Avenir Capital commentary for the second quarter ended June 2020, discussing their positions in Vail Resorts, Sony and CBRE Group.

Q2 2020 hedge fund letters, conferences and more

Dear Partner:

The Avenir Global Fund (the “Fund”) increased 4.7% for the June 2020 quarter bringing the past 1-year return to -11.6% (net)1. The MSCI ACWI index (AUD) returned 6.0% for the quarter and 4.1% for the past year. In local currency terms, the portfolio increased in value by 14.7% during the quarter but currency moves, which provided a useful buffer during the first quarter of the year, proved a headwind during the June quarter, reducing the return by 10.1%.

The second quarter of the year saw equity markets make similar spectacular moves to the first quarter, except in this case, in the opposite direction. While the March quarter saw the market fall into bear market territory in record time, with the MSCI ACWI (USD) ultimately falling by 22% during the quarter, the June quarter saw equity markets roar back up posting the biggest quarterly gain in 21 years. By 30th June, the MSCI ACWI (USD) had recovered much of the previous decline increasing 19% to end the quarter 7% below where it started the year2.

For our portfolio, the largest contributors during the quarter were Infineon, Wuliangye Yibin and Univar. Infineon announced better than expected results and its share price recovered strongly from the downturn, increasing 55% to end the quarter at €20.88. We introduced Wuliangye Yibin, a relatively new position, in our last letter. We acquired Wuliangye, a high quality and fast-growing Chinese consumer branded goods company, in February 2020, on share price weakness as the Covid-19 virus was still only impacting China. During the June quarter, Wuliangye announced very strong 2019 and 1Q20 operating performance, with net income up 30% and 19%, respectively, helping drive a 50% share price increase in the quarter. We highlighted Univar’s mispricing in our last letter. That has been corrected to some degree with the share price increasing 57%, during the quarter, to $16.86 per share, up 163% from the mid-March low of $6.40. We think ongoing volatility in the current environment is to be expected and we take comfort in each of our investments being anchored by a firm view of underlying or intrinsic value.

The largest detractors to performance in the June quarter were TravelSky, Bluegreen Vacations and new position, CBRE Group, although none of them were material. These stocks are exposed to coronavirus related risks, making them somewhat volatile positions, being influenced by daily statistics relating to infection rates in different regions and headlines relating to the development of potential vaccines. We believe all have long-term intrinsic value well in advance of their current stock price. Despite a volatile quarter, TravelSky ended the quarter roughly where it began with currency moves costing us slightly. It was a similar situation at Bluegreen, and CBRE is a new position which we discuss in more detail in this letter.

Market Commentary

While the overall market performed strongly in the second quarter, it proved the adage that there is no such thing as a stock market, there is a market of stocks, and the performance of different stocks in the market varied widely. While the MSCI ACWI (USD) finished the June quarter up 19%, the technology heavy, U.S. based Nasdaq index increased by 31% during the quarter. Following a familiar pattern, growth stocks did much better than value-oriented stocks, with the S&P 500 Growth index increasing by 26% compared to the S&P 500 Value index increasing by only 12%3.

There are some logical reasons for many technology stocks to see their price increase. The nature of the health crises has given rise to the narrative that the transition to digital will only accelerate and those companies best positioned will do even better than previously expected. Furthermore, the response by global central banks to fight the economic effect of the health crises mean that real interest rates might be expected to be lower for longer. With interest rates lower, the discounted value of future cash earnings are higher, so growth stocks, many of which are yet to earn any positive cash flow, can increase in ‘value’ simply because of the mathematical outcome of discounting forecast potential cash earnings in the distant future at a lower rate.

Party like its 1999

On top of these, arguably, valid reasons for an increase in valuations, there is, of course, the less valid reason for an increase in the share price of many companies, being FOMO, or, the fear of missing out. One of the characteristics of the recent, and longest ever, bull market we had (until mid-February), has been the remarkable lack of wide spread excesses or sense of euphoria in the market. That has been changing, over the past three years, and seems to be accelerating in the Covid environment. One of the major global investment banks, only a few weeks ago, suggested that the market was feeling a bit like 1929. Then, not more than four weeks later, they revised that view to the market feeling more like 1999 (leading up to the dotcom crash). It is starting to feel more and more like 1999 as every month goes by.

