(This is a complimentary issue of today’s subscriber-only DP Alert report. Get this report every business day on DecisionPoint.com!)

Everything was running smoothly as the market broke above the previous week’s trading range. And then…bah bah baaaaah… stimulus talks not only stalled, but were over as far as the president was concerned based on his Twitter feed. The market spiraled lower on the news, but did seem to slow the descent before encountering the gap on the 10-minute bar chart below. The RSI is very oversold, but I’m not counting on that to propel a rally. Looking at the charts and discussing the spike in positive breadth yesterday evening with Carl, he agreed with me that it was a buying exhaustion. Well, neither of us felt too great about the call this morning, but the pieces of the puzzle began to fall into place when the market dove. The tweet could certainly be the entire reason for this afternoon’s failure, but I suspect the market was primed for this buying exhaustion based on yesterday’s climactic indicators chart. Today we got very high negative breadth readings which is an indication of a selling “initiation impulse” or simply the manifestation of the buying exhaustion detected yesterday.

***Click here to register for this recurring free DecisionPoint Trading Room!***

Did you miss the 10/5 trading room? Here is a link to the recording (password: J942MF*c). For best results, copy and paste the password to avoid typos.

DP INDEX SCOREBOARDS:

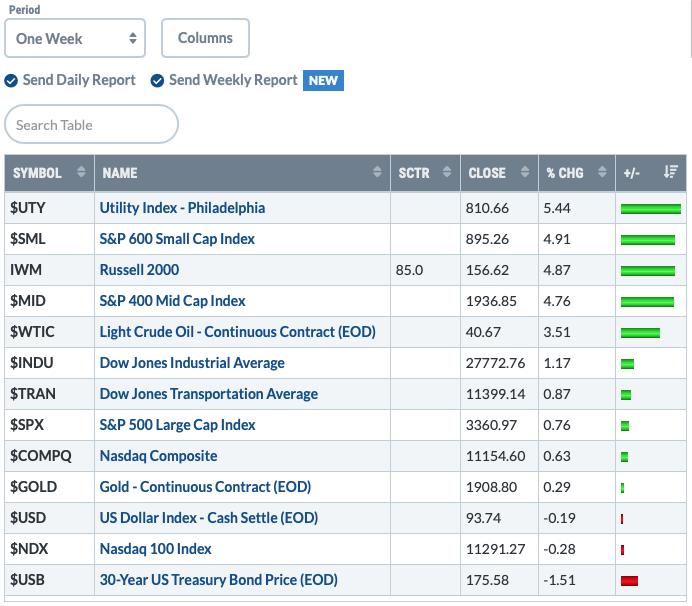

TODAY’S Broad Market Action:

One WEEK Results:

Top 10 from ETF Tracker:

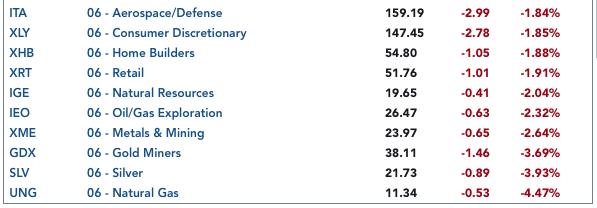

Bottom 10 from ETF Tracker: