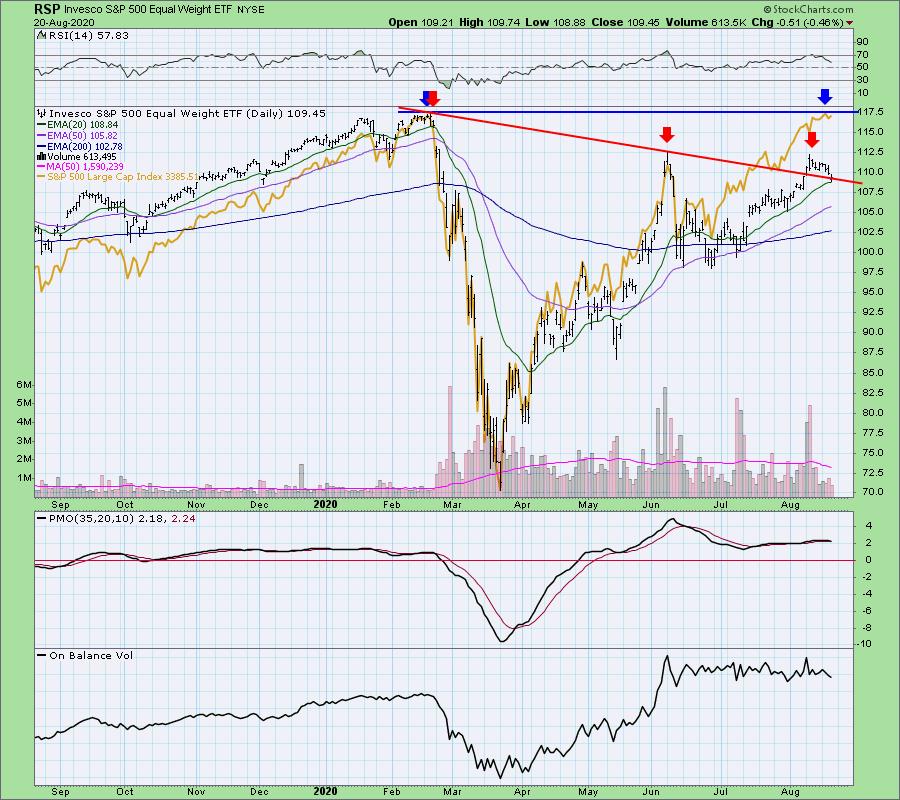

Yesterday I had the pleasure of doing a podcast with FinancialSense.com’s James Puplava (I’ll send the link out to the DecisionPoint free email list when I have it, sign up on the DecisionPoint.com homepage). We talked at length about the “top ten” large-cap stocks that run the show in the SPX. James did a study taking out those big cap stocks and found the chart was very different as to what is actually going on in the SPX. I decided to take a look at RSP, the equal-weight S&P500 ETF. Wow! According to RSP, the market is in a declining trend with a bearish bias. If investors get spooked and start letting go of the large-cap positions quickly, the market could fall swiftly as there is no foundation of strong stocks to pick up the slack.

