I think one of the best ways to better understand day trading is through examples…

Day trading is hard. That’s why I spend so much time teaching.

My Trading Challenge has over 7,000 video lessons showing real-world examples of day trading. Including my own.

The Challenge mentors and I show ALL of our trades. We host webinars several times a week to give newer traders examples of how we trade.

Once you become a self-sufficient trader, you can rely more on your own examples. That’s what experienced traders do.

Personally, I review every trade I make. And I almost always learn something.

But when you’re just starting with day trading, you need to take lessons from other traders and look at as many examples as you can.

So, let’s get started and dig into what is considered a day trade.

New to day trading and penny stocks? Access my FREE online guide here.

What Is Day Trading?

Day trading is exactly what it sounds like — very short-term trading.

A day trade can be a trade that’s completed in minutes or hours.

Most day traders look to complete their trades within the day. Some may occasionally hold overnight. Technically, that’s a swing trade. The list of day trading strategies is long and varied.

Some day traders use a scalping strategy. They profit off minute price swings, often with big position sizes.

I don’t love this strategy for small account traders because I don’t see a clear path to exponential growth.

Just realized something, SO many traders who have made $5,000-$50,000 think they know how to make big $ when in fact too many are just scalping and they have no idea how to ever grow into the millions and yet their small gains make them cocky beyond belief, I was there once too

— Timothy Sykes (@timothysykes) February 17, 2019

Others trade chart patterns like breakouts. They sometimes go for home runs … and strike out just as often.

Me? I like to trade just a few patterns for small gains. That’s how I’ve earned $7.1 million over my trading career.*

Check out this morning panic dip buy day trading example:

LCLP was trading at sub-penny levels a week before this trade. Then it got into crypto and hit a high of 6 cents!

You didn’t have to be a genius to know it wouldn’t hold. It topped my crypto penny stock watchlist after it ran on July 14 and 15…

I didn’t trade its spikes. Instead, I waited for it to panic, then bounce back up.

I dip bought these panics for profits of $599, $690, $1,970, $749, $584, and $708*…

And finally, there’s the 9% bounce for $845 I made on the minutes-long trade above.*

Say it with me: small gains add up.

How Many Day Trades Can You Make in a Day?

Among the questions new traders ask the most, “How many trades can you make in a day?” is right up there with “How much does the average day trader make?”

I don’t like either. If you’re making a lot of trades, you’re probably not putting enough thought into each one.

Successful traders watch more stocks than they trade. One of the biggest problems beginner traders experience is randomly trading stocks…

If you’re not watching the stock, identifying chart patterns, or building a trading plan, you’re randomly trading.

Even if you made money trading this way, that’s a bad habit. So much so that FINRA created the PDT rule to prevent newbies from blowing up their accounts.

The PDT (pattern day trader) rule limits small account traders to three leveraged day trades each week.

If you exceed this limit, you risk a 90-day day trading ban.

It’s not great for growing your account quickly … but it does force you to become selective about your trades. And that’s definitely a good thing.

Some day traders under the PDT will occasionally hold a trade overnight. This prevents the trade from counting against the three-trade limit…

And it can be an effective strategy on its own! Learn more about swing trading here.

Day Trading Examples

The morning panic dip buy is my go-to pattern. It’s been a profitable pattern for me for over two decades.*

Why?

Some traders take profits at the market open. With volatile penny stocks like LCLP, this torrent of selling sends the price down…

As the stock price falls, it triggers stop-loss sales. This sends the price down even further…

It’s tricky to time the bottom of a morning panic. You don’t need to nail it perfectly. Get in screen time and hone your Level 2 skills. You’ll begin to see where the momentum shifts.

I try to time my entries for this point. I also pay close attention to risk. If the stock doesn’t bounce, I cut my losses quickly…

But if it does, I sell on the bounce before the stock price stabilizes. I aim for quick profits of 10%–20%.

This is a great pattern for me because I travel and am often in time zones hours ahead of the U.S.

Look at this day trading example I pulled off from an airplane Wi-Fi connection…

I got in at 0.59 cents and out at 0.66 cents — almost a 12% gain!*

Trading at the market open is a great way for me to get in some trades without staying up all night.

That doesn’t mean I’m on vacation. My trading strategy is heavy on studying and precision. That’s how I want you to be too.

Top Day Trading Strategies with Examples

Day trading isn’t about picking ‘hot’ stocks or finding the ‘best’ patterns…

If it were that simple, do you think experienced traders would ever lose?

I’ve got news for you — EVERYONE loses. The Twitter traders who say they don’t lose are LYING.

I created my Trading Challenge to teach traders the lessons I learned the hard way.

There’s no shame in losing trades. I learn from my losses, and I want you to learn from them too. That’s why I show every trade I make on Profit.ly, the trade-tracking platform I helped create.

The only shame in trading is not putting in the work — especially if you want the success opportunities day trading has to offer.

