Stocks were strong again last week and for the month, the broad market index was up 4.5% and the long treasury bond was down 3%. This makes a good time to improve the growth and quality of your portfolio. As we trace out the recovery from the virus over the next two quarters, high and rising cash flow, and improving financial condition are likely to be important attributes.

Q1 2020 hedge fund letters, conferences and more

We will be managing through an apparent long-term disruption in global trade, the massive stimulus borrowing and shift to fiscal spending. Some structural changes are already underway with the gross profit margin of US companies down for the third consecutive quarter. This has been a very reliable predictor of lower stock prices. The recent strong recovery-bounce in stocks is a good opportunity to sell extended-share-price stocks with falling gross profit margins.

The hunt for bargains is less successful now as the population of depressed-share-price stocks is dominated by weak growth and poor financial condition. This is a concern for income strategies where dividends will be cut at falling cash flow companies. Focus on improving cash flow (MoneyTree with a big green globe) and improving financial condition (MoneyTree with a stable golden pot).

Valhi, Inc.: $9.720 BUY This Poor Company Getting Better

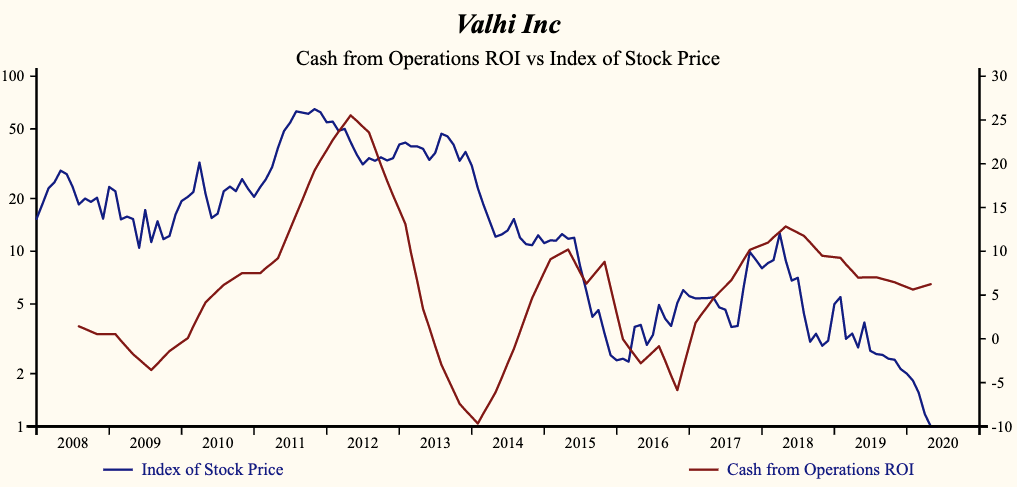

Valhi, Inc. (NYSE:VHI) has been an unprofitable company with frequently low cash return on total capital of 6.3% on average over the past 21 years. Over the long term, the shares of Valhi Inc have declined by 92% relative to the broad market index. The shares have been correlated with trends in Growth Factors. The more dominant factor is Cash from Operations (ROI) which has been 43% correlated with the share price with a four-quarter lead.

