It has been a long, hot, dusty, dry crop for those looking to harvest gains in the Agriculture space. While the world runs out of land and food for protein growth, at some point, insiders in Ag industries expect an awareness of the relatively tight balance between food supply and consumption to come to the fore. Investing in the top 10 agriculture names can be a lucrative trade, but you have to know where to look.

Alternative Protein

Some early stage investors are moving to cricket grind for the future of proteins. John Chambers wants us to eat crickets. More amazingly the company he is investing in is mistitled as the Aspire Food Group. I am not aspiring to eat crickets any time soon. LOL! We have also seen the likes of BYND or VERY.CA as alternative sources. While BYND seems to have its followers, I still don’t understand why if you want something that tastes like beef, you don’t just eat beef? Why eat something filled with taste additives, salt and food processes? Bring on the Nutrasweet concoctions. OK, I’m a boomer.

I grew up on a farm, my sister and her family currently farms 6000 acres, and I still relate to the good ol’ days in the industry. We had a few head of cattle, a chicken barn, the odd pig, and a 2-acre garden that I weeded and watered. Farming is hard work and I am thankful I chose a different career path. OK, I’m a boomer. All that to say, my life has had an interest in agriculture, but the talent required to make money within the business is higher than ever. Now I use that historical content for investing.

Farm Equipment

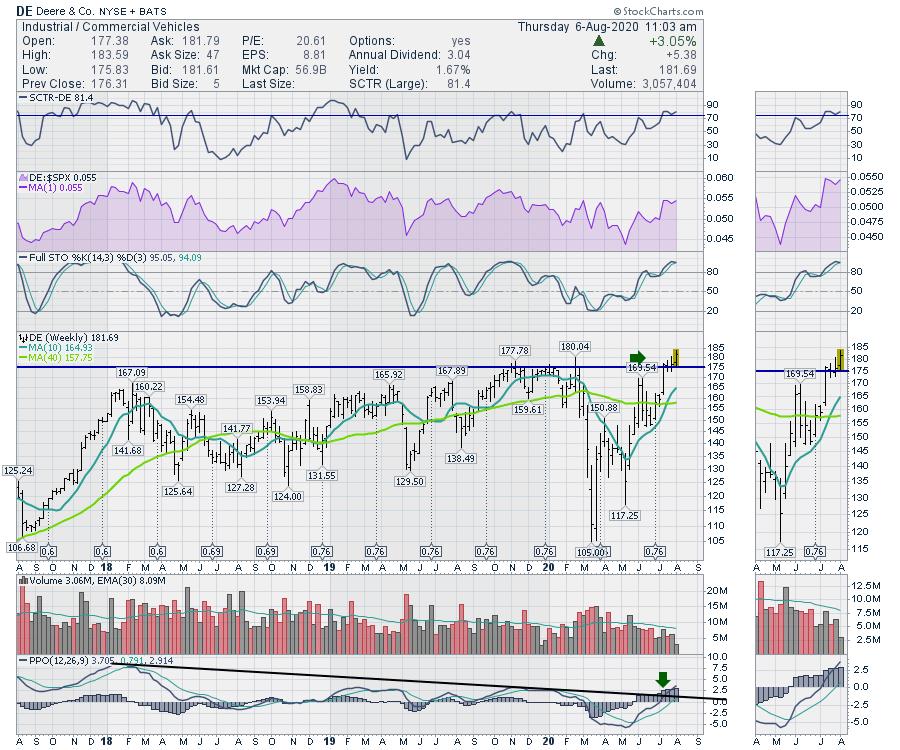

We farmed 1500 acres which would now be a hobby farm size, and the current size of the machinery dwarfs our farming efforts back in the 1970’s and 1980’s. John Deere (DE) is one example of a large equipment supplier to ag managers (farmers). The chart looks nice. This is a different way to invest in the top 10 Agriculture names, but because of their oligopoly position in the space, this can be profitable.

