The world is starting to come out of lockdown … And smart, proactive traders are preparing for back-to-work plays.

It’s been a crazy market over these past months of the pandemic. It’s not over. And the recent civil unrest is adding more volatility to the market — and the world.

I truly hope we can get to a better place soon.

And even as we watch the protests across the nation and as things start to open back up, there’s no sign of the stock market slowing down.

But as the country’s economy starts to reopen, I want you to be ready for the evolving market.

You still have an opportunity to level up and learn something that has the power to change your life. Trading changed my life over 20 years ago. Now, I give back through charity. That’s the power I found in penny stocks.*

Here’s the thing … We’ve never really seen a market like this — so I urge you to be smart and prepare. Be aware of what’s going on. Know which back-to-work plays to watch as the economy reopens.

Study up, get disciplined, and prepare. I’ve got a ton of resources for you — a lot of them are zero cost. No excuses. Let’s do this.

Get Ready for Back-to-Work Plays

It’s really happening.

President Trump announced a phased plan for reopening the country…

Like the groundhog coming out of his little hole on Groundhog Day, people are starting to emerge from lockdown … Of course, like that hog, there’s a chance we might need to dive back under cover.

I definitely want to travel again … but I’m also closely watching the volatility this could bring to the market. That can mean more trading opportunities.

Here are some of the top ways to prepare…

Understand What’s Happening in the Market Right Now

There are so many stocks in movement right now. Do you understand what’s moving them?

Right now, there are three key forces at play:

- Pumpers pump up stocks via email and social media…

- Newbies believe them and rush into trades … aka naïve chasing…

- Aggressive short sellers short too soon, causing short squeezes that create even bigger runups…

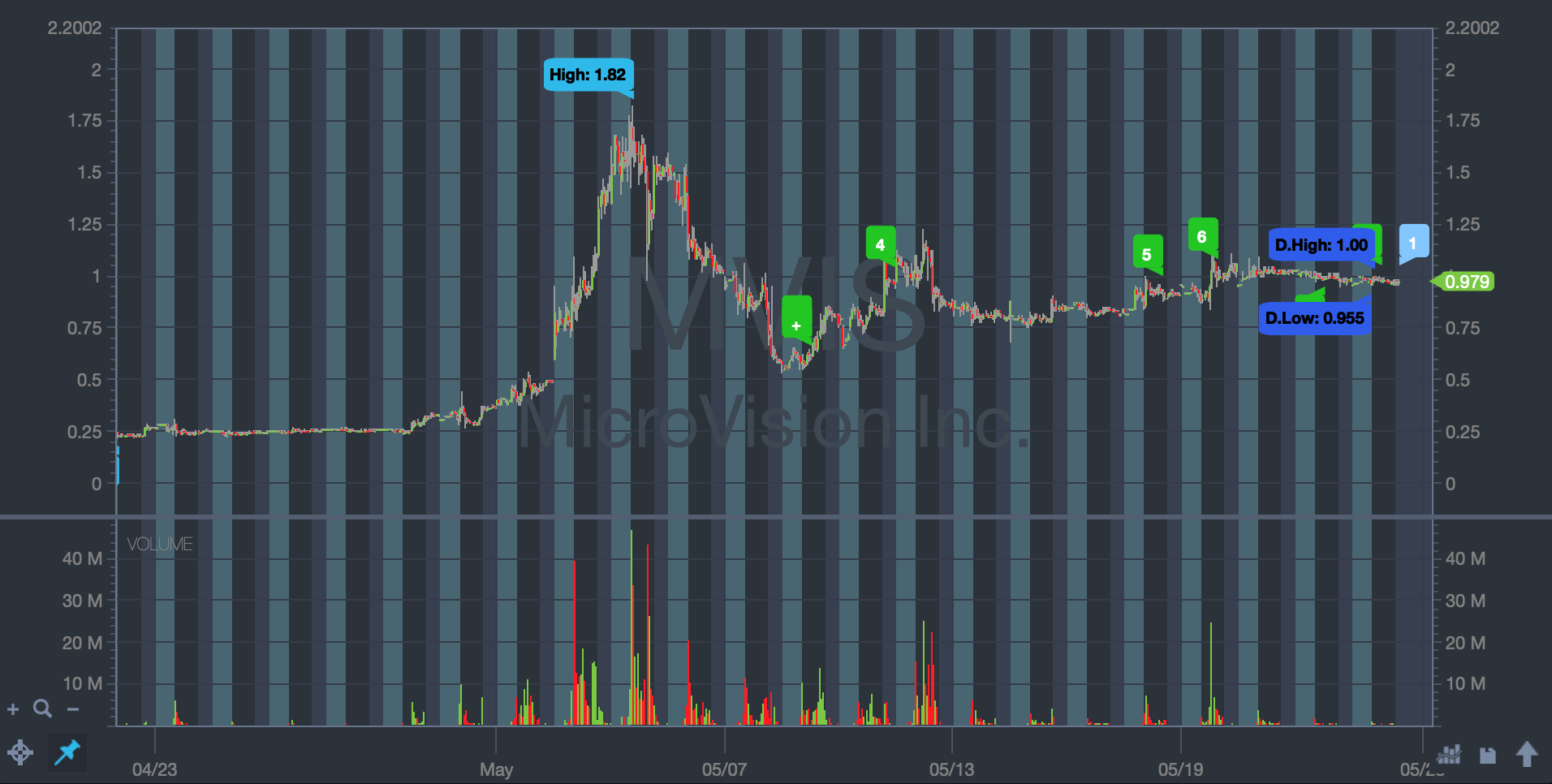

We saw this recently with Microvision Inc. (NASDAQ: MVIS). MVIS went from the $0.20s to $1.80. I was buying in the $0.30s and $0.40s. Just check out the chart …

This is the market right now.

What the pumpers are doing is NOT ethical. But am I fighting it? No, because I’m beating them at their own game. They’re creating opportunities for me.

But I do want to protect the newbies…

Unfortunately, too many don’t listen. They don’t watch videos like this:

Even if I can help one or two avoid the pain … it’s worth it.

Be Ready to Adapt

A lot of people are losing big in the stock market right now. Not me.

At the time of this writing, I’ve made over $220,000 so far in 2020.*

(*My results, as well as the other traders mentioned in this post, are not typical. We’ve spent years developing exceptional skills and knowledge. Always remember trading is risky. Never risk more than you can afford.)

To put that in perspective — my profits for the entire year in 2019 were about $125,000.*

Both years, I started with a small account — see why here. And I donate all of these profits to charity.

I didn’t suddenly become a genius this year. I’m still not that good at math. But I’ve adapted to the market and I’m taking advantage of the many opportunities out there right now. Even at the risk of overtrading sometimes.

On May 20, I’d made $5K by about 11 a.m. Eastern.* Not bad for about 90 minutes’ worth of work. And that was just an OK day — I was taking some plays, but I missed some, too.

I might know the patterns, but I’m not making these crazy profits because I’m special. It’s because the market is crazy right now, and I’m prepared. I’m taking advantage of it.

I don’t always trade this much, but when I see the opportunities, I adapt.

Rich person’s mentality: 90% of traders lose & mostly it’s due to lack of preparation/following other people’s picks & not being self-sufficient, I want to be part of the 10% of traders who win consistently so I will study my butt off & learn a little something from every trader!

— Timothy Sykes (@timothysykes) May 18, 2020

My top students do, too…

Tim Grittani reports making over $2 million* THIS YEAR already…

Mark Croock reports he’s up $2 million* total, up a few hundred thousand just this year…

They know that to take advantage of this market — and any market — adapting is key. Which is why you gotta know…

Former Runners and Supernovas

The market will change eventually. As more things start to reopen, the hot sector will shift … the plays will probably change.

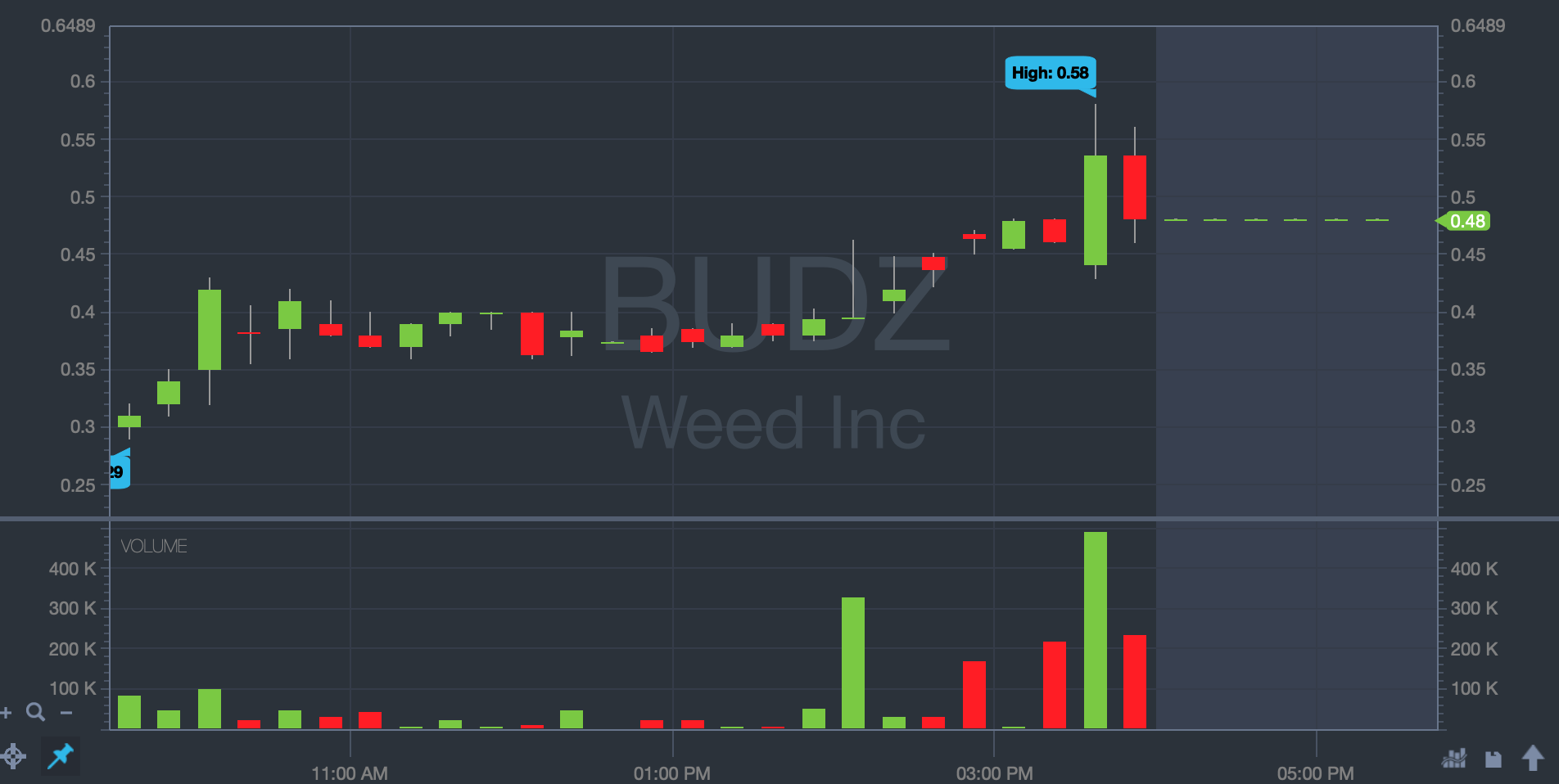

One example? My friend and StocksToTrade lead trainer Tim Bohen called it with a new wave of weed stock spikes. I just made a quick $1,170 profit* on Weed Inc. (OTCQB: BUDZ), a former weed supernova that spiked again since weed companies have been making bank during the lockdown…

I wasn’t the only one who saw this coming. One of my top students, Kyle Williams, also reported a verified $461 profit* on BUDZ, noting:

“The weed sector was getting hot so I took this former runner long overnight. I added in the morning when it broke yesterday’s high and let the trade work. It wasn’t as strong as I liked … And as the stock got closer to my profit target, my profit finger starting itching. Overall took a solid gain.”

Wanna get better at spotting supernovas? Check out this webinar replay — and sign up for my Supernova Alerts. You gotta be prepared. These spikes can move FAST. So you also need to…

Understand Volatility

Throughout the pandemic, the stock market has changed a LOT.

You had work-at-home plays, you had hand-sanitizer plays, mask plays…

Soon, you’ll see back-to-work plays.

Regardless of which stock is spiking, the biggest overarching theme is crazy volatility.

This crazy market might not last forever, but another volatile market will come along eventually.

The reopening will likely cause volatility of its own. There’s bound to be a lot of uncertainty. The recent nationwide protests against racial discrimination are adding to the volatility and uncertainty.

But if things settle down, people may be excited to get out and spend. We could see booming business as the economy reopens. Whatever happens…

Be ready to react.

If you haven’t already seen it, check out “The Volatility Survival Guide.” This is a NO-COST two-hour guide I created about how to trade during a volatile market.

It includes all the basics about trading in volatile markets and advanced tips on how to find the most promising stocks.

Also, never assume you know everything. Be sure you really…

Know Your Market and Trading Basics

It’s crucial to understand the current market and volatility … But all of that needs to be in addition to a strong foundation of trading knowledge.

A ton of new traders will think that’s boring. Guess what? A lot of new traders are also bound to fail.

Do NOT underestimate the power of learning trading basics.

Think about it this way…

Say you’re in an accident and taken into the emergency room. You want a doctor who can move fast under pressure … But you still want to make sure they went to medical school and learned the basics first.

Same with trading. You can’t just jump into the volatility without understanding the basics. That’s when people make mistakes.

Take Champignon Brands (OTCQB: SHRMF), for example.

This was the ultimate panic and bounce. I got in one drop too soon. I avoided the first drop on May 20 but then got in on it thinking it could bounce back to the $1.50s.

As it turned out, it was a weak bounce. So I got out when I saw the bounce wasn’t happening … And I was too early. It wasn’t a bad trade. My theory wasn’t wrong, but since I know how trading works I knew it was smart to get out rather than hold and hope.

I always follow rule #1.

Here’s the action:

A newbie who didn’t understand might have held a position … And maybe they would have profited — or lost big.

Profit.ly user GaRIK088 got it, reporting a small verified trade but a solid strategy: “OTC Dip buy played it too safe, but […] I would take it every time.”

This is the game. It doesn’t always work out, and you need to understand how the market works.

Apply for My Trading Challenge

My Trading Challenge can help you learn market and trading basics. This is where I teach traders about penny stocks based on my 20+ years of trading experience.

It’s not for lazy traders or people who just want hot stock picks. I’ve created a ton of resources like comprehensive video lessons, webinars, and an incredible chat room.

I care about what I’ve built, and I only want people who are willing to work hard.

To me, education is worth the investment … But even if you can’t invest money into your trading knowledge, there’s no excuse NOT to learn.

You can read my book for FREE: “An American Hedge Fund.”

You can check out these 30 foundational videos on YouTube. Once again … FREE.

You can read my FREE PennyStocking 101 Guide.

Seriously. There’s no excuse to spend the remaining days of lockdown wasting your time playing video games or zoning out on Netflix.

I just interviewed a $19K profit student* and here’s what he had to say:

“Learn from the video lessons. Plenty of people watch your video lessons — but actually learn from them.”

Here’s the full video:

Armor Up

Recently, I hosted a webinar with STT’s Tim Bohen about the recent market volatility … You can check out the replay here.

A TON of people had questions, so I recorded a video to respond to some we didn’t get to…

One person asked, “What’s the difference between your chat room and STT Breaking News … do I need both?”

My response: You can use all the help you can get. We ALL can.

SO many traders lose … as many as 90%. Trading is a battlefield. It can get really bloody really fast.

You need the right armor.

Having the right broker is armor. Don’t be fooled by cheap brokers or crappy trading apps with great marketing but bad execution.

Having great software is also armor. It’s no secret that I’m a huge fan of StocksToTrade — I helped design the platform, after all.

I constantly say things like look for stocks with great catalysts … look for recent runners. I find them on STT, and the Breaking News tool has made it even easier.

And I can give you mental armor. I can teach you rules and patterns. But I’m not a news wire.

STT’s Breaking News chat is run by two stock market pros. They break news all the time. They subscribe to so many news sources. These guys filter through it all so you get the most important, most actionable breaking news items.

Focus on What Works for You

I know what my favorite patterns are.

NEW BLOG POST: My Favorite Pattern to Trade https://t.co/9PTHBYIymG EVERYONE NEEDS TO LEARN THIS ONE PATTERN, ESPECIALLY IF YOU HAVE A SMALL ACCOUNT! Retweet/favorite this if you love this pattern too! It was a truly GREAT example on $TLSS yesterday

— Timothy Sykes (@timothysykes) May 22, 2020

I’m really good at buying morning spikes, or morning panic dip buys.

I haven’t been shorting much lately. It’s a tough strategy, and other things are working better for me.

You’ll probably trade most effectively if you find what patterns you’re best at and focus on them. That’s how you become self-sufficient.

People need to focus on learning/refining your trading process & self-sufficiency FAR more than just making $ when beginning trading in the stock market. Ask yourself what can you today, tomorrow, this month, this year to put yourself in the best position 1-2-3-5 years from now?

— Timothy Sykes (@timothysykes) May 22, 2020

What’s your favorite pattern? Take the time to find out. Test strategies. That’s how you find what works for you.

The Economy’s Reopening … Are You Ready?

The world is slowly starting to come back to life after lockdown. Are you ready to take advantage of the back-to-work plays that are bound to start cropping up?

There’s still a lot we don’t know about the reopening and how it will take shape. But there are proactive actions you can take right now to be prepared for what unfolds.

What will you do? Keep watching Netflix? Or actually work toward something? Invest in your knowledge however you can … BE PREPARED!

What are you seeing in the early stages of reopening? Leave a comment and let me know…

The post Back-to-Work Plays: How to Prepare for the Economic Reopening appeared first on Timothy Sykes.