With the month of August come the dog days on Wall Street, which traditionally means low volume and sluggish markets. Unfortunately, when the algos see low volume and few bids, the market often slides in big chunks, so this may be a very tough August – or not.

Accordingly, unless we are truly near the ultimate top for the longest bull market in history, investors who continue to analyze the market based on metrics of the past will continue to be bearish and miss whatever time is left in this ongoing bull market. Happily, as I will detail below, investors who dig deep into company fundamentals, management moves and crucial technical indicators are more likely to be rewarded, often in a big way. And this is even more true in a market where the Federal Reserve continues to pump money into the banking system.

Last week in this space, I wrote: “For investors, at least in the present, it’s not what the economy can do to the markets that matters most. Instead, it’s what the Fed can do to the markets, to 401 (k) plans and to trading accounts that should keep us up at night,” while adding “we are in a new world, where, in a complete reversal of traditional relationships, the markets are driving the economy and the Federal Reserve and global central banks are driving the markets.” And by and large, nothing has changed.

Familiar readers know about MEL, the complex adaptive system composed of the markets (M), the economy (E), and people’s lives (L), so I won’t dwell on the fact that its existence is self-evident. What I will note, however, is that over the last several months, I’ve described a series of influences on the market, which now are asserting their effect on stock prices in a more decisive fashion and which have turned the economic apple cart upside down; in effect, they have placed the stock market as the leading influence in MEL.

These influences are best grouped in “the big five” macro influencers:

- COVID-19

- The Federal Reserve

- Demographic milestones

- Retirement and trading accounts

- High Frequency Algos

Specifically, while most stocks traditionally fall in tandem during periods of economic hardship, the combination of the influences described above has changed the playing field, requiring a different analytical approach to stock-picking. In fact, the whole stock-picking dynamic has been further turned upside down as the market adapts to the evolving dynamic of the COVID-19 pandemic and the Federal Reserve’s response to the economic collapse caused by the shutdown.

Moreover, as the stock market now rules MEL’s roost, we now live in a world where bull and bear markets may coexist depending on how the interaction between the markets, the economy and people’s lives shake out for individual sectors and stocks. Indeed, the final cog in the machine is the machine itself, the high-frequency trading algorithms (HFT), whose instant reaction to headlines can change any market trend instantaneously.

What it all boils down to is that success in this market requires a working knowledge of how these five influences affect stock prices and how to best decipher and manage them.

In a Bipolar Market, Follow the Money and Monitor Management

It’s foolish to believe you are in a bear market when the New York Stock Exchange Advance-Decline line (NYAD), as I describe below, makes new highs on a regular basis. Indeed, by definition, when the NYAD is moving higher, it’s due to the fact that more stocks are rising than falling.

That said, these are not normal times, thus successful stock-picking requires a wide-ranging and in-depth analysis of the market, individual sectors and stocks on a regular basis. For example, if you limit your analysis to ETFs, such as the Healthcare Select SPDR Fund (XLV), you would correctly conclude that healthcare stocks have been in an uptrend until recently.

Yet a more in-depth analysis would reveal that not all stocks in healthcare are in a rising channel. Indeed, if you owned shares of pharmaceutical giant Glaxo Smithkline (GSK), you would be lagging the market, whereas if you owned shares of biotech equipment and materials manufacturer Repligen (RGEN), a stock I recently recommended, your only question at this point would be how much of a profit should I take and when should I take it?

The difference is that RGEN’s management recognized the fact that COVID-19 changed the entire playing field in biotechnology and pharmaceuticals and aggressively pursued the product lines that would benefit most from a feeding frenzy in drug and vaccine research, while simultaneously managing the risk to its workforce and its supply chain successfully. The net result is that Repligen delivered a well-above-estimates earnings report on 7/30/2020 and punctuated the report by raising its entire year’s guidance significantly, a fact that was picked up by the headline-reading algos and the day traders, who moved the stock decidedly higher.

Meanwhile, GSK, who is a major vaccine maker and should have had an advantage against other vaccine players, somehow failed to get into the COVID-19 vaccine sweepstakes early or convincingly enough and was basically left out in the cold. Certainly Glaxo, a usually well-run company, could bounce back. But at the moment, the stock looks like dead money.