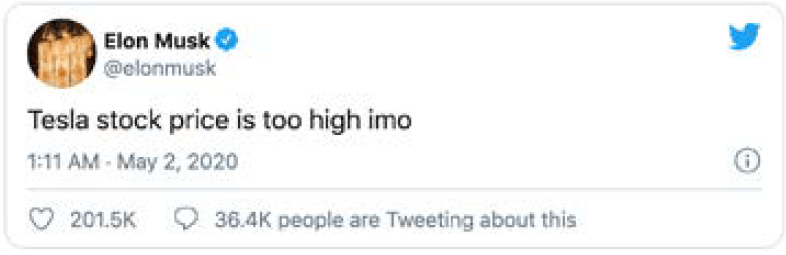

The market capitalisation of Tesla, one of the great battleground stocks of current times4, has increased almost 4x so far in 20205 and increased by the entire market capitalisation of Ford Motor company in one day– 20th July, 20206. Tesla has never generated an annual profit and has roughly negative US$6 billion in retained earnings. Even Elon thought the Tesla share price was too high back in the beginning of May. The share price has more than doubled since then.

Tesla is up for inclusion in the S&P 500 index this year, having just reported four consecutive quarterly GAAP7 profits for the first time and, should it be added, based on today’s share prices, it will slip between 12th placed Mastercard, which earned net income of US$8 billion in 2019, and 13th placed J.P. Morgan, which earned net income of US$36 billion in 2019

8.

Market Concentration

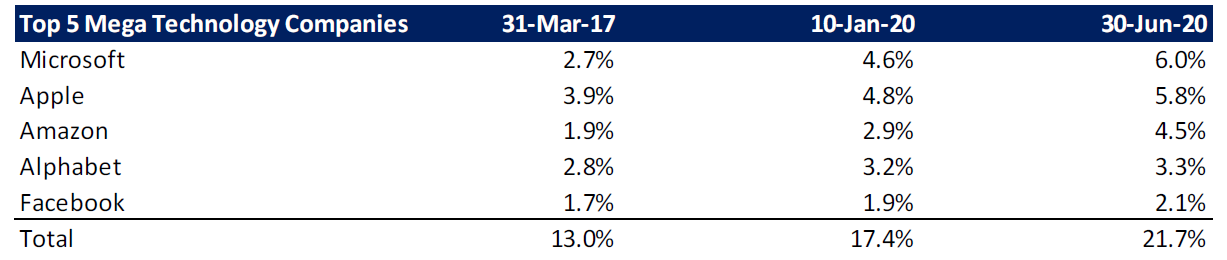

The broad indices are providing ever increasing concentration and valuation risk. While the music keeps playing and, in fact, appears to be getting louder, people will keep dancing. But that doesn’t mean that the danger is not increasing. As of 10th January 2020, before the coronavirus was seriously troubling western markets, the top five companies made up 17.4% of the total market capitalisation of the S&P 500 index9. This level of market concentration was already equivalent to the market concentration just prior to the dotcom crash in 2000. Since then, the market fortunes of the mega five have improved further, so that they now make up 21.7% of the S&P 50010. Their market share has increased by 25% in the first six months of this year. While this is striking in itself, consider that the market share of these giants, as at 31st March, 2017, was 13%11. The market share of the big 5, of the major U.S. equity index, has increased by 67% in just over three years.

While this has caused us no end of consternation over the past 3 years, as we haven’t owned them, it fills us with excitement for the next 5 years, because we don’t own them. For the past 25 years, Bank of America has surveyed fund managers about how they are positioning portfolios. The latest survey found that nearly three-quarters of fund managers agreed that holding big U.S. tech stocks was the “most crowded” trade in the market, the survey’s strongest ever consensus. Buying tech stocks is now the “longest ‘long’ of all-time”.12 Many passive index investors (or investors in benchmark focused funds) do not fully realise how much their fortunes rest on the fortunes of these five companies.

