Dan Zwirn, CEO and CIO of Arena Investor, in his letter for the second quarter commentary discusses the current and specific investment opportunities Arena is looking into in a post-Covid environment.

Q2 2020 hedge fund letters, conferences and more

Investment Opportunities In The Post-COVID Environment

The opportunities in convertibles, both public and privately negotiated, which is a good way for many troubled companies with diminished credit to raise capital, which has been fueled by the buoyant equity markets, which we are seeing despite the fact that from a bottom-up perspective, things look pretty bleak on the ground.

In private credit, sponsors and BDCs are having problems with their legacy investments and having their financing pulled. Here we can step in at the appropriate price/structure either to purchase existing loans at a discount, refinance existing loans at higher returns, or provide debtor-in-possession (DIP) financing in bankruptcies.

While government intervention is at all-time highs, most of that money is continuing to go towards what we refer to as the “haves” (i.e. investment grade credit) versus the “have-nots” (i.e entrepreneur-owned small businesses, small commercial properties, subprime consumer credit, etc.). While there are lots of “have nots” to avoid, there are more selective opportunities in areas that were not already benefitting from the massive amount of liquidity available before COVID.

Lenders Are Getting Coerced By Equity Sponsors

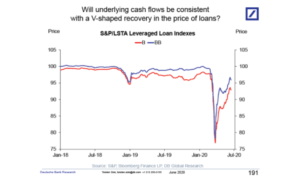

The systematic misaligned incentives that propped up the credit bubble are creating a tremendous amount of “amend, extend and pretend” activity. In leveraged loans and middle-market credit, lenders are getting coerced by equity sponsors, hoping their circumstances can improve before they have to reckon with recapitalization, while credit investors are assuming equity risk (for which they are not receiving compensation) in the interim.

In North American Real Estate, we are seeing warehouse and other recourse credit lines (i.e. for commercial mortgage lenders) being withdrawn or reduced, and we are very focused on those situations. Globally, our most notable opportunities is in the continued financing of the construction of affordable housing in New Zealand (with a government guaranteed offtake and pre-sales plus other construction guarantees that minimize our risk and exposure).

In areas like litigation finance, insurance finance and various other forms of specialty finance that are not correlated to the broader economy and where some players have gotten knocked out due to their own asset/liability mismatches and/or inappropriate financing, there is the opportunity to participate at appropriate pricing and structure today. We are seeing new pools of collateral to finance with existing partners and a pipeline of new partnerships in the US and Europe coming to fruition. Industrial areas like aviation and what we are calling the “last chapter of physical retail” (including the monetization and repurposing of inventory, real estate, leaseholds, IP, etc.); there have been hundreds of billions of dollars wiped out, and the market attitude is, “no amount of pricing will get me to invest” – and that is where we come in.

The post Arena Investors 2Q20 Commentary: Lenders Are Getting Coerced By Equity Sponsors appeared first on ValueWalk.