For manufacturing, the January Industrial Production report, and the February NY and Philly Fed manufacturing surveys will be released this week.

No major economic releases scheduled.

8:30 AM ET: The Producer Price Index for December from the BLS. The consensus is for a 0.5% increase in PPI, and a 0.5% increase in core PPI.

8:30 AM: The New York Fed Empire State manufacturing survey for February. The consensus is for a reading of 12.0, up from -0.7.

7:00 AM ET: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

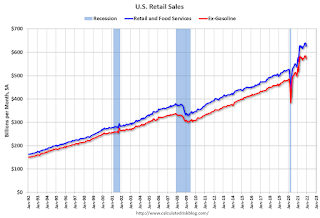

This graph shows retail sales since 1992. This is monthly retail sales and food service, seasonally adjusted (total and ex-gasoline).

Retail sales ex-gasoline were down 2.0% in December.

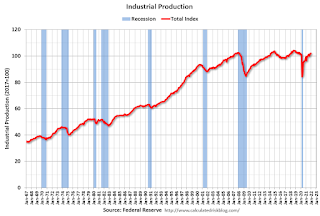

This graph shows industrial production since 1967.

The consensus is for a 0.4% increase in Industrial Production, and for Capacity Utilization to increase to 76.7%.

10:00 AM: The February NAHB homebuilder survey. The consensus is for a reading of 82, down from 83. Any number above 50 indicates that more builders view sales conditions as good than poor.

2:00 PM: FOMC Minutes, Meeting of Jan. 25-26

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for a decrease to 222 thousand from 223 thousand last week.

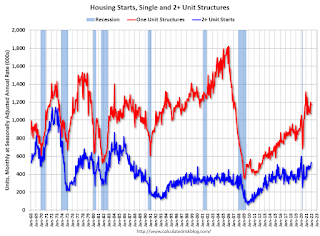

This graph shows single and multi-family housing starts since 1968.

The consensus is for 1.700 million SAAR, down from 1.702 million SAAR.

8:30 AM: the Philly Fed manufacturing survey for February. The consensus is for a reading of 20.0, down from 23.2.

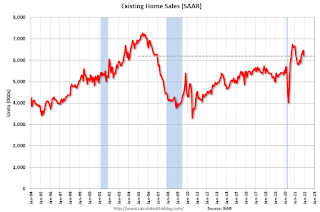

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 6.12 million SAAR, down from 6.18 million.

10:00 AM: Existing Home Sales for January from the National Association of Realtors (NAR). The consensus is for 6.12 million SAAR, down from 6.18 million.

The graph shows existing home sales from 1994 through the report last month.