Broyhill Asset Management commentary for the month ended November 2020, discussing the rally in value stocks in November.

Q3 2020 hedge fund letters, conferences and more

As the opportunities to add value increase so does the personal risk, the career risk and the business risk, until finally there will be incredible opportunities to make money… that no one will dare to take advantage of. We would like at least to be the last ones trying.” – Jeremy Grantham

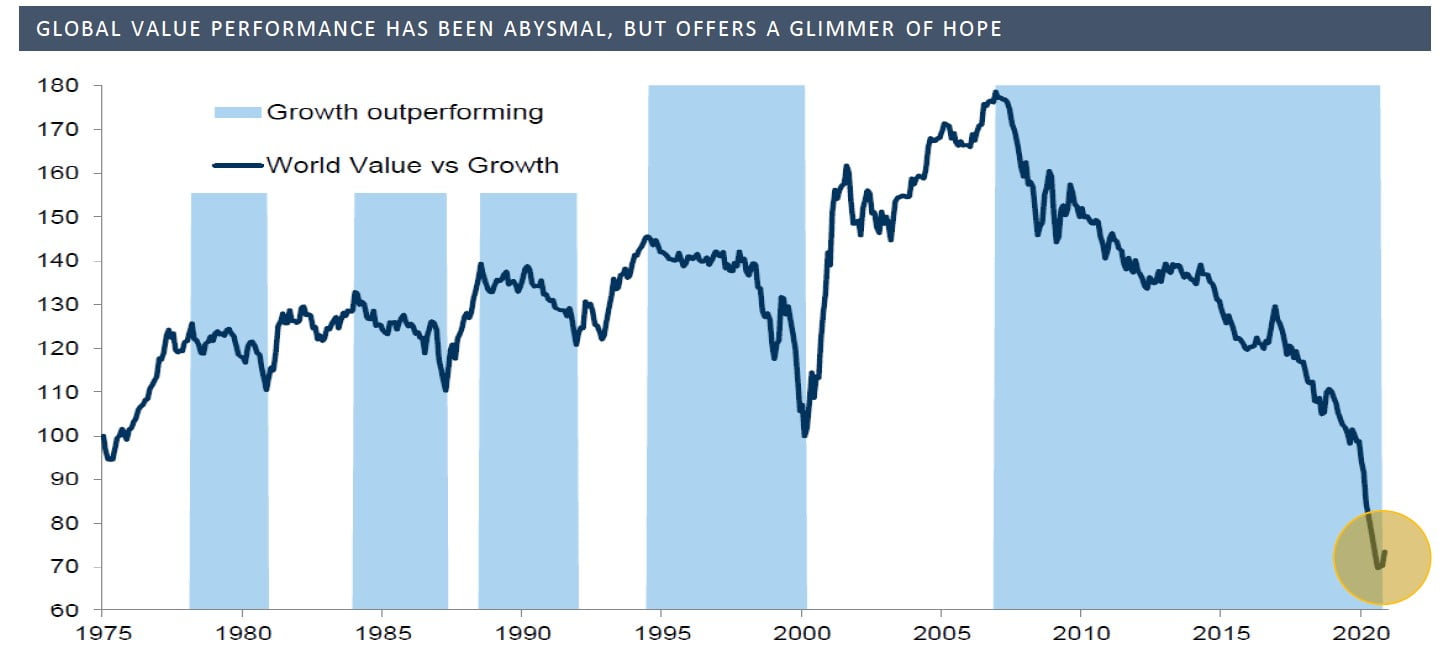

In their most recent quarterly letter, GMO’s Ben Inker speculates that future financial historians may declare that the release of vaccine trial data in November 2020 marked the start of the great Value stocks rally of the 2020s.