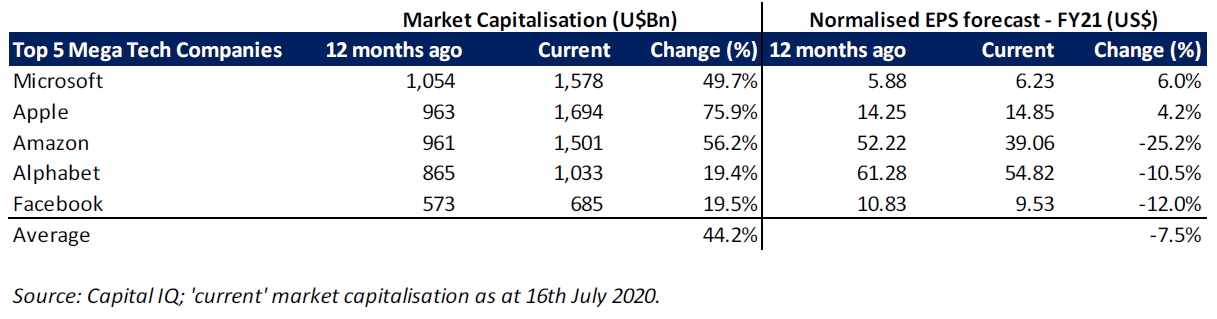

There is no question that these are admirable companies with strong growth prospects, but they are not undiscovered, and they do not come without risks, including valuation. The big 5 have seen their market capitalisation increase by 44%, on average, over the past 12 months13 while their consensus expected earnings for fiscal 2021 have fallen, on average, by 8% over the same period.

These companies have done a remarkable job of lifting the index over the past five years, indeed, over the past ten years since the GFC, but it strikes us as optimistic to think they can do the same job over the next five years from their current lofty perch. For these companies to increase in value by 10% per annum for the next five years they would have to add an incremental US$4 trillion to their combined market capitalisation by 202514. This is the equivalent of adding the entire current market capitalisation of the next thirteen companies in the S&P 500 today. In other words, adding another Berkshire Hathaway, Visa, Johnson & Johnson, Wal-Mart, Proctor & Gamble, Mastercard, JP Morgan, United Health, Home Depot, Nvidia, Intel, Netflix and Verizon. Alternatively, you could add the bottom 288 companies in the S&P 500 to make up the same US$4 trillion. Not impossible, but also not a slam dunk. We prefer to look elsewhere for opportunities and, in doing so, provide valuable diversification for our investors, including ourselves.

Where are the opportunities today?

In terms of where those other opportunities are, the market is not offering wide spread bargains. The ongoing threat of Covid, to both personal and economic heath, still represents clear and present danger. Equity markets, particularly in the U.S., are still elevated, with signs of increasing investor exuberance, investor crowding and investor excess in parts of the market. The U.S. also offers political risk with the presidential election four months away. Presumptive Democratic presidential nominee, Joe Biden, is pulling ahead in the polls as President Trump’s popularity takes a beating, arguably, due to his administration’s handling of the Covid crises. While the outcome is far from certain, Biden presents potential risk to the equity market as he may well unwind President Trump’s corporate tax cuts. By our estimate, this could cut S&P 500 earnings by ~12%15, reducing the ‘e’ under an already expensive ‘p’, increasing P/E multiples further.

At the same time, Covid infection rates and hospitalisations are soaring in the U.S. with the path out of the health crises very unclear. The U.S. is being rocked by civil unrest as the death of George Floyd proved to be the spark that ignited a renewed call for better treatment of and opportunities for black Americans and other minority groups with the “Black Lives Matter” movement gaining momentum. U.S. aircraft carriers are patrolling the South China Sea to push back on Chinese territorial claims, and Indian and Chinese troops are in repeated, and sometimes deadly, skirmishes on their border. There is a lot happening in the world that creates a lot of uncertainty.