I designed my Trading Challenge to make it easier for you. There’s a 60-lesson course to get you started…

You’ll also get webinars with a ton of day trading examples. They’re hosted by top traders like Tim Grittani, Mark Croock, Michael Goode, and of course myself…

Plus, you can access arguably the best chat room on the internet and 7,000 video lessons to help you catch up with the rest of my hard-working students.

I don’t accept everyone. If you’re looking to get rich quick, you’ll need to find your tips elsewhere…

But if you want to put in the work and learn the RIGHT way … Apply for the Trading Challenge today!

Plan Your Entries and Exits

You must plan your entries and exits. This is the scientific name for buy low, sell high. It’s the biggest difference between profits and losses.

Don’t guess bottoms and tops, that leads to FOMO…

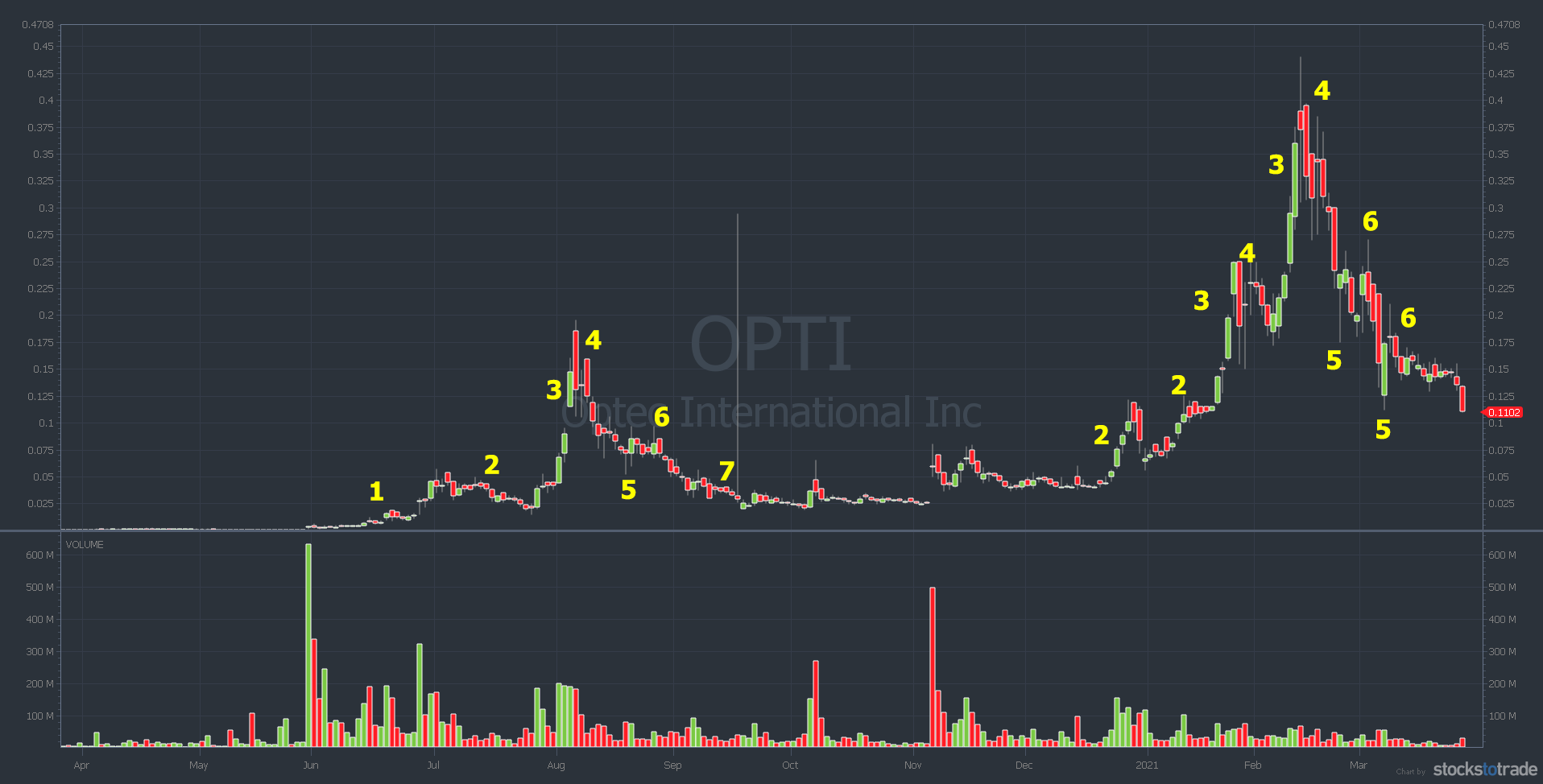

Even if you manage to nail a best-case entry and exit on a trade or three, it probably won’t be sustainable. That’s why I created the 7-step pennystocking framework:

I’ve used this framework to trade penny stocks for 20+ years. It hasn’t changed.