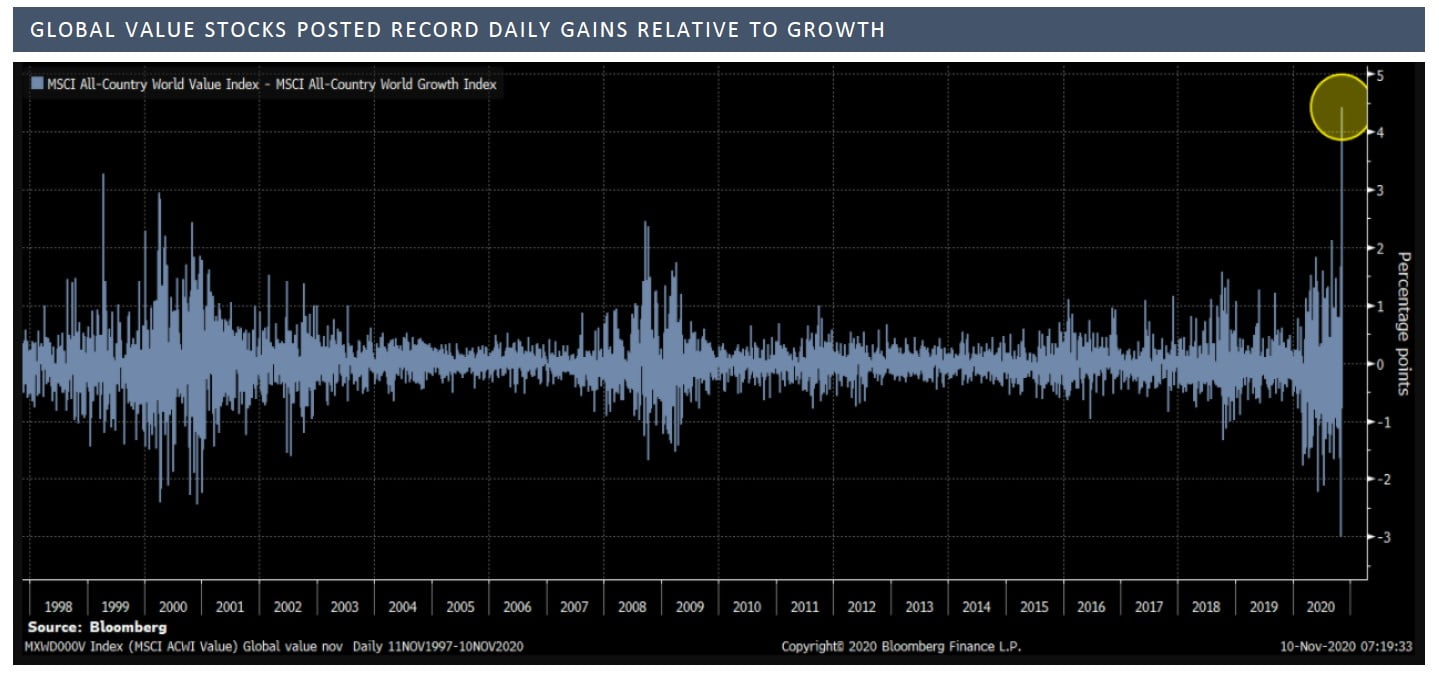

That would be consistent with our experience, as we outlined for investors on Broyhill’s quarterly call last month. The first word of an effective vaccine sent the world’s cheapest stocks surging the most on record relative to their faster-growing peers, as investors rotated out of expensive COVID beneficiaries and into depressed value stocks poised to gain from a COVID recovery.

Given the magnitude of their underperformance and the scale of the discount at which Value stocks are trading, we think November’s initial surge was just a hint of what’s to come.

