The Broad Market Index was down 3.2% last week and only 76% of stocks out-performed the index. From last week’s BLOG, the second surprise in the recent financial statements (now 93% complete for the first quarter of 2020) is the broad improvement in the basic industrial sector and the further gross margin pressure in the technology sector.

Q1 2020 hedge fund letters, conferences and more

Most investors are dramatically underexposed to industrial stocks. Years of underperformance have diminished the share of industrials in the major indexes. Since industrial stocks peaked in 2017, the sector average share price has declined by 15% (relative to the broad market) and price-to-sales (valuation) has dropped to levels not seen since the depth of the financial crisis in early 2019. Over the same period, higher sales growth and a persistent profit-margin increase propelled technology stocks to a 44% gain.

Within the technology sector, a small list of very large companies has come to dominate. Any pressure on the growth of those companies would produce a tech-bubble-style rotation with industrials making a strong comeback in a generally weak stock market.

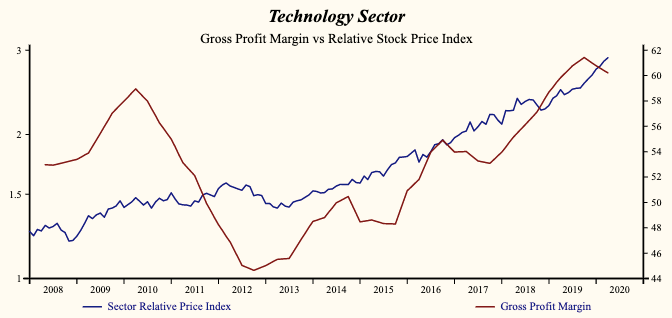

Technology Sector

The average gross profit margin in the technology sector is down for the second consecutive quarter while shares trace out all-time highs. SG&A expenses are low in the record of the Sector but falling. The gross margin is falling at a more rapid rate than SG&A expenses, producing a deceleration in EBITDA relative to sales. The shares have been very highly correlated with the direction of the profit margins.

There are currently no industries within the Technology sector showing growing strength in fundamentals compared to this time last quarter. The industries showing growing deterioration in fundamentals compared to this time last quarter are Aerospace & Defense, Computers, Computer Software, Connectors & Distributors, Electrical Equipment and Semiconductors.

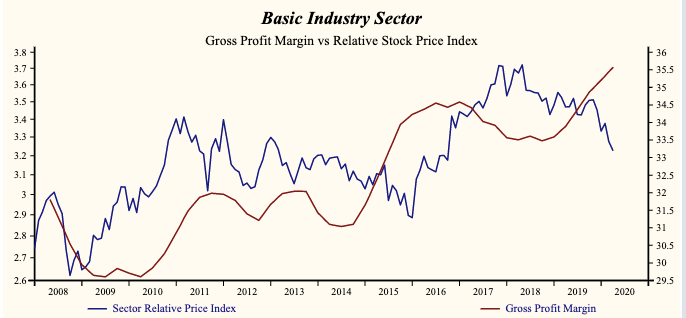

Basic Industrials Sector

The average gross profit margin has been rising in basic industrials for the past year and shares are trading at the lowest prices since 2015. Inventories are down, improving the chance of a further increase in the gross margin. SG&A expenses are high in the record of the sector and falling. That implies that the sector has further capability to accelerate EBITDA relative to sales with lower costs. Higher gross margins and lower SG&A expenses are producing a leveraged acceleration in EBITDA relative to sales. The shares have been correlated with the direction of the EBITDA profit margin.

Industries within Basic Industrials sector showing growing strength in fundamentals compared to this time last quarter are Gold & Silver, Steel, Railroads and Conglomerates. Industries showing growing deterioration in fundamentals compared to this time last quarter are Chemicals, Packaging, Metals, Shipping and Machinery.

Choose Carefully!

Sell technology stocks with profit margins down (Red Pot) and profitability down (Brown Crown of the tree) and buy industrial companies with sales growth up, rising gross profit margins, lower SG&A expense and good financial condition (Stable Golden Pot)

While there is a great uncertainty as to how the world will look and behave as the virus recedes, current evidence suggests that the age of technology sector dominance is over.

The post Age Of Technology Sector Dominance Is Over appeared first on ValueWalk.