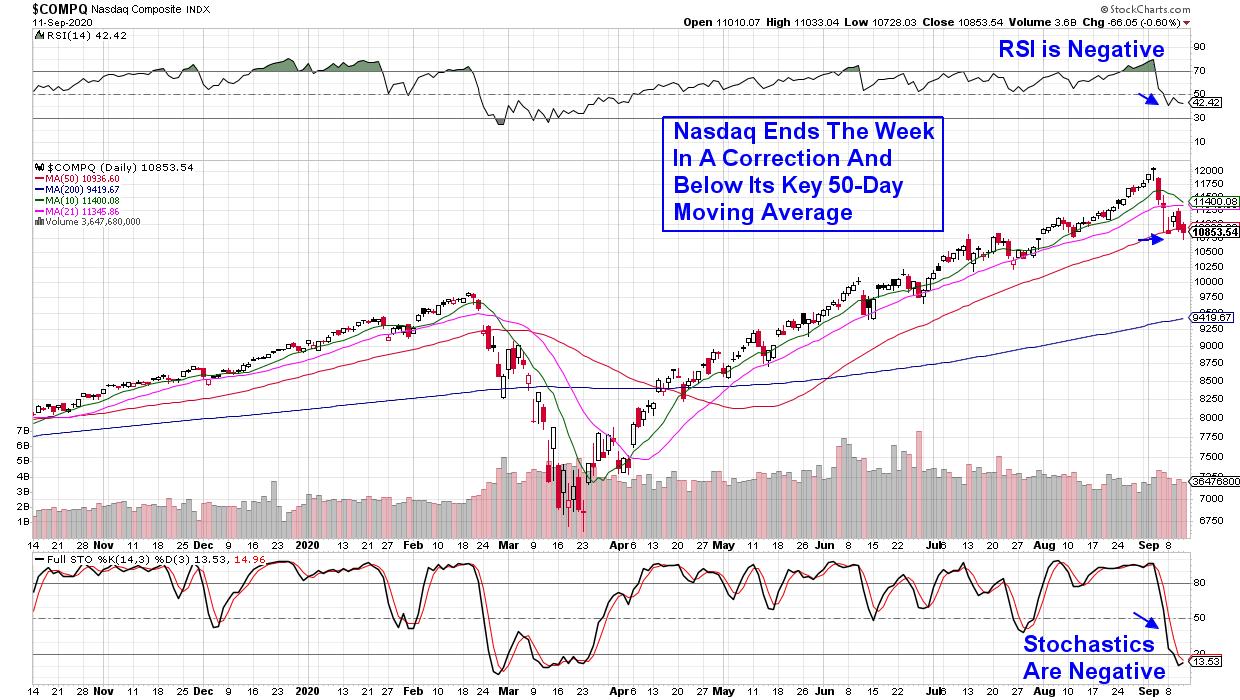

Fast-moving growth stocks have been taking it on the chin, with the Tech-heavy Nasdaq now down over 10% from its recent peak in price. The drop puts this Index into a correction, which has investors on the lookout for more potential downside.

DAILY CHART OF NASDAQ COMPOSITE

Those who follow my work at MEM Investment Research will know that we’ve been removing stocks from our Suggested Holdings List as they break below key support, while staying with others where their charts remain positive.

Overall, however, we may be in for continued bumpiness over the near-term. A move into stocks that provide a high yield, as well as having growth prospects and an attractive chart, could very well help with weathering the possible upcoming storm.

