Famed technician and collaborator of the late Marty Zweig, Ned Davis, is known for asking the question “Do you want to be right? Or do you want to make money?” And, as crass and cynical as the words may sound to the uninitiated, truer words were never spoken in the context of being a stock trader.

Please don’t misunderstand me. I am as concerned as anyone about the state of the world. It’s impossible not to be when the daily news feature a pandemic, riots in the streets of major U.S. cities and a raging political landscape, both internationally and domestically. Yet, even in these uncertain times, there are still plenty of individual stocks with very attractive chart patterns and positive money flows. Moreover, based on the general state of life in the world at the moment, the bears could easily justify their negative views on the markets if they only focused on the news.

On the other hand, as I will detail below, it’s hard to be bearish if you look at the technical landscape in the markets purely from a trading standpoint. Clearly we are in uncharted waters, as institutional investors have reportedly missed the rally off of the recent bottom and are now wondering if they should play catch up to retail investors who seemingly have taken over the market. And yes, the market could theoretically crash and burn at any moment. But is that possibility any higher today than on any other day?

Furthermore, when it comes down to making trading decisions, the number one historically proven external factor which affects stock prices the most remains the actions of the Federal Reserve. And, unless I’m wrong, as quarterly statement time gets closer and money managers have to justify their jobs, the odds of the pros moving into the market are likely to rise. What that means is that June, the last month in the quarter, may not be too bad for the market, as under pressure money managers move money into stocks in order to dress up their books and work on their bonuses. Of course, that means July could get interesting, but that’s not here yet, so we’ll worry about it then.

Certainly, we should not be cavalier. There are plenty of valid arguments as to why there may be a bad outcome down the road in response to the Fed’s massive easing over the last few weeks. And when I look at life outside the markets, I am as concerned about them as any person who is aware of what may happen in the future, as the debt-fueled economy and the global order which it has fueled finally decides to have a reckoning.

But we’ve known about budget deficits and rising sovereign debt for years. The political landscape has been raging and ragged for at least a generation now.

Frankly, the more we hear and talk about all these things, the higher the stock market seems to go. All of this suggests that, until proven otherwise, stock prices, especially in the era of trading algorithms, are mostly influenced by the action of global central banks. And, at the moment, the central banks, especially the Fed, are still more than willing to finance the world’s problems in hopes that, if they throw enough money at them, they will go away.

Does that mean that they are right? I frankly don’t know. Do we act irresponsibly and throw caution to the wind? Of course not; we trade responsibly, with careful money management techniques and the prudent use of sell stops. But what it does mean is that, from a trading standpoint, we should focus on our individual stock positions and how they react to whatever is happening inside and outside the market.

For an in depth look at how I got here and how I analyze the markets, check out my May 25, 2020 interview with StockCharts.com’s David Keller on his show Behind the Charts on StockCharts TV. To subscribe to my service, click here.

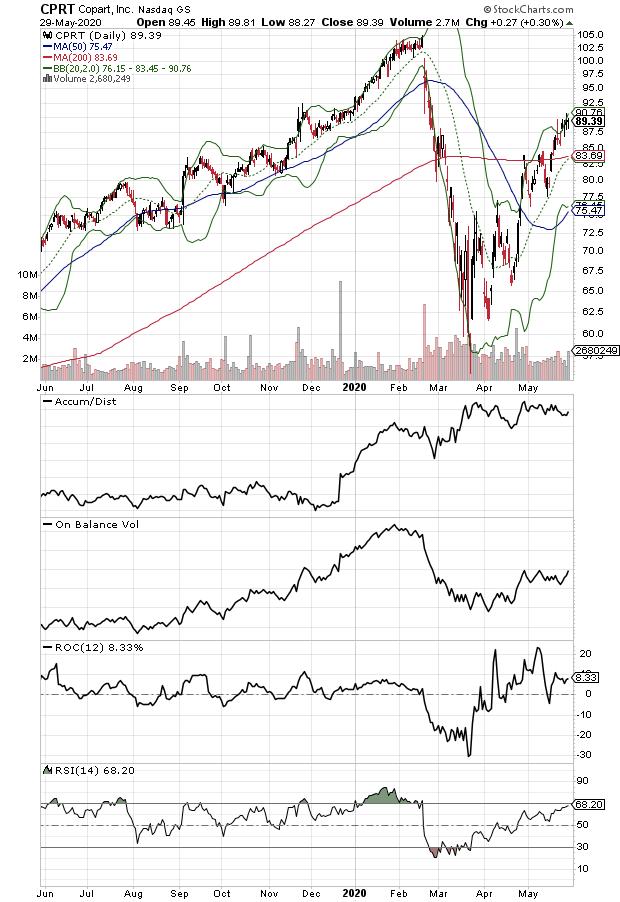

Copart Cops Chart Breakout as Management Hits Leadership Home Run

Copart (NSDQ: CPRT) is one of those companies whose business segment – brokering used car parts between body shops, insurance companies and other interested parties – is not at the top of anyone’s glamour list. Yet the stock has proven to be a standout in the post COVID-19 rally.

