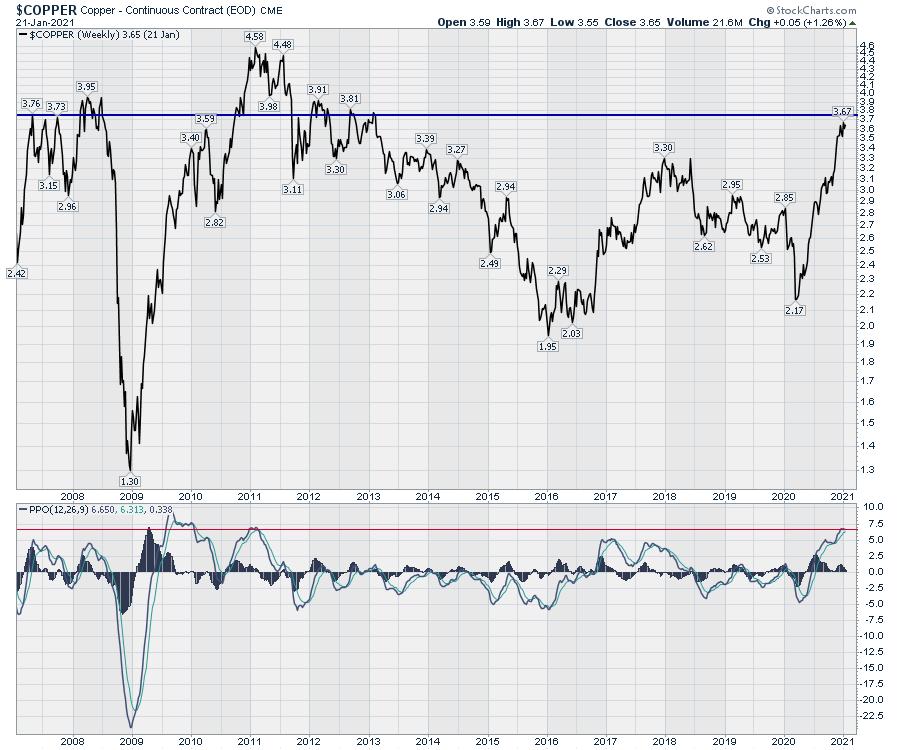

As investors start huddling into the mega-cap techs, there is a lot of churn underneath the surface. I am particularly interested in the new commodity bull market and a couple of specific charts within.

In the world of Copper, the momentum seems to be stalling after reaching the highest level in 10 years shown by the PPO. It has been an awesome run. A pullback to $3.30 could be expected and still maintain a trend of higher highs and higher lows. The extreme momentum level suggests caution at least.

The second one is crude oil. While I fully expect crude oil to blow through this level in 2021, the oil names have been stalling as crude oil reaches this junction. Horizontal resistance at $54 and downward trend line resistance at $55. The momentum indicator is at the highest level in 10 years. While the oil price is trading in the low 50’s, even a slow grind higher will probably roll over the momentum indicator for a while.

I do want to be a buyer of related stocks on a pullback but it might be time for copper and oil investors to let the price drip a little lower before looking at the next wave higher.