The FOMC Minutes report released Wednesday stated little to no change. Rates will stay low until 2023 and the monthly $120 billion bond-buying program will stay in place.

The Fed has been hesitant to change any fiscal policy as it has been very attentive to the economic recovery. However, this has worried some investors that believe hefty spending will increase inflation.

Currently, the inflation rate is set to rise to around 2% by the end of 2021. For Jerome Powell, Chairman of the Federal Reserve, this number is acceptable as supporting the economy and maintaining a positive forecast for the unemployment rate is still the focus. With that said, the overall market reaction was lackluster, but upon a closer review we do see some signs of stress.

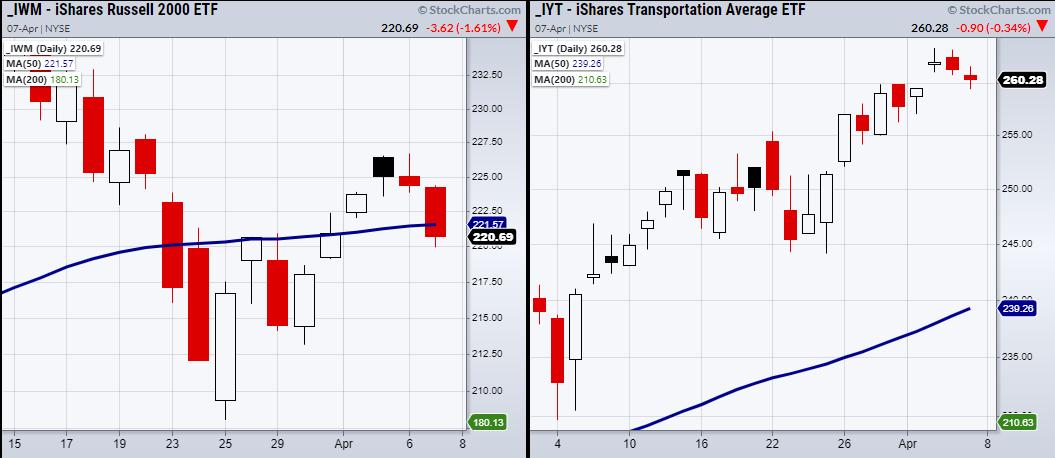

The small cap index Russell 2000 (IWM) closed under its 50-day moving average, which it recently cleared at $221. The 50-DMA has been the best support for IWM to hold from a technical standpoint. Now, we will wait a second day for confirmation to see what IWM does.

The Semiconductor sector (SMH) has also struggled to clear resistance at $158, along with the Transportation sector (IYT), showing some drifting price action. Because IYT helps to show the demand side of the economy, this holds great importance as we look for the market to continue upwards.

On Thursday, we should watch for IYT to show some more decisive price action and for IWM to either confirm a cautionary phase, with a second close under its 50-DMA or rally back over that major moving average.

ETF Summary

- S&P 500 (SPY): Holding near highs

- Russell 2000 (IWM): Watching for confirmation of cautionary phase with second close under the 50-DMA at 221.57

- Dow (DIA): 329.72 support

- Nasdaq (QQQ): 338.19 high to clear. Support 321.40

- KRE (Regional Banks): Support 64.31

- SMH (Semiconductors): 258.59 resistance

- IYT (Transportation): Watch to hold 260

- IBB (Biotechnology): 145 support

- XRT (Retail): 88.56 support the 10-DMA

Forrest Crist-Ruiz

MarketGauge.com

Assistant Director of Trading Research and Education