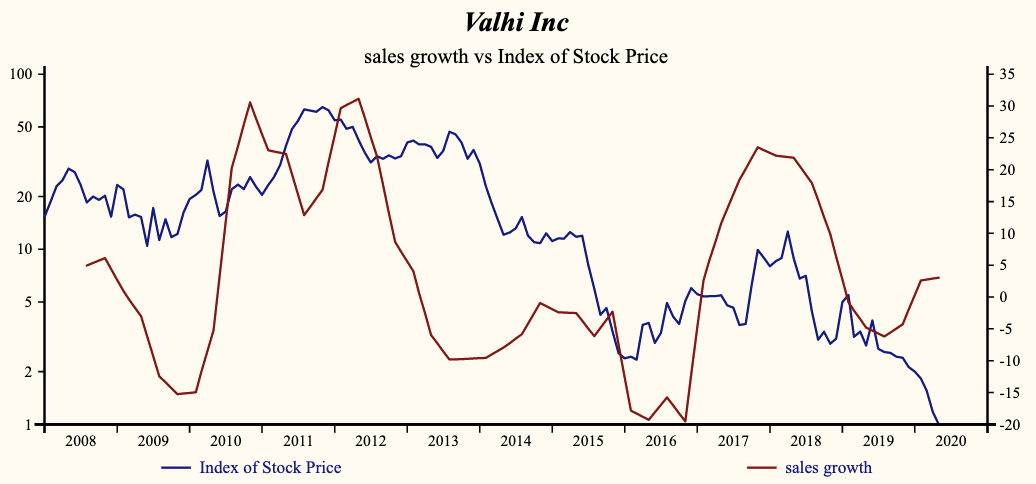

Currently, sales growth is 3.0% which is low in the record of Valhi but higher than last quarter. Receivables turnover has been 72% correlated with the direction of the share price with a four-quarter lead and continues to fall. Declining receivables relative to sales reflects continued improvement in the quality of sales growth.

After a steady decline, the company is now recording a low and rising gross profit margin. Furthermore, lowering inventories (not producing more than it’s selling) improves the chance that the gross margin will continue to rise.

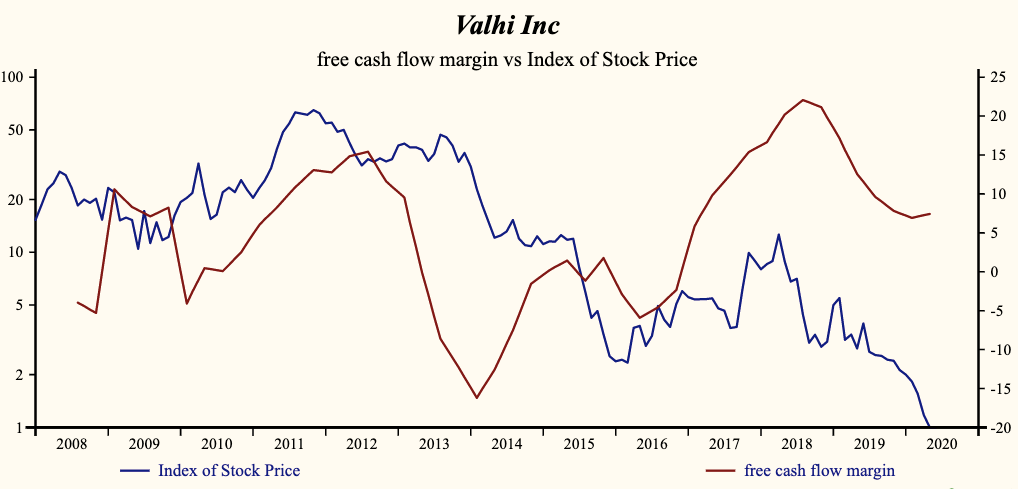

The EBITDA margin also reversed course last quarter and is now rising for the first time since its historical peak in mid 2018. Free cash flow as a percentage of sales measures the relationship between cash flow growth and capital expenditures. Lower capital expenditures have been 62% correlated with the share price with a five-quarter lead and is now accelerating free cash flow.

A 9.4% Dividend Yield

More recently, the shares of Valhi Inc have declined by 92% since the April, 2018 high. The current indicated annual dividend produces a yield of 9.4%. Current trailing operating cash-flow coverage of the dividend is 5.5 times.

The shares are trading at lower-end of the volatility range in a 25-month falling relative share price trend. The current depressed share price and high yield provides a good opportunity to buy the shares of this evidently accelerating company.

Buy stocks with companies with sales growth up, rising gross profit margins, lower SG&A expense and good financial condition (Stable Golden Pot) and improving cash position or profitability (Green Crown of the MoneyTree). In other words, the more stable the pot appears, the better the attributes. Green and gold are good. Red is bad and the more intense the red the more urgent the call to action.

The post Dividends: Focus on Improving Cash Flow Companies appeared first on ValueWalk.