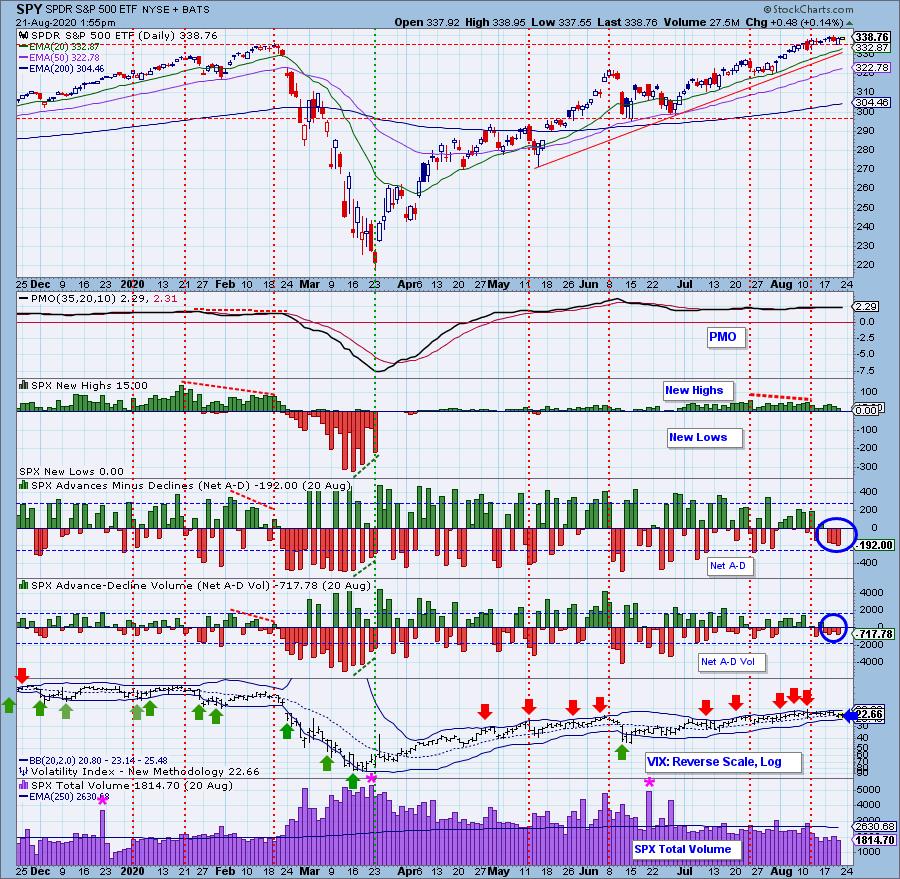

More to this point, notice the lack of participation on Net A-D and Net A-D Volume which were negative on the last few rally days. The VIX is now below its moving average on the inverted scale which suggests internal weakness ahead.

And how about those negative divergences in %Stocks indicators that show a decline in participation despite the rallies higher. The Swenlin Trading Oscillators (STOs) have continued lower.

We have are just beginning a weekly free DecisionPoint Trading Room on Mondays at noon EST! Carl has agreed to join us for the first one on August 24th at noon EST! He’s never done anything like this before so it will be special to get his intraday take on the markets and what to expect in the week ahead.

Here is the link to register for this Monday’s free DecisionPoint Trading Room! Sign up on our DecisionPoint.com homepage free email list to receive the weekly links!

I just finished up my DP “Diamond Mine” trading room this morning for Diamonds subscribers-only. This intimate trading room was fantastic and is certainly worth the price of admission by subscribing to our Diamonds Reports. We examined the Diamonds presented this week and symbols to watch in the coming week.

DecisionPoint Diamonds are becoming even more indispensable! Not only do you get 60 “Diamonds in the Rough” stocks/ETFs per month with complete analysis that includes stops/targets… but there will now be a Friday Diamonds Recap that will look at the performance of each week’s Diamonds and their prospects moving forward. Over the weekend, we clean the slate and start over again.

Included for my Diamonds subscribers-only will be a new one-hour trading room, “The DecisionPoint Diamond Mine” on Fridays! It will be an opportunity for us to talk live, review current and past Diamonds for possible entries/exits/stops/targets and take your questions and symbol requests in this intimate trading room.

DecisionPoint Alert subscribers will continue to enjoy clear, concise analysis of the overall market, including Dollar, Gold, Gold Miners, Oil and Bonds from both Erin and Carl Swenlin. You are prepared each market day knowing the implications of market behaviors for that day, week or month!

All subscribers have access to our exclusive ChartLists that are annotated and curated by Carl Swenlin. Know what he thinks is important on all of the sectors, indexes, indicators and more!

Today’s ChartWatchers “Diamond of the Week”:

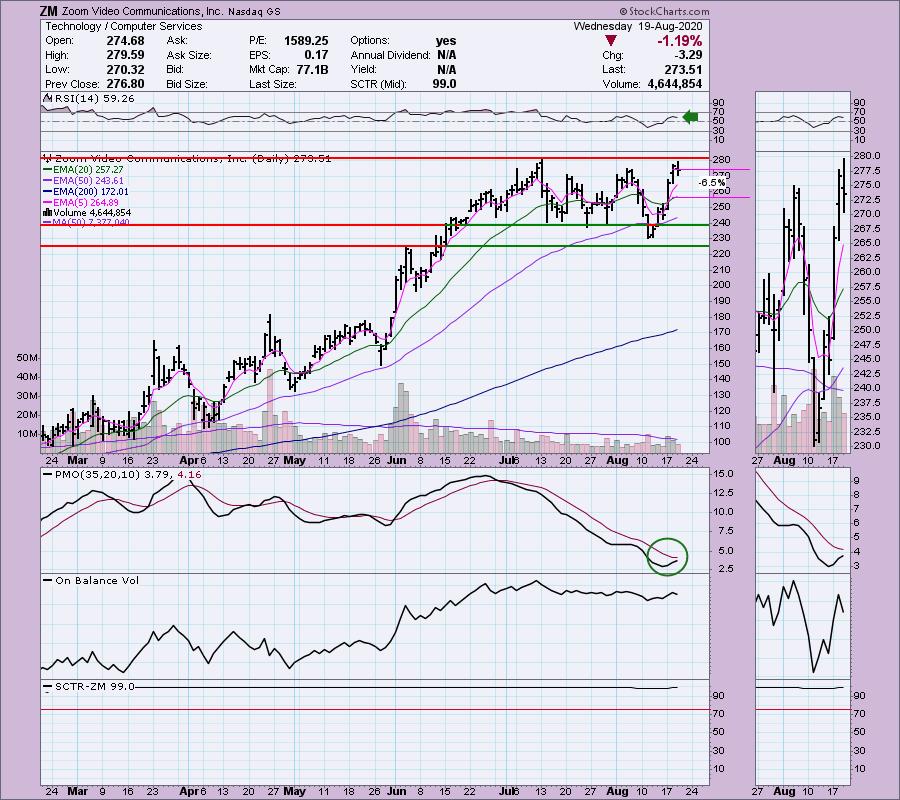

This “Diamond in the Rough” selection from the August 19th DecisionPoint Diamonds Report. I have included the chart from Wednesday with my original comments. I then will follow-up with the current chart.

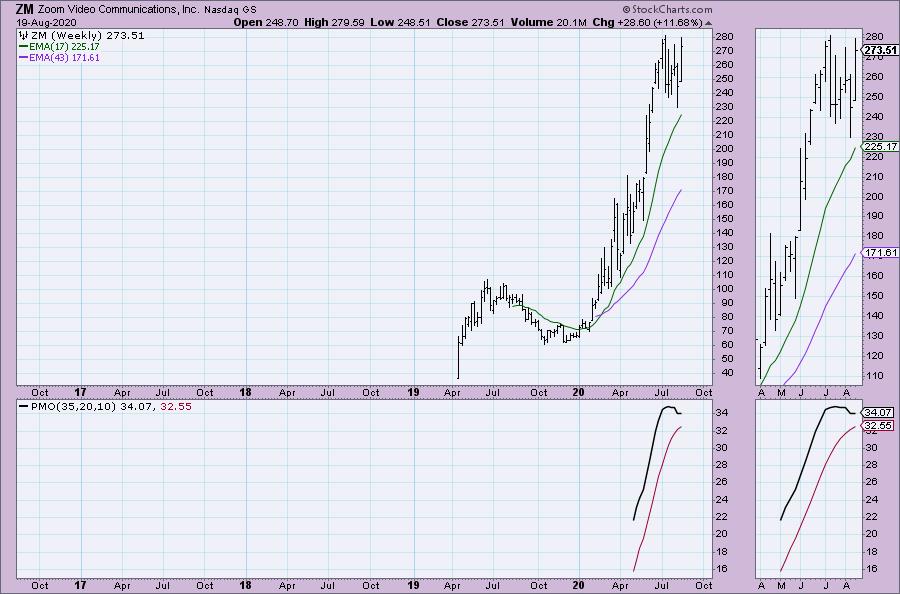

Zoom Video Comm Inc (ZM) – Earnings: 8/31/2020 (AMC)

Zoom Video Communications, Inc. engages in the provision of video-first communications platform. It connects people through frictionless video, voice, chat and content sharing, and enable face-to-face video experiences for thousands of people in a single meeting across disparate devices and locations. It focuses on customer and employee happiness, a video-first cloud architecture, recognized market leadership, viral demand, an efficient go-to-market strategy, and robust customer support.

Yesterday I presented Citrix (CTXS) the purveyor of “GoToMeeting” and today I have one of its competitors, Zoom Communications. This chart looks very similar to the one I opened with of $DJUSSW. We have a possible flag formation that is ready to execute. The PMO has turned up and it looks like ZM may breakout of this trading range. I would set my stop around the 20-EMA as I don’t think I’d want to ride it down to support at $225. There is a slight negative divergence between OBV tops and price tops right now which is another reason I really would want to wait on it if it starts to drop below the 20-EMA. They do report earnings soon, so keep that in mind.