On the positive side, many countries appear to have the virus, largely, under control although ongoing diligence is required, as we are seeing in Australia, where flare ups can take hold very quickly. Businesses are adapting and consumers are still showing a desire to spend. Certain markets, like China, offer large and growing domestic opportunities and a willingness to do what it takes to keep the virus controlled. Our best performing investment for the first six months of this year has been the Chinese company, Wuliangye Yibin, which has increased in price by 78% since we bought it in February16. We are currently reviewing other opportunities that we believe offer similar upside.

We are proceeding with caution, given the circumstances, but we are also taking the opportunity to acquire stakes in select companies with great competitive positions and offering what we believe to be significant opportunity to create long-term wealth for shareholders.

Regardless of the short-term impact of Covid we believe that the prospects for broad based market returns over the next 5-10 years remain subdued. Over the near term, returns are likely to be determined by investor psychology and behaviour as much as they are by fundamental outcomes. Over the long-term, the fundamental performance of businesses and the price investors pay for those business will win out. Current market stress and volatility, and the wholesale selling of anything with any kind of economic sensitivity, is setting up some extraordinary long-term investment opportunities.

Portfolio Activity

Our job at Avenir is to plot a course through an uncertain world by assembling a portfolio of high-quality businesses that offer a margin of safety, the prospect of attractive returns and a diversified and controlled set of investment risks. We will not be seduced into taking risks in order to keep up with a benchmark, nor to chase increasingly expensive and risky investment opportunities because others are doing so. During the crises, we have sought to calmly and methodically review our investment holdings to determine where investment theses have been impaired, due to Covid, and where new opportunities have been created. We have sought to increase the overall quality of the portfolio by reducing exposure to companies and sectors at the epicentre of the health crisis, and increasing exposure to companies that are in regions and sectors which we feel offer better protection from the Covid dynamics and the prospective returns offered by strong competitive positions and attractive entry prices. Some of these are discussed below.

Sony Corporation

We initiated a position in Japanese technology and media company, Sony Corporation, in June. Sony has been through a challenging period where internal infighting and hubristic forays into areas outside their competence saw a long period of poor returns but, today, it is predominantly driven by divisions with strong competitive positions in profitable and growing sectors and with significant barriers to entry.

Sony is the world’s second-largest music label globally. Recorded music was in secular decline for about a decade but has returned to growth thanks to music subscription services like Spotify. The number of paying music subscribers is only 10% of the global installed base of smartphones, so there is a lot of scope to continue growing.

Sony has long been one of the world’s leading gaming companies, and with more people looking for ways of entertaining themselves at home, the PlayStation 5, which will be released at the end of 2020, could drive a strong upgrade cycle.

Sony has about 50% global share in the supply of digital image sensors used in smartphones and digital cameras. There is a persistent, but we believe misplaced, fear that this business will be disrupted by larger-scale and lower cost Asian chipmakers, but we believe that competitiveness in image sensors is driven by design, not scale. There is a secular trend to more and larger sensors in smartphones, plus longer-term trends, such as in the automotive sector, that benefits Sony.

Sony Pictures is a beneficiary of the insatiable demand for content from streaming services such as Netflix, Amazon Prime and Apple TV. In summary, Sony holds leadership positions in the main businesses in which it participates, has strong growth prospects and generates high returns on capital, yet, at around 15x P/E17, trades at a significant discount to peers.

Vail Resorts

Another company we acquired in the quarter is Vail Resorts which we were able to purchase at a discount to its historical valuation amidst the Covid-19 volatility. Vail Resorts is the largest publicly listed ski resort firm in North America and Australia and operates a network of 37 resorts, including Whistler, Vail and Perisher. This increasingly global network is made valuable by an ‘Epic Pass’ that gives skiers access to all the resorts under the same pass. The pass is typically cheaper than passes offered by competing firms to a single resort, and the average cost (~A$500) is equivalent to ~5 days of skiing, motivating people to opt for the pass. Vail Resorts also has a large moat as the firm either owns the land, on which the ski fields reside, or engages in long-term leases with the forest service, and there has not been significant additional ski resorts built in the U.S. in over 35 years—limiting new supply & competition.

