On the weekly RRG, XLB is inside weakening but rotating back towards the leading quadrant. On the daily RRG, XLB is pushing rapidly into leading from improving. This alignment makes the sector very interesting to watch in coming days/weeks.

It is one of the seven sectors that are in a clear uptrend on the monthly chart and trading at or near all-time-highs.

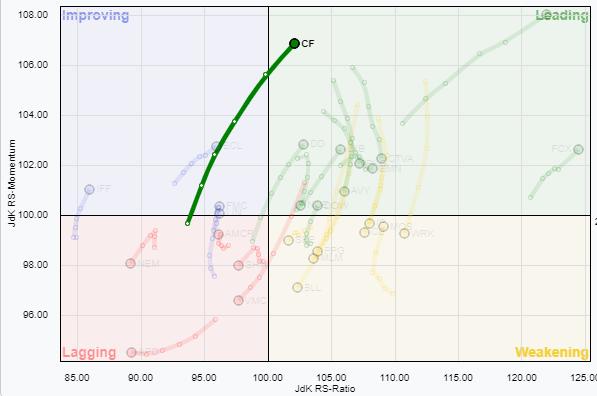

Inside the sector, CF Industries holding is an eye catcher with a long tail just crossing over into leading from improving at a strong RRG-Heading.

Inside the sector, CF Industries holding is an eye catcher with a long tail just crossing over into leading from improving at a strong RRG-Heading.

Looking at the chart above we can see a confirmation of the uptrend in price as CF just took out its most recent high at $ 40.

That $ 40 level was, and is, important as it served as both support and resistance a few times since early 2019.

This makes $ 40 the first support level to watch. To the upside there is a resistance area between $ 50 – $ 52 that will probably be strong enough to catch the initial move up. But once broken will very likely cause an acceleration higher.

So from current levels that is around $ 7 – $ 9 upward potential and $ 3 downside risk.

How to Play

- BUY the stock; this will give you an outright DELTA-1 long position

- BUY (deep) in the money CALLs; this will give you exposure to the stock with a relatively high Delta. May 32.50 Calls are currently trading around $ 11 which means that you are synthetically buying the stock at $ 32.50 + $ 11 = $ 43.50 while CF is currently trading at $ 42.90. So you pay a $ 0.60 time premium which results in a Delta of 0.90.

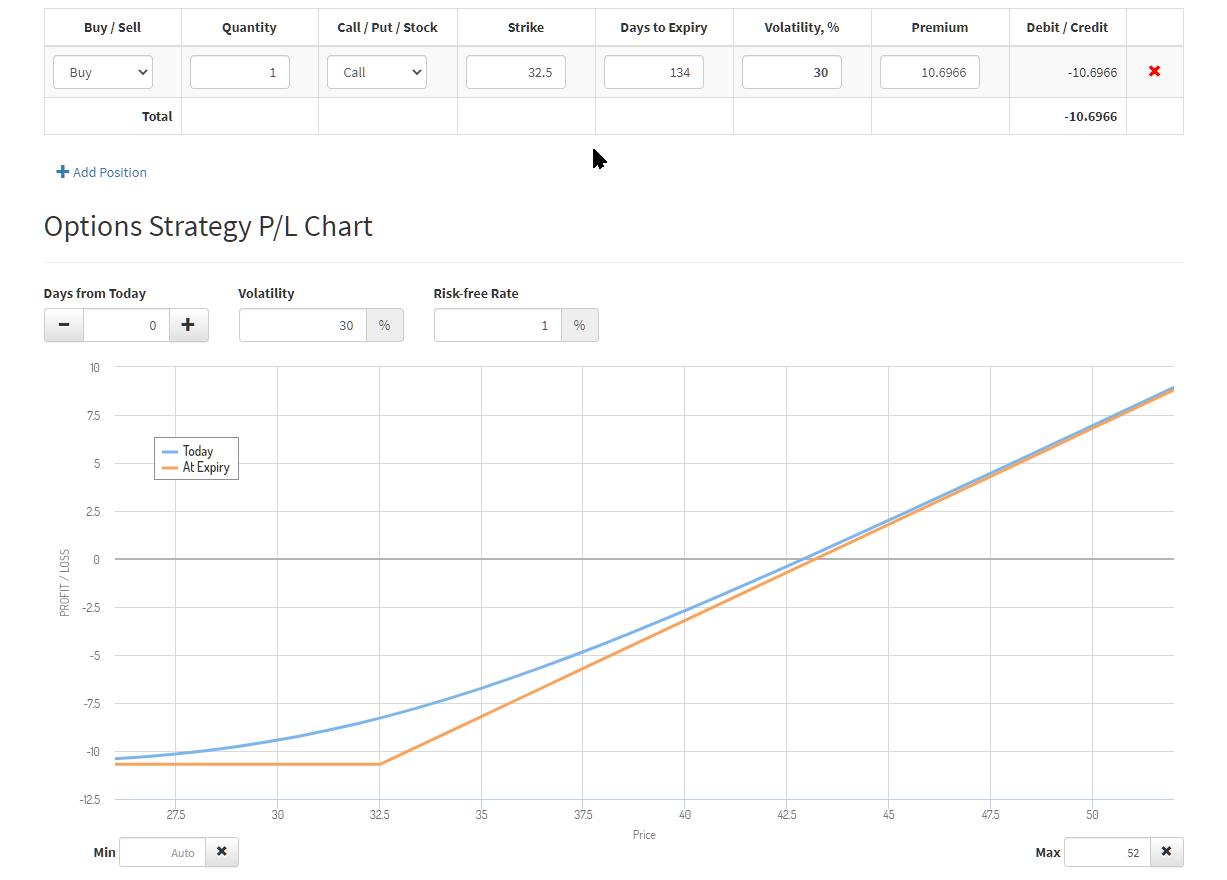

The Payoff diagram for such a Call option looks like this

As you can see you participate almost completely in case of a rise in price for CF. When the price goes down you will lose less because of the declining Delta (=exposure). From now until expiration, the blue line will move towards the orange line which is the payoff at expiration at various prices of the underlying stock (CF).

Below $ 32.50, the Call option will expire worthless resulting in a maximum loss of $ 11 (the premium paid). This limits the loss, where a long position in the stock would still continue to decline in value.

So a deep in the money call option is a good alternative for a cash position in the stock. First of all it requires less cash outlay up-front, only $ 11 instead of $ 42.90 and less downside risk. The disadvantage is that the option will expire at some stage, in this case in May, leaving you with no position while a stock can be held indefinitely and potentially recoup any losses after a decline.

My regular blog is the RRG Charts blog. If you would like to receive a notification when a new article is published there, simply “Subscribe” with your email address.