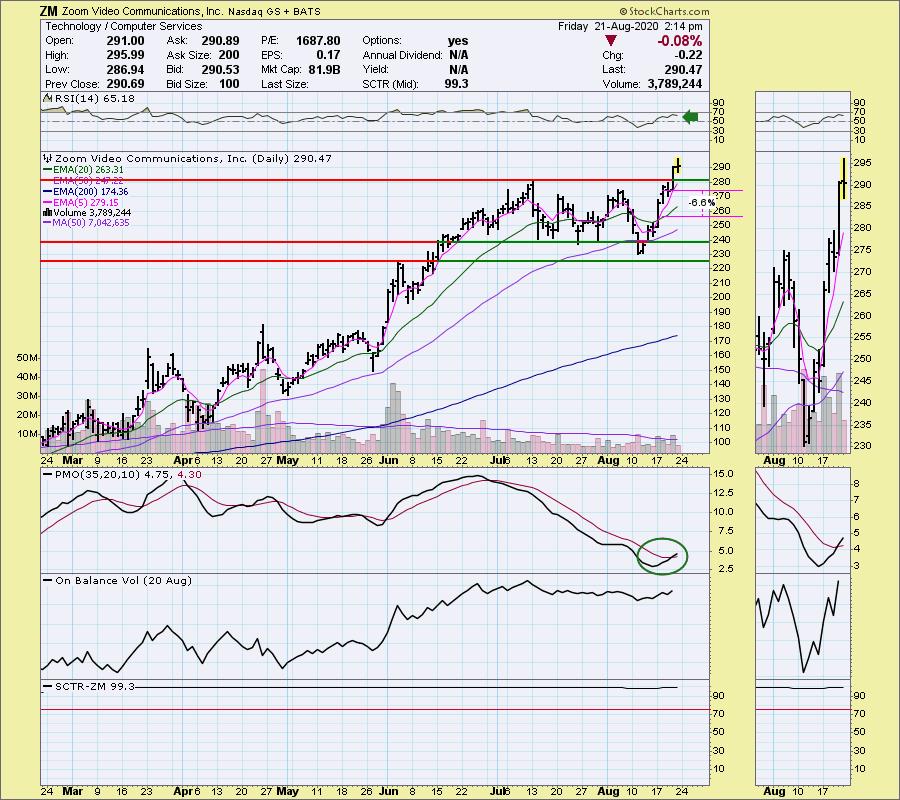

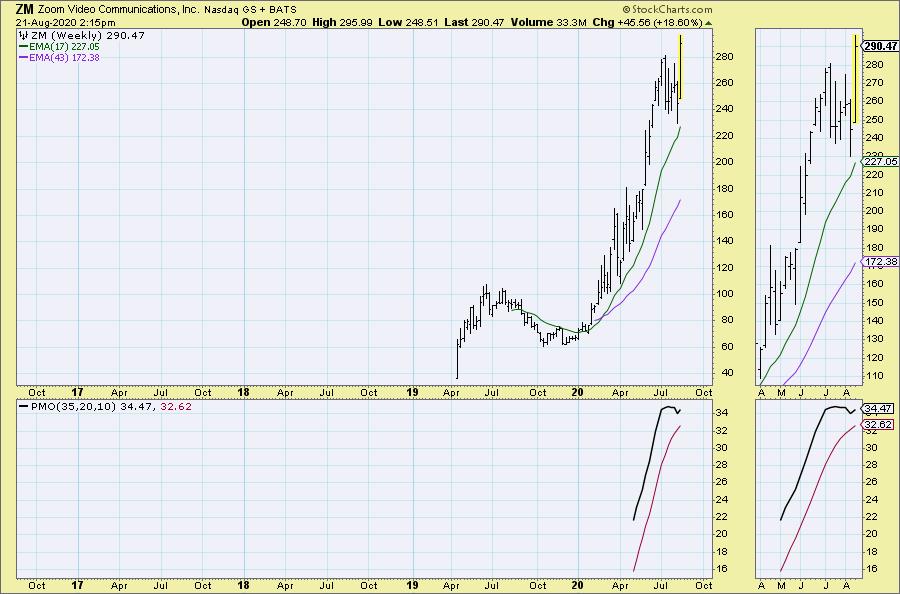

FRIDAY’s Chart is below:

We don’t see much more on the weekly chart as Zoom is very young and doesn’t have a lot of data. I do think the flag is very clear in the thumbnail.

FRIDAY’s Chart:

Conclusion: RSP and the SPX indicators are weaving a tale of a likely decline. RSP is still in a long-term declining trend and the negative divergences persist on the indicators. Be sure and sign up on our free email list to join the new DecisionPoint Trading Room! Carl will be joining us for our first DP Trading Room on Monday, so you don’t want to miss it! Here’s the registration link to Monday’s DP Trading Room. And don’t forget, you can give our reports a try with a 1-week trial by subscribing to the “Bundle” package and using coupon code: dptrialcw.

Happy Charting!

– Erin

Technical Analysis is a windsock, not a crystal ball.

Helpful DecisionPoint Links:

DecisionPoint Alert Chart List (subscribers only)

DecisionPoint Golden Cross/Silver Cross Index Chart List (subscribers only)

DecisionPoint Sector Chart List (subscribers only)

Price Momentum Oscillator (PMO)

Swenlin Trading Oscillators (STO-B and STO-V)