Each number on the chart refers to a different entry. The exit varies for every trader.

To use this framework, look at the stock’s history of running, the quality of its catalyst, and a few other indicators. It goes like this:

- Step #1: The Pre-Pump or Promotion

- Step #2: Ramp

- Step #3: Supernova

- Step #4: Cliff Dive

- Step #5: Dip Buy

- Step #6: The Dead Pump Bounce

- Step #7: The Long Kiss Goodnight

The panic bounces I outlined above are the day trading example of Step #6.

And they don’t just work with penny stocks. Check out top trader Jack Kellogg’s day trading example from GameStop Corp. (NYSE: GME) earlier this year:

The green arrows show Jack’s entry and exit using Step #5. He dip-bought an intraday panic for $107,000* … Then he used Step #6 to rack up a $100,000 profit.*

Jack’s a master trader. He’s made $7.9 million in his trading career — most of it in 2021!* Don’t attempt to copy his strategy … Just know what’s possible with smart entries and exits.

Trade High-Volume Stocks

Volume’s critical when day trading. If a stock isn’t trading high volume, you won’t be able to get in and out where you want.

This is especially important for OTC stocks. These stocks can make big moves, but a lack of volume means your order might not get filled.

If you want to grow your account, you need to scale into bigger position sizes. Remember that LCLP chart above? To make my $845 profit*, my position size was 325,000…

The stock traded nearly half a billion shares, and my order was still just partially filled! Only trade liquid stocks.

Use Technical Analysis

Technical analysis focuses exclusively on price and volume. This is what you care most about in day trading.

Other things matter too, which is why you should always research the stocks you trade…

But you’re not holding these stocks for long. So you need to see what they’re capable of doing today.

What Are the Best Day Trading Software and Apps?

If you’re still using the Robinhood app for your day trading, read this section closely.

Trading is a battlefield. Use inferior equipment at your own risk.

If other traders have better charts, screeners, and news scanners than you … that means they’re getting into — and out of — trades faster than you.

In day trading, speed matters. Skip this step, and you’ll pay for it later…

For me, the best day trading platform is StocksToTrade.** It was designed by day traders … I even had a hand in it myself!

StocksToTrade has all the features I want in a trading platform. StocksToTrade gives you the advantages I wish I had when I was starting out.

Its features include:

- Clean charting

- A news scanner to help you spot catalysts

- 40+ built-in stock screeners

- Add-on services to help you hone your edge

Start the first 14 days of the rest of your trading life for only $7.

Day Trading Books

Don’t just learn from me. Every great trader has a different perspective. Here are some of the greats:

- “Japanese Candlestick Charting Techniques” by Steve Nison

- “Reminiscences of a Stock Operator” by Edwin Lefèvre

- “How to Make Money in Stocks” by William O’Neil

(As an Amazon Associate, we earn from qualifying purchases.)

If you want to learn what I had to learn the hard way, read my trading story for no cost: “An American Hedge Fund.”

And of course, there’s my student Jamil’s take on my pennystocking course. He took my strategies and organized them into an awesome book: “The Complete Penny Stock Course.”

If you get through all of that, there’s always more to learn.

Frequently Asked Questions About Day Trading

There’s no substitute for experience. But you can trust me on these…

Is Day Trading Difficult?

It isn’t rocket science … but so many traders lose because they don’t put in the effort. I’ve been day trading for 20+ years, and I still have more to learn. Chances are you do too.

What Is the Best Market for Day Trading?

I like the OTC markets — which aren’t really markets at all. There are no market makers or investment firms … It’s just you, your patterns, and a few million greedy traders.

Can You Start Day Trading With $500?

This amount would make exponential trades harder without risking your entire account. But at the start, trading small isn’t a bad thing. It will give you time to hone your strategy before taking it to the next level.

Day Trading Examples: The Bottom Line

In day trading, there’s a lot to learn. Take the time to study and look at the examples of experienced day traders.

That’s why I created my Trading Challenge. I want to show you that it can be done if you focus on the right things.

Part of my Challenge includes lots of day trading examples and lessons — it’s how you can work to improve step by step.

What did you think of this deep dive into day trading? Did you learn anything? Let me know in the comments — I love hearing from my readers!

Disclaimers

*This level of successful trading is not typical and does not reflect the experience of the majority of individuals using the services and products offered on this website. From January 1, 2020, to December 31, 2020, typical users of the products and services offered by this website reported earning, on average, an estimated $49.91 in profit. This figure is taken from tracking user accounts on Profit.ly, a trading community platform. Timothy Sykes has a minority shareholder interest in the platform. I’ve also hired Tim Grittani, Michael Goode, Mark Croock, and Jack Kellogg to help in my education business.

**Quick disclaimer: I helped design and develop StocksToTrade.

The post Day Trading Examples: How to Trade, Books, & Top Strategies appeared first on Timothy Sykes.