New S&P Analysis: Banking M&A 2020 Deal Tracker: 10 deals announced in December 2020

Q3 2020 hedge fund letters, conferences and more

According to a new analysis from S&P Global Market Intelligence, U.S. banks and thrifts announced 10 deals in December 2020 as deal activity continued to rebound from single-digit monthly tallies following the initial outbreak of the coronavirus pandemic.

Key highlights from today’s banking M&A analysis include:

- At least 10 banking M&A deals were announced per month in four of the last five months of 2020.

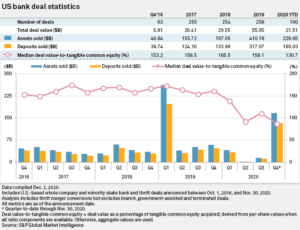

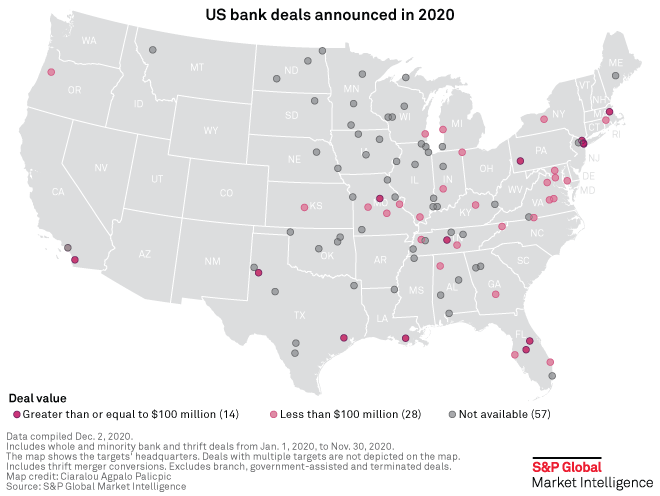

- During 2020, only 112 deals were announced for an aggregate $27.67 billion, compared with 258 deals worth $55.05 billion in 2019.

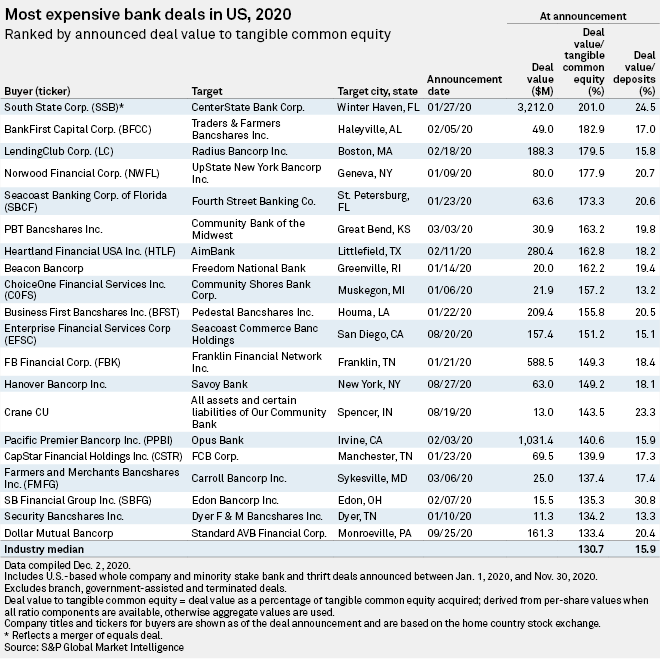

- The median deal value to tangible common equity ratio for deals announced in 2020 was 132.4%, down from 158.1% in 2019.

Banking M&A 2020 Deal Tracker

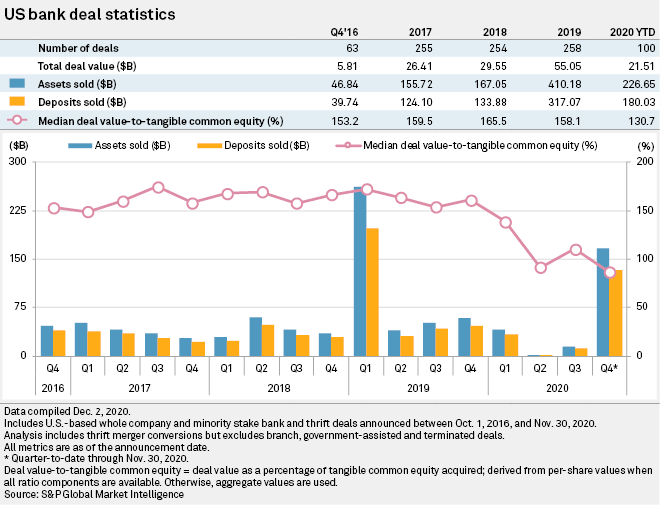

U.S. banks and thrifts announced only four deals in November, the lowest monthly total since May during the depths of the initial COVID-19 shutdowns. While deal activity has been muted in 2020 due to the pandemic, U.S. banks had announced at least 10 deals per month for the previous three months.

During the first 11 months of this year, the industry saw 100 deal announcements worth an aggregate $21.51 billion, compared with 235 deals worth $54.23 billion over the same period in 2019. The median deal value to tangible common equity ratio for deals announced in 2020 was 130.7%, down from 156.0% for the same period in 2019.

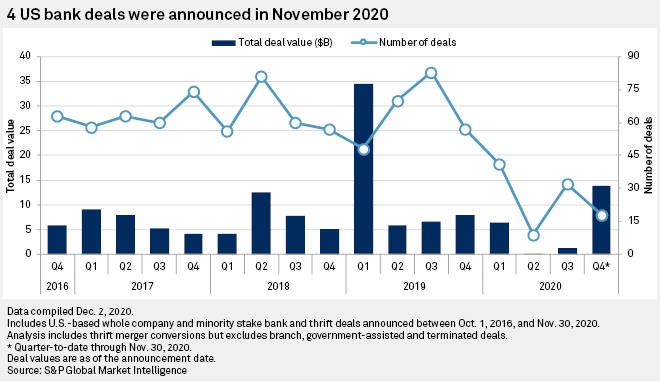

On Nov. 16, PNC Financial Services Group Inc. announced that it agreed to buy BBVA USA Bancshares Inc., a unit of Banco Bilbao Vizcaya Argentaria SA, for $11.57 billion at a deal value to tangible common equity ratio of 131.3%. This was both the largest deal announcement of 2020 and the largest U.S. bank deal since BB&T Corp. and SunTrust Banks Inc. announced their blockbuster $28.28 billion merger of equals in February 2019, becoming Truist Financial Corp.

Read the full article here by S&P 500 Global Market Intelligence

The post 10 Banking M&A Deals Announced In December 2020 appeared first on ValueWalk.