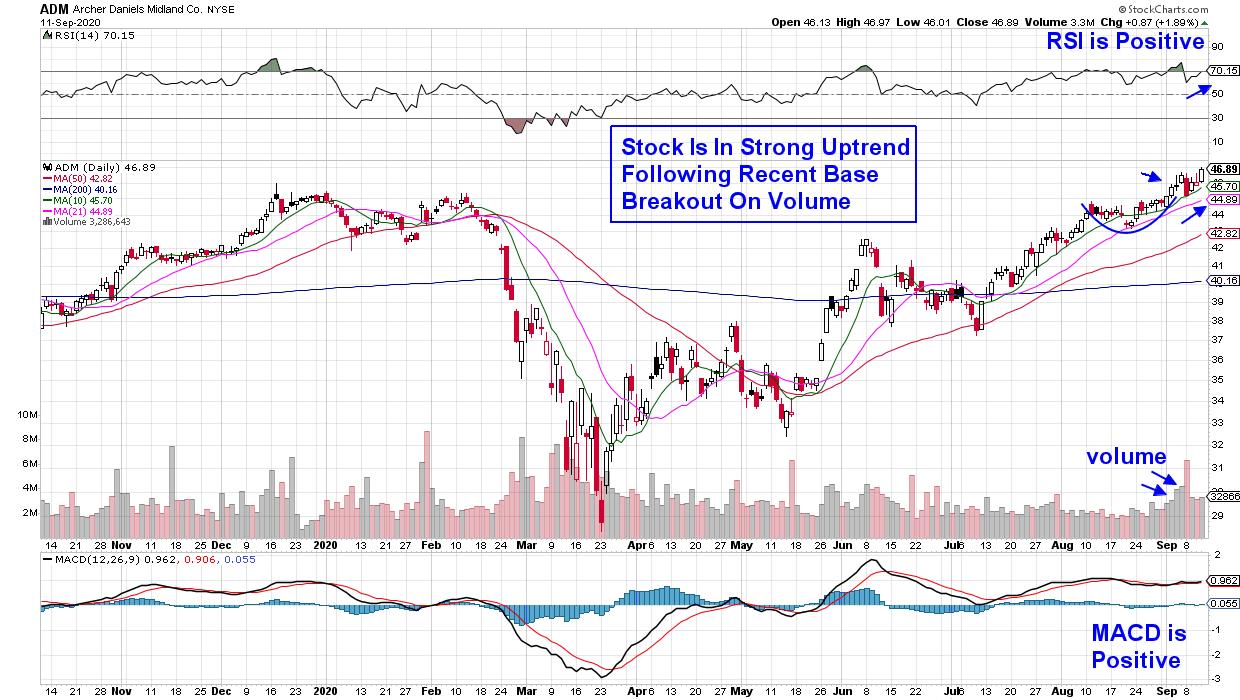

This would include stocks such as Archer Daniels Midland (ADM). The 3.1%-yielder is a multinational food processing and commodities-trading corporation that has recently seen its earnings estimates raised higher for both this year and next.

DAILY CHART OF ARCHER DANIELS MIDLAND (AMD)

The company expects a groundswell of export demand for the rest of 2020, led by robust purchases by China and elsewhere, as the coronavirus pandemic fuels food security concerns around the world. ADM is in a strong uptrend following a 1-month base breakout earlier this month. Look for a continued move higher given its $85 price target from Wall Street.

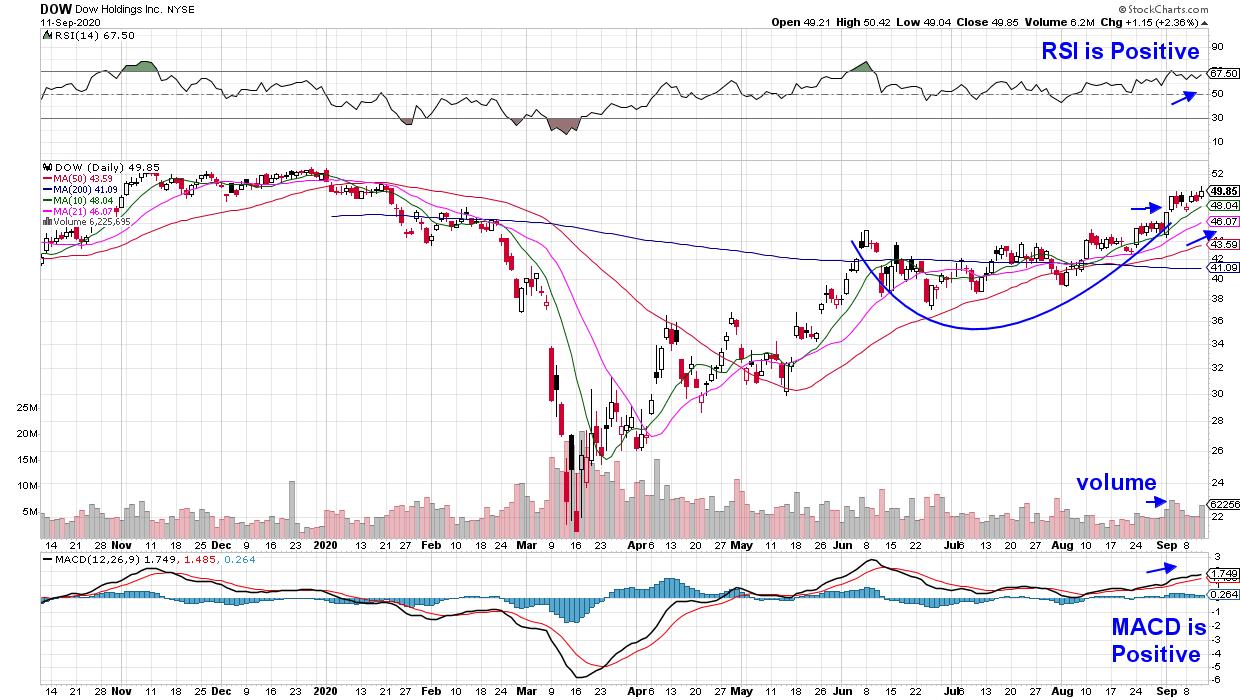

Dow Holdings (DOW) is another mega-cap yielder that has seen its estimates revised higher. In fact, the company is estimated to grow earnings by 184% next year due to their production of polypropylone, which has seen its price rise due to distribution chain breakdown.