The average household income of Vail Resorts’ customers exceeds $200,000, and over 50% of resort visits are by drive-in locals, providing some buffer to Covid related disruptions. The sell-off creates an opportunity to purchase Vail Resorts at a discount to historical valuations. While the path through Covid is not clear, Vail Resorts will likely emerge stronger than its rivals and be even better placed to continue to execute on its value creating consolidation strategy in the snow space. Over the past five years, prior to the impact of Covid-1918, Vail Resorts grew revenue by 80% and earnings per share by a factor of 10×19.

Barron’s magazine recently featured Avenir’s analysis of the company, Vail Resorts. You can find the Barron’s article here.

CBRE Group

CBRE Group was added to the Fund in the quarter. Though the company is well known as a commercial real estate broker – the biggest in the world at double the size of #2 – it also has property management and investment businesses that provide annuity-like revenue. With a strong global footprint, the company has grown revenue and operating profit by 19% and 13% annually, respectively, for the past decade20 – a track record we thought attractive as the stock was sold off.

We believe the market is concerned for a couple of reasons. The first is the near-term impact to earnings due to a drop in sales and leasing volumes as a result of Covid-19. As a guide, in 2009 CBRE’s sales revenue bottomed out at 40% of the peak before recovering the year after. Whilst the timing of the recovery from the current downturn is unknown, we expect a decline of similar magnitude in this cycle. Secondly, the Covid-19-enforced working from home shift means investors are extrapolating that trend to result in excess office space. Acknowledging that there has likely been some change in the way people work, we believe that there is a fundamental desire for communal working areas and that, from discussions with those in the industry, reduced demand for offices could be partially offset by an increase in space in order to maintain social distancing protocols. Regardless of how our working habits evolve, CBRE, with its dominant and global footprint, is well positioned to provide advice and support to companies in relation to their property needs.

Should current depressed conditions continue, CBRE has low leverage and is therefore able to consolidate the industry by acquiring weakened competitors should the opportunity arise. In conservatively assuming a recovery to pre-Covid-19 earnings in 2023, we believe the stock has material upside.

Outlook

As always, all members of the Avenir investment team are invested in the Fund alongside our investors, and while the current uncertainty and volatility can be very unsettling, we believe that the portfolio is currently trading at deeply discounted levels with the embedded margin of safety and prospective five-year returns as high as they have ever been. The Fund also offers diversification from the companies, regions and market sectors that dominate the portfolios of many investors today.

The type of business we favour has not changed and we would still rather buy high quality but appropriately priced businesses than businesses priced for perfection in the current uncertain environment. We are value-oriented investors, but we don’t simply buy ‘cheap’ companies. Robust, well-capitalised businesses that can grow underlying value are still, and always will be, our hunting ground. Periods of volatility are a sweet spot of ours as it allows us to continually improve our margin of safety by reallocating capital from companies with a higher price-to-value ratio to those with a lower price-to-value ratio. By doing so, we aim to substantially reduce risk and increase the prospective returns for the portfolio.

We consider that the Avenir portfolio currently trades at a heavily discounted price to our view of underlying value positioning the portfolio for robust returns over the next 3-5 years. We have not seen such attractive portfolio positioning for many years and investors may consider this as an opportune time to allocate capital to Avenir Capital.

Our private equity heritage encourages us to view every investment we make as if we are buying the whole company. This helps to keep our focus on the quality of the underlying business, its long-term prospects and the price we are being asked to pay, rather than trying to speculate as to what the market or individual company prices may do over the short-term.

We believe that our fundamental research-driven and concentrated investment approach will continue to generate attractive investment outcomes for our investors, and the team at Avenir remain enthusiastic and focused in our search for the next great investment.

“The danger has not arrived, so the danger has passed.” – Winston Churchill

Best Regards,

Adrian Warner Managing Director

This article first appeared on ValueWalk Premium.

The post Avenir Capital 2Q20 Commentary: Vail Resorts appeared first on ValueWalk.