ARKK may be the most extraordinary example of sheer brilliance and horrific money management combined.

We all watched ARKK fly to its peak in early 2021. We all watched ARKK tumble to nearly 70% of that peak this year in 2022. And we all listened to Cathie Wood dig herself deeper into her long-term beliefs about disruptive tech, disinflation and the future of humanity.

In the ARKK fund, Tesla, Inc. remains the largest holding, with ROKU Inc., Teledoc Health, Square Inc. and Zoom Video Communications making up the rest of the top five. As we investors and traders began the week, ARKK, which already began to intrigue me as a potential bottom trade, started the session in the red. Meanwhile, as ROKU, Zoom and Unity Software (also a holding that went green early) looked promising, I put up an ARKK chart to first assess risk.

Whether this is a bottom or relief rally remains to be seen, but why was the risk so compelling?

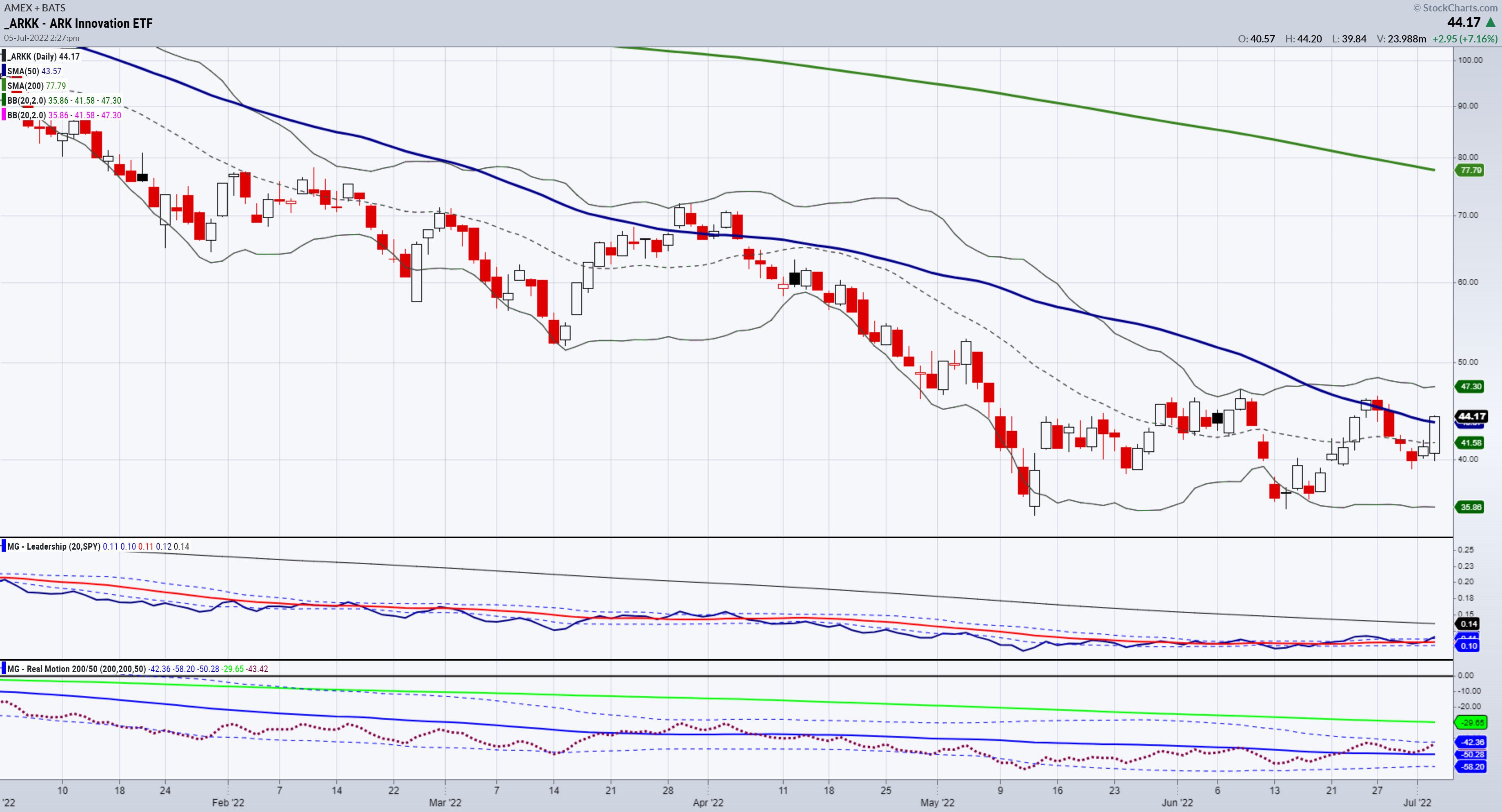

On May 12th, ARKK made a new low at 35.10. If you look at our two proprietary indicators, the Leadership chart shows that at the time, ARKK underperformed the benchmark. The Real Motion indicator (momentum) showed that, at the day it made the low, momentum was having a mean reversion (current market price is less than the average past price). ARKK was oversold, and our momentum chart reflected that. Incidentally, the price on May 12th also flashed mean reversion when the price broke below the Bollinger band, then closed above it.

Since then, ARKK made a higher low June 14th at 35.65. Soon after, by June 23rd, ARKK began to take leadership over the benchmark. Subsequently, Real Motion flashed a positive divergence in momentum when the red dotted line crossed over the 50-day moving average (blue line).

Back to today. After ARKK opened lower first thing, the rally began. ARKK shows a stronger outperformance to the benchmark now. It also has better momentum — in fact, the best momentum since April, when the price was trading above $60.00. ARKK cleared the 50-DMA on price for the first time since April as well. Now, we want to see it hold and close over the 50-DMA again to confirm a phase change to recuperation. We want to see momentum continue going strong.

Which brings me back to risk. As an early-in-the-day buyer, we were able to risk under the 2022 low. If this is truly a bottom, that low should hold. If not, we have a viable stop loss. Plus if we are right, we can add to the position and raise the risk point accordingly.

All in all, we applied smart money management to a potentially brilliant fundamental narrative.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth and a special bonus here.

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

With newer fears of recession, Mish takes a walk back to the 1970s, when dislocation wreaked havoc by the end of the decade, in this video from Bloomberg TV.

See Mish’s latest appearance on BNN Bloomberg!

See other recent BNN Bloomberg Appearances from Mish here.

ETF Summary

- S&P 500 (SPY): 378-380 support zone after a rocky start.

- Russell 2000 (IWM): Support is 170; needs to clear 174 to stay in the game.

- Dow (DIA): 307 support, needs to clear 315.

- Nasdaq (QQQ): 282.50-283 pivotal and 290 resistance.

- KRE (Regional Banks): 56 the 200-WMA 60 resistance.

- SMH (Semiconductors): If yields stay lower, then this could see it way back over 200.

- IYT (Transportation): 211.90 support with resistance at 220.

- IBB (Biotechnology): Our leader and maybe savior as in 2009, it was the first of the Family to bottom. Now needs to hold 120.

- XRT (Retail): Respected the inside day and broke out over 59.24 now support.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education