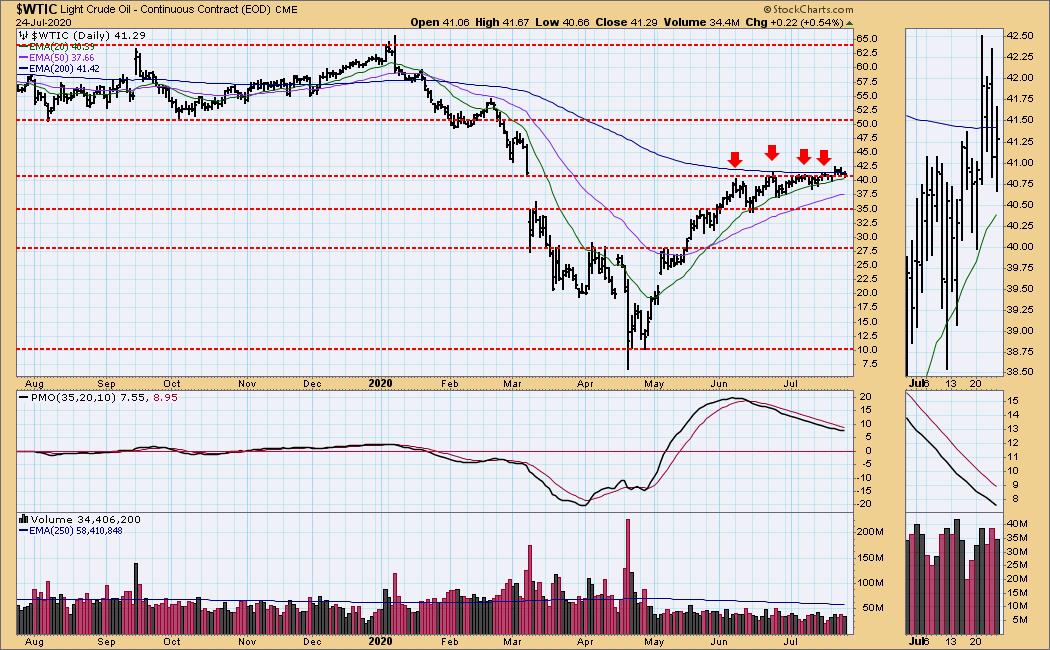

I have been watching the Energy sector closely this week. $WTIC, which I follow daily in the DecisionPoint Alert report, finally broke out and, although the Price Momentum Oscillator (PMO) hasn’t turned up, Oil prices are staying above the 20-EMA and have made an attempt to get back above the 200-EMA.

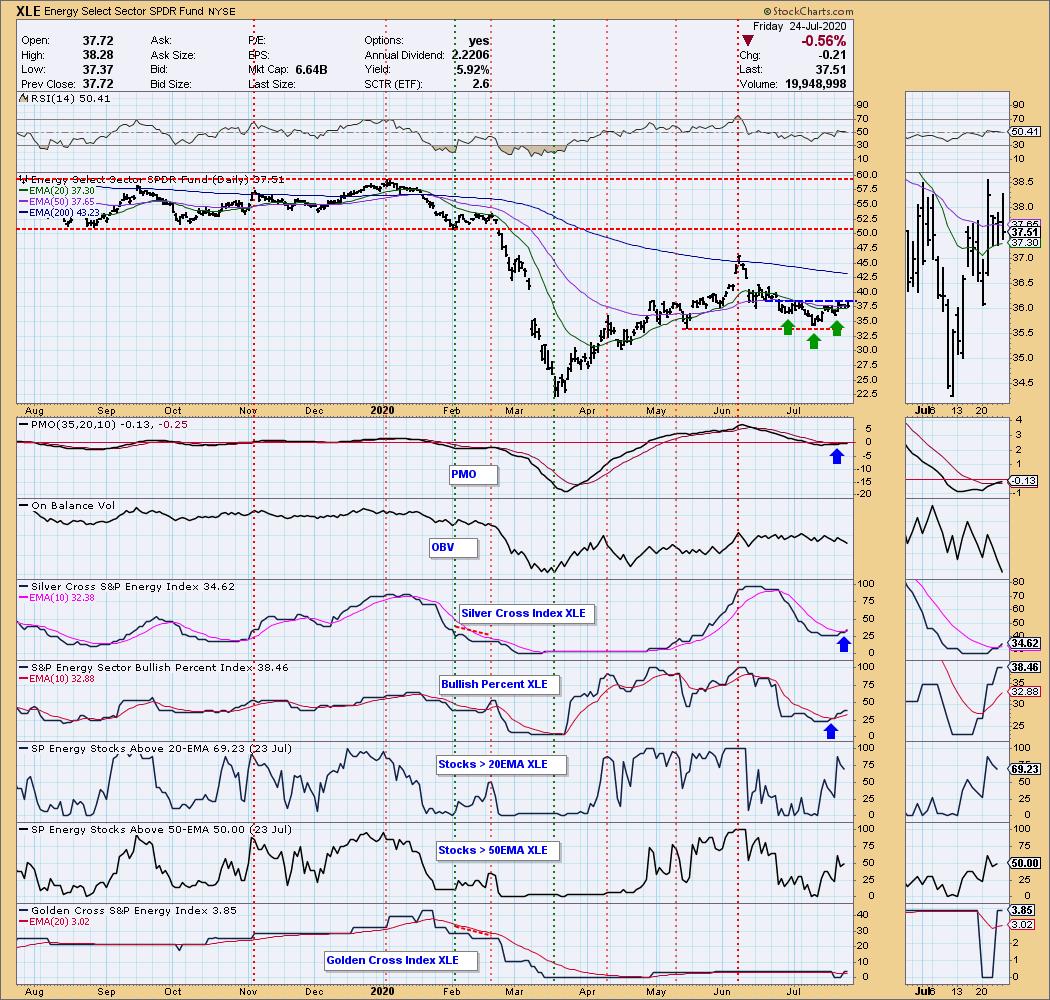

Of course, Oil is only one component of Energy (XLE). Take a look at the bullish chart for the sector. We could be catching this one early. There is a bullish reverse head-and-shoulders that is trying to execute. The PMO gave us a crossover BUY signal yesterday. The 20-EMA is about ready to cross the 50-EMA for a “silver cross” IT Trend Model BUY signal. The Silver Cross Index just had a positive crossover (this index tracks the %stocks on IT Trend Model BUY signals, meaning stocks whose 20-EMA is above their 50-EMA) and we can see a huge improvement on %stocks with prices above their 20/50-EMAs. I also like the look of the BPI.