Moreover, the move in RGEN was not a huge surprise given the company’s business and its central niche in biotech’s science and manufacturing dynamic. Furthermore, from a technical analysis standpoint, RGEN’s price action was forecasting that a positive surprise might be in the offing, as it had the following characteristics well ahead of its breakout:

- Accumulation/Distribution, On Balance Volume (OBV) were rising

- The stock found excellent support at its 50-day moving average while remaining above its 200-day line

- The stock cleared stout resistance areas near 100 and again at 120, as delineated by the Volume-by-Price indicator which cleared the stock for a breakout in each case

In other words, because this is a treacherous bipolar market, it pays off to do detailed analysis of stocks on a daily basis. Furthermore, if you only look at price charts, you’re only getting half the story. Thus, in order to get the big payoff in this market, it’s a requirement to dig deep into company fundamentals to understand the business, monitor management and discern what the technicals are saying.

NYAD Remains in Uptrend

The New York Stock Exchange Advance Decline line (NYAD), until proven otherwise, remains in a stubborn uptrend despite the market’s daily gyrations; as I describe above, those investors who do their homework will reap the greater rewards in this market.

Still, the short-term action in NYAD suggests that some sort of pause may develop over the next couple of weeks. Thus, although the risks at this point are low, investors should beware of the possibility of a Duarte 50-50 sell signal appearing. Just to refresh memories, a sell signal is generated when NYAD falls below its 50-day moving average at the same time that the RSI indicator falls below 50.

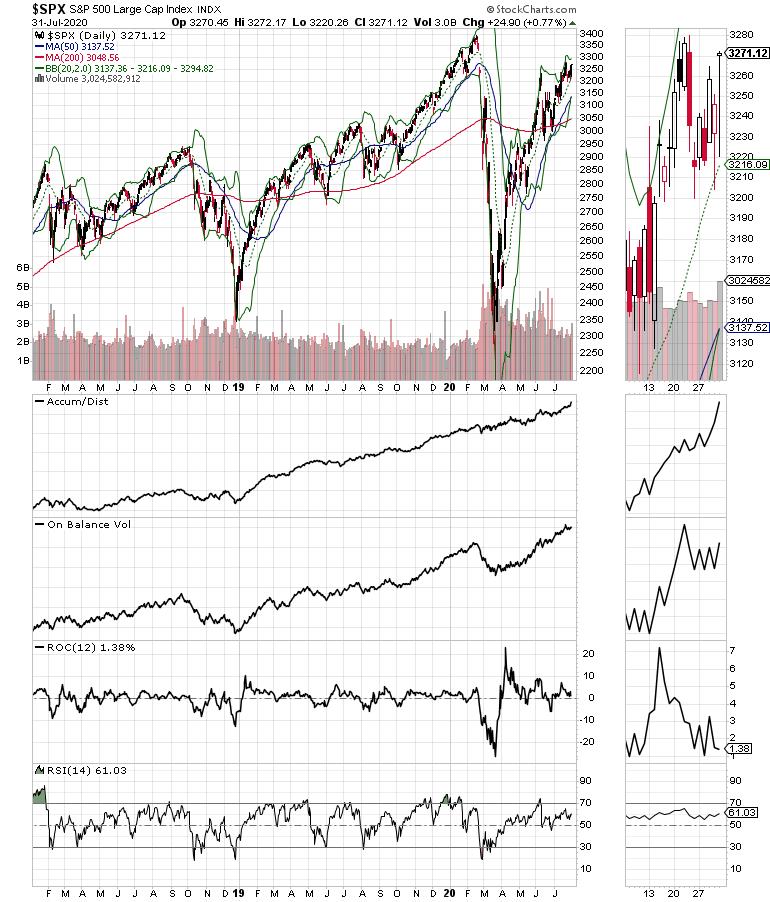

The S&P 500 (SPX) also looks set to embark on some sort of consolidation pattern. On the positive side, SPX remains above its 20-, 50- and 200-day moving averages, although On Balance Volume (OBV) is a bit on the weak side in the short term.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.