The analogy for equipment is go big or go home. Farmers run multi-million-dollar businesses through practices managing input costs, fertilizers, land ownership and leasing, futures markets, seasonal purchasing swings, insurance strategies, disease and weather. Online purchasing of bulk fuel deliveries, buying animals and equipment through auctions, hedging crop inputs and product sales, have changed the world for Ag managers. Tractors have autopilot systems, barns are food factories, fields are planted by GPS, and harvest equipment has more monitoring equipment than most of us have ever used. OK, I’m a boomer.

The problem is ag managers(farmers) are supplied by some of the largest companies in the world like Deere & Co. as an example. This oligopoly relationship is difficult to hold control as the ag manager is location centric and needs to rely on these large providers near their location.

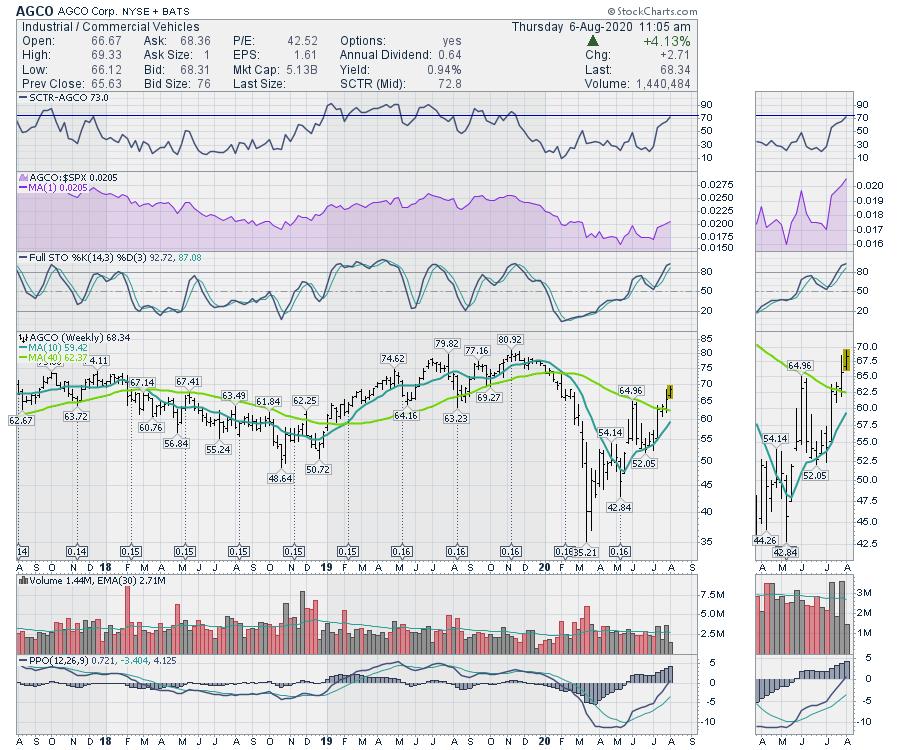

AGCO is another name to invest in the equipment side of the agriculture business.

The reason I lay all this out, is the investing world seems to be ignoring the picture and has since the commodity run stopped years ago. If the US dollar is changing course and headed lower, that should help commodity related industries. Some of these large companies have the global scale and marketing capacity to improve margins in tight situations. A recent example is the problems experienced with COVID 19 in meat packing plants. Beef at the grocery store went up 50%, which gives companies like BYND, VERY.CA and Aspire a wider margin to work with to compete.

On the selling of finished products, a monopsony occurs when there are many sellers (ag managers) and a singular buyer of their products. These large-scale companies are some of the most sophisticated buyers in the business. These companies will oscillate in and out of being in favor, but they definitely can be some of the top 10 names in Agriculture investing.

Food Processors

Conagra (CAG) is a major player in the food space. The chart couldn’t be more interesting. It is breaking out to new three-year highs and this weeks’ high is right at the all-time total return high. The PPO is also breaking out to fresh highs. That suggests the current momentum is higher than anything in the last few years! That’s nice to see.