Moreover, if you read the company’s most recent earnings call, you get a feel for a management team whose crisis management skills show why the company continues to lead its sector and why they are likely to survive this and many crises. Without making this an encyclopedia-length article, I’d just like to point out that when the COVID-19 situation broke out, CPRT’s management team was all over it. First of all, they reassured their workers that no one was going to lose their job. Next, they drew their entire credit line and positioned themselves to stay in business. Then, they proved themselves to be essential by noting to law enforcement that, if they didn’t pick up the crashed cars dotting the landscape after accidents and do their job, then who would?

As a result, the company stayed in business with little change in their financial or business structure, and the chart proves it, as the stock just broke above its 200-day moving average and is putting on the afterburners. At this point, it’s quite plausible to see the stock move back toward its pre-COVID-19 high, given its positive momentum. Nice work.

NYAD Holds near Breakout

The New York Stock Exchange Advance Decline line (NYAD) delivered a midweek chart breakout and held close to this positive level as the week ended, a fact that suggests that the most likely outcome for this market, barring a complete reversal, remains one of higher stock prices. Furthermore, NYAD now has increased its bullish profile as it:

- Made two new highs during the most recent trading week

- Rises in a higher high and higher low daily pattern

- Trades above its 20-, 50- and 200-day moving averages

- Has positive momentum due to RSI being well above the zero line, and

- Features RSI that remains below 70, a sign that the uptrend is still not overbought

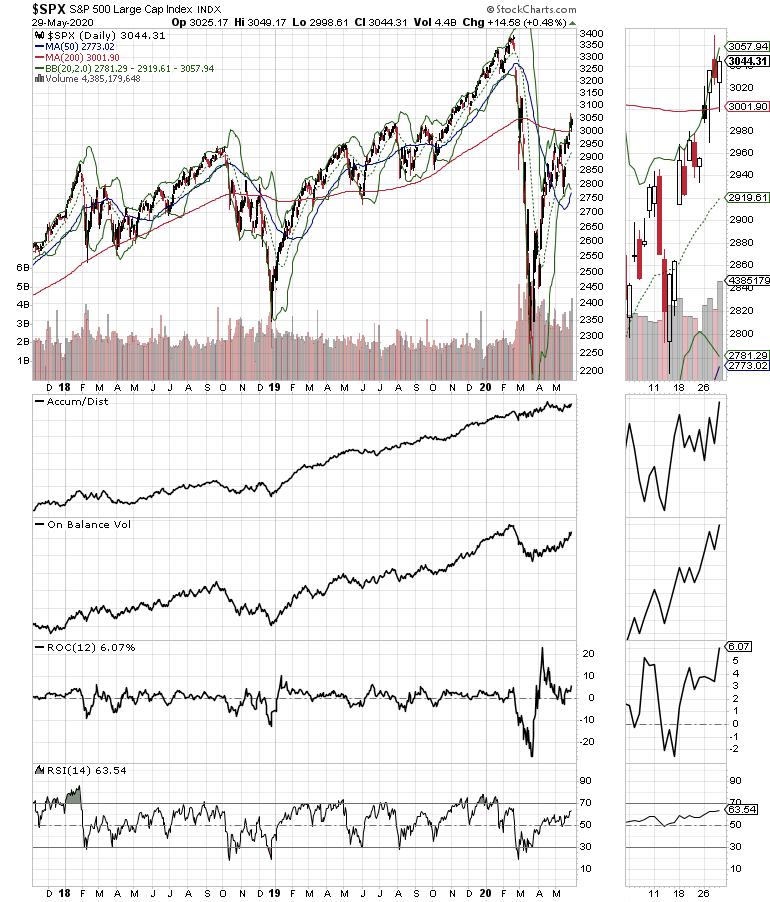

Perhaps the most overlooked positive sign in the market is that, despite the gloom and doom in the air, the S&P 500 (SPX) was able to close the week above its 2000day moving average, fully confirming that, at least for now, warts and all, the U.S. stock market is, by definition, back on the bullish side of the trend.