Market Outlook

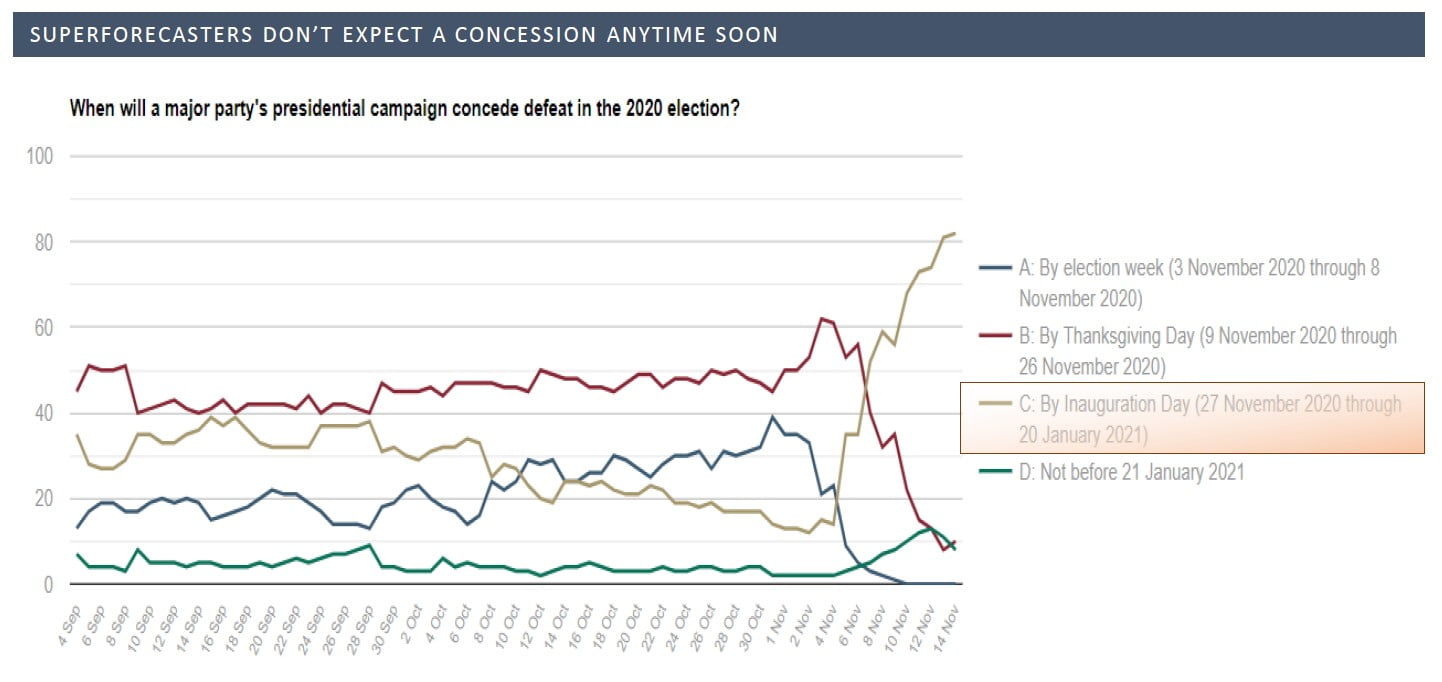

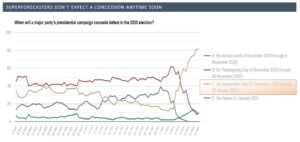

Election rhetoric drove markets for months

The election results and implications have been well covered so we won’t dwell here, except to say that the longer this uncertainty prevails, the greater the risk to investor sentiment. Aside from that, the biggest remaining question in our opinion is the senate and we’ll have to wait until January to see where things shake out there. For now, markets seem to be excited about the prospects for a divided government.