DAILY CHART OF DOW HOLDINGS, INC. (DOW)

The highly versatile plastic that DOW produces has seen demand grow; particularly in the automotive and construction industries which are seeing expansion. The stock broke out of a 3-month base on volume last week and is now in a confirmed uptrend. The stock was upgraded today with a $55 price target.

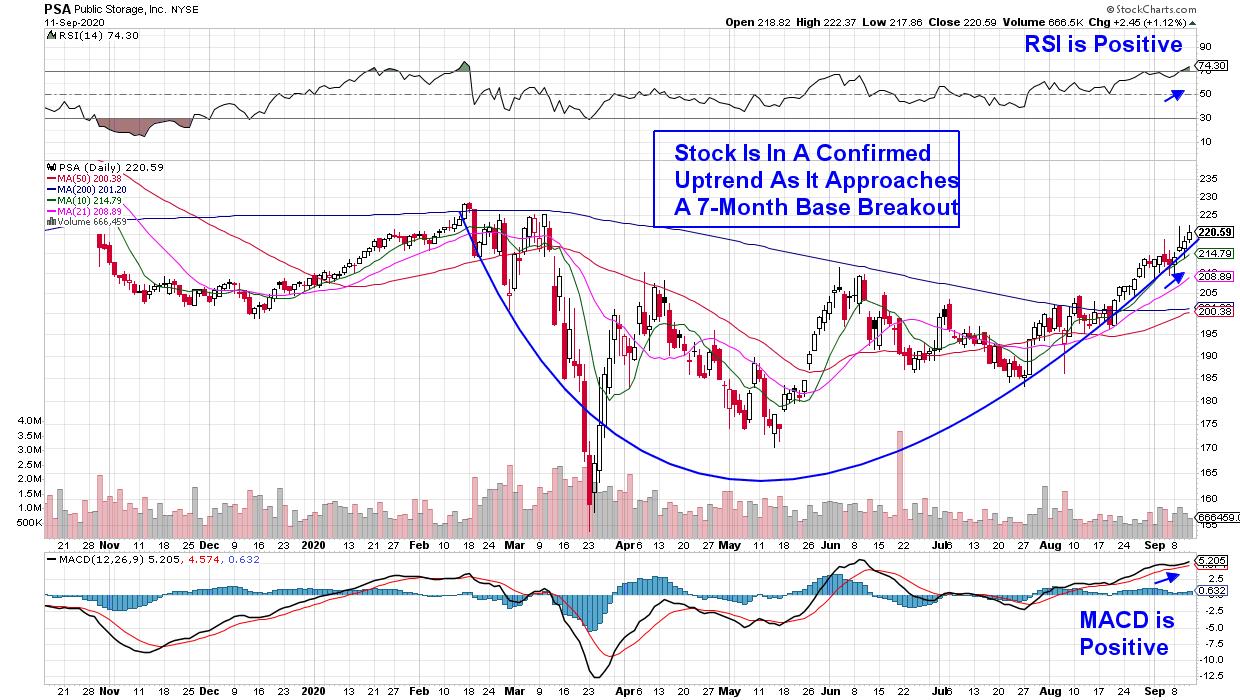

While most REIT stocks remain in a downtrend, self-storage facility provider Public Storage (PSA) has been in a stable uptrend of late as demand for their units has increased. Many once-popular cities such as New York and San Francisco have seen an exodus of younger renters who have returned home and now need a place to store their belongings.

The 3.6%-yielder has had a tough year; however, estimates for next year are close to turning positive as analysts raise guidance. As you can see in the chart above, the stock is in a confirmed uptrend, with a positive RSI and MACD pointing to further upside.

The good news is that each of these highlighted stocks are poised to trade higher due to improving growth prospects. Their attractive yields make them even more compelling during this currently volatile environment.

From my work, I’m anticipating a move back into high-growth stocks such as Technology and Internet-related areas, particularly given their strong fundamentals due to high demand for their products. Great gains can be made following the pullback in leadership stocks.

If you’d like to be alerted to when these high-growth areas turn near-term positive again, you’ll want to subscribe to my bi-weekly MEM Edge Report. In addition to being provided with precise entry points, you’ll be provided with insights into why that select stock is poised to trade higher. You can use this link here to take a 4-week trial at a nominal fee.

Warmly,

Mary Ellen McGonagle