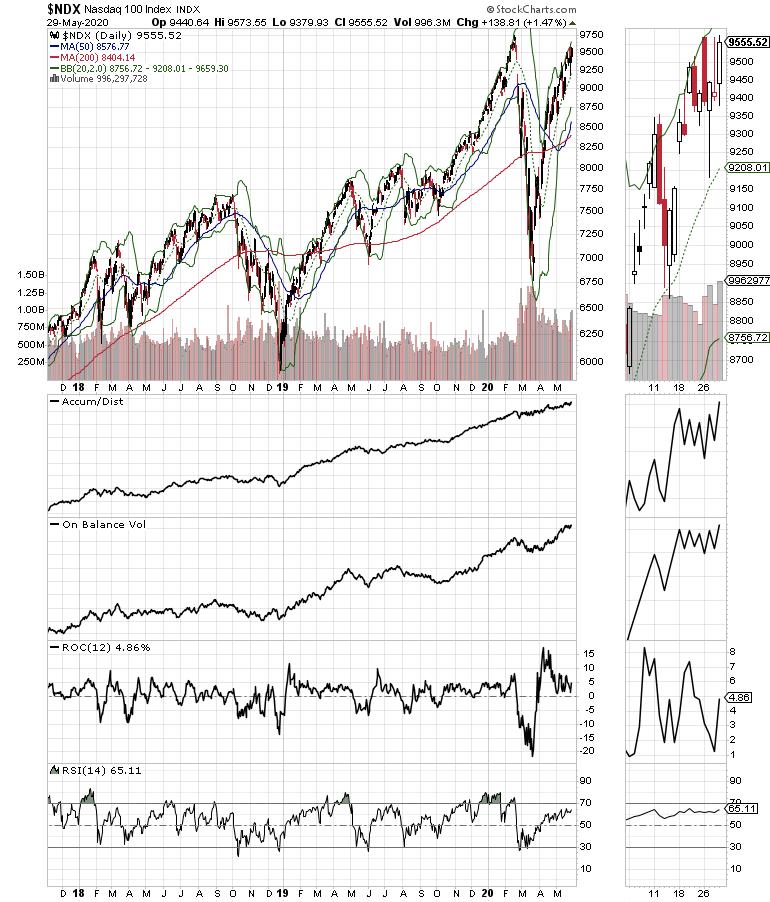

Moreover, the NASDAQ 100 index (NDX) is within striking distance of its all-time high, also confirming the bullish trend.

Therefore, the burden of proof has now fully shifted to the bears.

When You Trade, Focus on the Markets

It’s hard to tune out the crazy world we live in, and, in our personal lives, it’s not a good idea to ignore the reality of the moment. However, when we step into the trading room, the best thing to do is to focus on the price action of the markets and our individual positions.

A perfect example is what happened last week when, on Thursday afternoon, the market lost all its gains on a news item suggesting that President Trump was going to say something that would bring the U.S.-China trade war back. By Friday, when Trump actually made his statement, nothing of the sort happened and the market moved to new highs.

During this period, there were many stocks which ignored the volatility of the major indexes. If you panicked and sold stocks that were doing well, you likely missed them making higher highs on Friday when what really happened was totally different than what the algos thought they read in the headlines the day before.

The bottom line is that, to trade successfully in this market, it’s best to keep an eye on how your own positions are doing as you watch what the news and the algos do to the indexes. If you’re okay, there is no reason to sell into the daily madness. Study your charts. Know your companies. Mind your sell stops because, in the stock market, it’s always better to make money than to be right.

I own shares in CPRT.

Joe Duarte

In The Money Options

Joe Duarte is a former money manager, an active trader and a widely recognized independent stock market analyst since 1987. He is author of eight investment books, including the best selling Trading Options for Dummies, rated a TOP Options Book for 2018 by Benzinga.com and now in its third edition, plus The Everything Investing in Your 20s and 30s Book and six other trading books.

The Everything Investing in Your 20s and 30s Book is available at Amazon and Barnes and Noble. It has also been recommended as a Washington Post Color of Money Book of the Month.

To receive Joe’s exclusive stock, option, and ETF recommendations, in your mailbox every week visit https://joeduarteinthemoneyoptions.com/secure/order_email.asp.