Part of the weekly research here at The Acquirer’s Multiple features some of the top picks from our Stock Screeners and some top investors who are holding these same picks in their portfolios. Investors such as Warren Buffett, Joel Greenblatt, Carl Icahn, Jim Simons, Prem Watsa, Jeremy Grantham, Seth Klarman, Ray Dalio, and Howard Marks. The top investor data is provided from their latest 13F’s. This week we’ll take a look at:

Q2 2020 hedge fund letters, conferences and more

Allison Transmission Holdings

Allison Transmission Holdings Inc (NYSE:ALSN) is the world’s largest manufacturer of fully automatic transmissions for commercial vehicles, which serve as fuel-saving alternatives to less expensive manual and automated manual transmissions. It supplies its products to several end markets, including on- and off-highway equipment and military vehicles. For its on-highway business, where Allison maintains 60% of the global market share, Allison transmissions are incorporated into class 4 through 8 trucks, buses, and a limited number of large consumer vehicles, such as heavy-duty pickup trucks and motorhomes. Allison has been a leader in commercial hybrid propulsion systems and has more recently made inroads into fully electric powertrains with the acquisitions of Vantage Power and AxleTech in 2019.

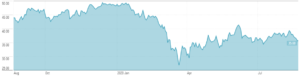

A quick look at the price chart below for Allison Transmission Holdings shows us that the stock is down 19% in the past twelve months. We currently have the stock trading on an Acquirer’s Multiple of 9.67, which means that it’s undervalued.

(Source: Morningstar)

Superinvestors who currently hold positions in Allison Transmission Holdings:

Jim Simons – 6,167,919 shares

Cliff Asness – 689,795 shares

Ken Griffin – 289,235 shares

Paul Tudor Jones – 61,196 shares

Lee Ainslie – 33,911 shares

Joel Greenblatt – 23,151 shares

Ray Dalio – 21,830 shares

Michael Price – 17,500 shares

For more articles like this, check out our recent articles here.

The post Deep Value Stock $ALSN Appearing In Dalio, Greenblatt, Price Portfolios appeared first on ValueWalk.