Tyson Foods (TSN) is not performing as well as ConAgra. While the chart is basing here, it is definitely starting to turn up with a series of higher lows. A few indications that things might be going well are starting to show up. First of all, at the top of the chart is the SCTR ranking. This ranking compares the price action to large cap peers. Moves from the worst performing stocks (below 30) seem to be a trend change for the name. Something to watch for. The relative strength compared to the $SPX (purple area chart) is also close to breaking out. I like to watch for trend changes in relative strength. With ConAgra breaking out, we might see more interest in the industry, which can account for 50% of a stocks move. Keep an eye on Tyson, it might follow the lead of ConAgra.

Pilgrims Pride is missing the move that ConAgra has. The stock is living in the lower right-hand corner of the chart which is not bullish in any way. The only good news is it is trying to find support near the 4-year lows. I’d let someone else own that.

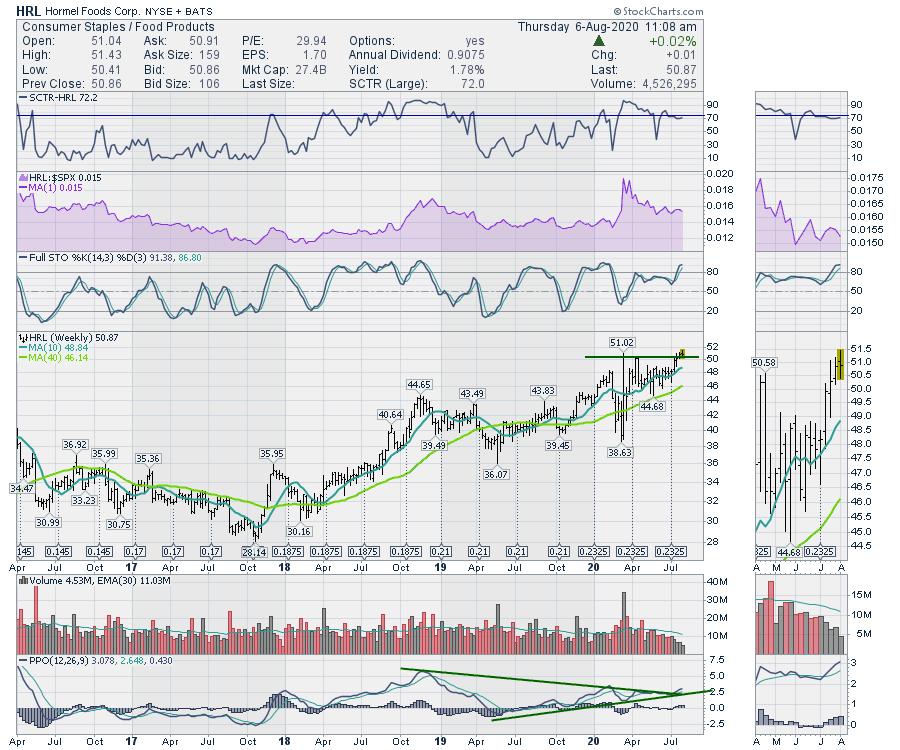

Hormel (HRL) is also breaking out which is a much better look than Pilgrim’s Pride. I do like the chart, and I also like that the PPO is breaking a downslope in momentum. A breakout to new highs on the stock as the momentum changes is a particularly interesting chart for me.

I’ll cover off other areas of agriculture in future articles. For now, some of these charts are just starting to break out to new highs, which is a pretty tasty trade. What I like best, is it doesn’t involve dining on crickets! Investing in the top 10 agriculture names can be a lucrative trade, but it can also be very profitable to look at the extensions of the agriculture trade.

If you would like a list of Ag related stocks, feel free to email me at info@gregschnell.com with the Subject Line: Ag chart list.