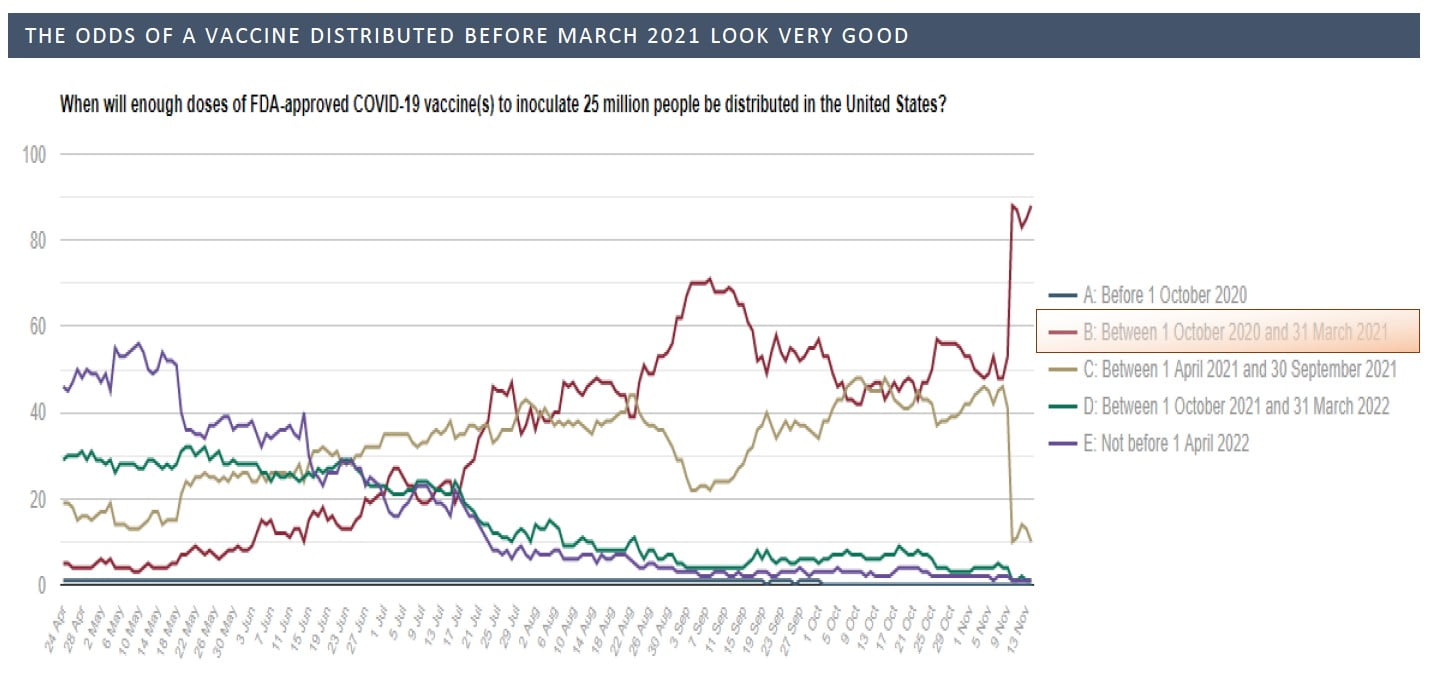

Vaccine headlines quickly overshadowed the election

Encouraging news on Pfizer’s vaccine overshadowed election results last week and sent markets soaring. While there are still many remaining questions, we think the market’s reaction was largely rational. The expected timeline was in line with consensus expectations, but the 90% efficacy was much better than most anticipated.

A VALUE-able reversal GLOBAL

Word of an effective vaccine sent the world’s cheapest stocks surging the most on record relative to their faster growing peers, as investors rotated out of expensive COVID beneficiaries and into depressed shares poised to gain from a COVID recovery. Global value stocks jumped almost 6% while their growth counterparts fell 2% over the two days.

If something can’t go on forever, it won’t

Last week’s move in value stocks was extreme on many metrics. But not nearly as extreme as the move in growth stocks over the last decade, which is perhaps the best run for growth (and the worst for value) in a century. Stepping back to look at the full picture, we see how much room value has to run. Don’t look now, but we may have just turned the corner.

We quantified the upside potential for value stocks on our recent call. Click here or on the image below to access the presentation. And if you’d like to dial into future calls, you can send a request to Tim LeRoux at tim@broyhillasset.com

The post Broyhill Asset Management November 2020 Commentary: Value Returns appeared first on ValueWalk.